Reminder: Sabrient is available to chat with Members, comments are found below each post.

Courtesy of Scott Martindale, Senior Managing Director, Sabrient

So, Mr. Bernanke said all the right things, and like clockwork, stocks moved up while the dollar and bonds moved down. Gold and silver hit new highs. All systems are go. Hey, this stuff is getting easy to predict, isn’t it?

I attended the annual Capital Link CEF/ETF Conference today in New York City — always a well-attended and informative event. John Calamos gave the opening address, and his market view seems to represent the prevailing opinion, i.e., short-term bullish but longer-term cautious, with the expectation of higher interest rates down the road along with creeping inflation. One panelist pointed out that the bond market is pricing in 115 bps increase in 10-year yields over the next three years, and another shared that capital inflows into ETFs have been among the highest in the inverse Treasuries, which implies that investors are positioning heavily for lower bond prices.

So, should we assume that this scenario is an inevitability…or a self-fulfilling prophecy? Or will this turn into a contrarian play in which the old adages that the herd is always wrong and the market likes to fool the greatest number of participants kick in? Time will tell, but my view remains bullish for stocks – so long as no major exogenous events occur that send oil prices into orbit.

Let’s look at the SPY chart. It speaks for itself – i.e., bullish.

Price broke out strongly above previous resistance at $134. RSI crossed up strongly through the neutral line last week and is headed for a date with overbought territory soon. Similarly, MACD has a bullish crossover and is pointing up. Price is well above all of its daily moving averages such that some mean reversion will be in order soon – but not necessarily much of a pullback, as the moving averages play catch-up. Volume on these strong days, however, is still disappointing.

The TED spread (i.e., indicator of credit risk in the general economy, measuring the difference between the 3-month T-bill and 3-month LIBOR interest rates) closed at 22.25. Fear as measured by the CBOE market volatily index (VIX) closed at 15.35, after a short-lived pre-Fed spike to 16.42. Still no signs of distress in these figures.

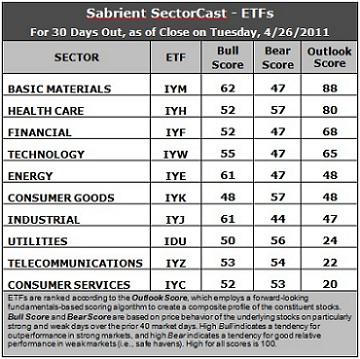

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

The most notable observations in this week’s Sabrient’s SectorCast Outlook scores are:

1) Basic Materials (IYM) and Healthcare (IYH) remain the top ranked with scores of 88 and 80, respectively.

2) Technology (IYW) got a 10-point boost in its Outlook score to a 65, mostly from improved analyst projections, and jumped back into fourth place over Energy (IYE), which sunk by 10 points to 48.

3) Financial (IYF) gained 10 points to move back into third place with 68.

4) Consumer Services (IYC) has fallen back into the cellar, scoring a lowly 20, and is joined in the bottom two by Telecom (IYZ).

5) There is a clear gap between the top four sector ETFs (IYM, IYH, IYF, and IYW) and the other six. If Industrial (IYJ) and Consumer Services (IYC) were ranked a little stronger, the overall rankings would be clearly bullish. As it is, they are “cautiously bullish,” in my view.

Looking at the Bull scores, Basic Materials (IYM) has been the strongest during strong markets, followed by Industrial (IYJ) and Energy (IYE). No one else is very close to these three. Consumer Goods (IYK) is the biggest laggard on strong market days, and in fact, IYK is now the only one with a Bull score below 50.

As for the Bear scores, we are seeing the weak Bull scores leading and strong Bull scores trailing. Consumer Goods (IYK), Healthcare (IYH), and Utilities (IDU) are the favorite “safe haven” sectors. Industrial (IYJ) clearly lags on weak market days, followed by Basic Materials (IYM), Finance (IYF), Technology (IYW) and Energy (IYE), reflecting relatively quick abandonment by investors on weak market days.

Overall, Basic Materials (IYM) still displays the best combination of the three scores. Basic Materials (IYM) and Healthcare (IYH) tie for the best combination of Bull/Bear, with IYH showing all-weather balance and IYM shining best on bullish days. Energy (IYE) is close behind.

Top ranked stocks in Basic Materials and Healthcare include Kronos Worldwide (KRO), Silver Standard Resources (SSRI), Simcere Pharmaceuticals (SCR), and AmerisourceBergen (ABC).

Low ranked stocks in Telecom and Consumer Services include ViaSat (VSAT), Crown Castle International (CCI), StoneMor Partners L.P. (STON), and MGM Resorts International (MGM).

These scores represent the view that the Basic Materials and Healthcare sectors may be relatively undervalued overall, while Consumer Services and Telecom sectors may be relatively overvalued, based on our 1-3 month forward look.

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a one-month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs, such as the ones I identify above.