The first full week of the New Year was uneventful. There seems to be some trepidation among U.S. equity investors after such a strong finish to 2013. On Friday, the jobs report was disappointing, but investors quickly shook it off as nothing more than an anomaly given the prior trends and closed the week on a high note. Among the business sectors, the big winner last week was Healthcare, but Technology also showed signs of life.

The first full week of the New Year was uneventful. There seems to be some trepidation among U.S. equity investors after such a strong finish to 2013. On Friday, the jobs report was disappointing, but investors quickly shook it off as nothing more than an anomaly given the prior trends and closed the week on a high note. Among the business sectors, the big winner last week was Healthcare, but Technology also showed signs of life.

The big year-end rally put the market in an extremely overbought technical condition, and it seems many traders are now anticipating an overdue — and perhaps significant — correction to occur soon. And they are watching closely for clues from the “January effect” (early market performance) and from the imminent rash of earnings reports as we enter earnings season this week, including many of the big banks.

Improving conditions in the Eurozone have led to a steady decline in long-term sovereign debt yields among the PIIGS, down to quite manageable levels. Here at home, the Federal Reserve’s tapering of monetary stimulus will gradually push up long-term U.S. Treasury yields, but for the near term, the 10-year yield should stay below 3.5% while the fed funds rate remains near zero. Indeed, the yield curve has already steepened over the past month, widening the interest-rate spread. At the same time, credit spreads among various types of bonds are shrinking as perceived risk shrinks. Hopefully, all of this will loosen up banks’ purse strings and give them greater incentive to lend. And with investors generally getting more comfortable with risk assets in a recovering global economy, it bodes well for the U.S. stock market in 2014.

A particularly encouraging sign from last week was news that the foreign trade deficit narrowed 12.9% in November, the second month in a row of contraction, to a 4-year low of $34.3 billion, while analysts had forecast $40.4 billion. Exports rose 0.9%, while imports fell 1.4% (largely due to a combination of falling oil prices and oil imports). The rise in exports was taken as a sign that the global economy is recovering along with the U.S., and given the recent dynamics of oil, the Energy sector appears poised to lead as new technologies are helping to increase domestic supply, keep prices in check, and create job growth.

BlackRock’s ETP Landscape report for December notes that full-year equity ETP (exchange-traded products) flows set an all-time record at $247.3 billion in 2013, surpassing the previous high from 2008, which was the only other year they had exceeded $200 billion.

For the last two months of 2013, bulls showed a noticeable preference for higher-beta, lower quality names (“risk-on”). Take a look at the chart of conservative ETFs like the Guggenheim Defensive Equity ETF (DEF) or the PowerShares S&P 500 Low Volatility Portfolio (SPLV) versus the Guggenheim S&P 500 Equal Weight ETF (RSP), with its bias toward the lower caps (due to equal position weighting), or the iShares Russell 2000 ETF (IWM). They were all highly correlated with similar performance during the first half of the year. However, the conservative ETFs have significantly underperformed since the market bounced from its “June swoon,” as investors went into big-time bull mode and largely ignored the defensive sectors and dividend payers.

As I said last week, even with substantial expansion in P/E multiples, current valuations are not unreasonable, particularly when you compare earnings yields versus fixed income yields. But further market gains will need to come from robust corporate earnings growth, which will require much more emphasis on revenue growth than we have been seeing. Earnings reporting season has begun, so we soon will see how Q4 shaped up.

Although equities remain the most promising asset class, I expect that high equity correlations will start to fall and skilled stock-picking will be back en vogue. Moreover, I am hopeful that a flight to quality at current market multiples will allow those stocks with soundest business models and the greatest quality and sustainability of earnings to be the leaders.

Sabrient’s models generally are designed to flourish in such an environment because we tend to focus on GARP (growth at reasonable price), including a strong forward look based on sell-side analysts’ consensus earnings projections, plus an accounting analysis intended to provide a “backstop” that helps reduce risk of those pesky stock meltdowns (due to earnings misses or restatements). Our subsidiary Gradient Analytics is a forensic accounting research firm with the unique expertise to evaluate the quality and sustainability of a company’s reported earnings.

Since acquiring Gradient in 2011, Sabrient’s annual “Baker’s Dozen” model portfolio tripled the market performance in 2012 and doubled the market in 2013. The new Baker’s Dozen portfolio for 2014 launches on Monday. Although any experienced stock picker can identify some big winners in a bull market, we firmly believe that the best way to consistently outperform a benchmark index with a diversified portfolio is to avoid the “blowups” that offset your winners. Our worst performing stock in the last two annual portfolios (26 total positions) was down only -2%, and that was in 2012. For 2013, our worst performer was up +14% (http://sabrient.com/bakers-dozen)

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 184.14. After closing the year in extremely overbought territory and at its all-time high of 184.69, it has not given back much during this technical consolidation period. SPY remains inside its long-term bullish rising channel, which current spans from about 185 to 174. The 20-day and 50-day simple moving averages have been offering reliable support to every pullback, and the lower trend line of the bullish channel has been rock-solid last-resort support. Oscillators like RSI, MACD and Slow Stochastic all bounced last week without price giving up much ground. I still think SPY will make another run at a bullish breakout during the month before any significant correction occurs, but you should be vigilant of news events or bad earnings reports from bellwether stocks that might trigger a bigger pullback.

On Friday, the CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed at 12.14. Investors are showing no fear, although there are a number of market commentators warning that we should expect higher volatility in 2014. Also, Adam Parker, chief U.S. equity strategist for Morgan Stanley, is among the most optimistic on Wall Street. He said, “The only thing people are worried about is that no one is worried about anything. That isn’t a real worry.” He is predicting the S&P 500 to hit 2014 by the end of 2014.

Latest rankings:

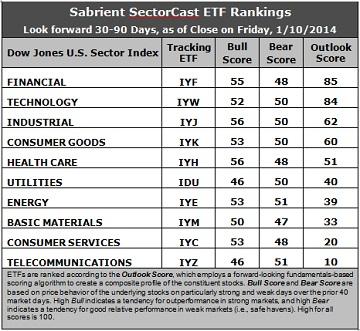

Relative rankings are based on Sabrient’s proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The “Outlook Score” employs a fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting score), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes Sabrient’s Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (“safe havens”) when the market is weak.

Outlook Score is forward looking while Bull and Bear are backward looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use the ten iShares that represent the ten major U.S. business sectors: Financial, Technology, Industrial, Healthcare, Consumer Goods, Consumer Services, Energy, Basic Materials, Telecom, and Utilities. Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs.

Observations:

1. Financial (IYF) takes over the top spot with an Outlook score of 85, but it’s really more of a virtual dead heat with Technology (IYW), which scores 84. These two sector ETFs have occupied the top two spots for quite a while. Financial displays one of the lowest forward P/Es and the strongest sentiment among both Wall Street analysts (upgrades to earnings estimates) and company insiders (buying activity), Technology still displays a relatively low forward P/E, a solid forward long-term growth rate, the best return ratios, and strong sentiment among both sell-side analysts and company insiders. In third place is Industrial (IYJ), but its score is only 62. These three are the only ones displaying positive net changes to consensus earnings estimates among the analysts.

2. Telecom (IYZ) is in the cellar yet again with an Outlook score of 10. It scores among the lowest on almost every factor in the model, including the highest forward P/E, lowest return ratios, and a low projected long-term growth rate. Consumer Services (IYC) is now in the bottom two with an Outlook score of 20, primarily due to valuation.

3. This week’s fundamentals-based rankings still reflect a mostly bullish bias, with economically-sensitive sectors Financial, Tech, and Industrial making up the top three. The most notable movement this week was the 30-point fall in Energy (IYE), from 69 to 39, as analyst and insider sentiment suddenly soured after showing marked improvement last week. Also, Industrial continues its slow but steady upward march, which is bullish.

4. Looking at the Bull scores, Industrial and Healthcare have been the leaders on strong market days, scoring 56. Utilities (IDU) and Telecom are the laggards with a score of 46. However, the top-bottom spread has narrowed to only 10 points (from a 16-point spread last week), which reflects somewhat higher sector correlations on particularly strong market days.

5. Looking at the Bear scores, there is still an unusually tight top-bottom spread of only 4 points, which indicates very high sector correlations on particularly weak market days — but then again, there really haven’t been any big down days, so the scores are less reliable. Relatively speaking, Energy and Telecom have been holding up the best on recent weak market days, scoring 51, but in fact there is no clear leader when scores are this closely bunched.

6. Overall, Financial shows the best all-weather combination of Outlook/Bull/Bear scores. Telecom is the by far the worst. Looking at just the Bull/Bear combination, Industrial again this week displays the highest score, which indicates good relative performance in extreme market conditions (whether bullish or bearish), while defensive sector Utilities scores the lowest, followed closely by Telecom and Materials, indicating investor avoidance (relatively speaking) during extreme conditions.

These Outlook scores represent the view once again that Financial and Technology sectors are still relatively undervalued, while Telecom and Consumer Services may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Our Sector Rotation Model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), suggests holding Technology, Financial, and Industrial ETFs in the current bullish climate.

Some intriguing stocks from Financial and Technology sectors include Google (GOOG), CACI International (CACI), MasterCard (MA), and Signature Bank (SBNY), all of which are highly ranked in the Sabrient Ratings Algorithm and score in the two highest quintiles of the Sabrient/Gradient Earnings Quality Rank (EQR).

Other ETFs highly-ranked by Sabrient from the Financial and Technology sectors include the RevenueShares Financials Sector Fund (RWW) and the Technology Select Sector SPDR (XLK). Also, Fidelity offers its own line of U.S. sector ETFs, including the Fidelity MSCI Financials ETF (FNCL) and the Fidelity MSCI Info Tech ETF (FTEC).

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.