As I’m working on the second book, Cash Flow Your Way to Wealth, I thought I would put out some samples from the book. Here is part of Chapter 1, which presents the basic idea of personal cash flow and the cash flow diagram. Look for the book to come out in a couple of months. Enjoy! SI

Most people mistake income for wealth, but the two are very different things. Income is the amount of money that you have coming into your household – the size of the stream entering your canyon. Wealth is the storage of money that you have – the level of the lake in your canyon. Huge amounts of water flow through the Grand Canyon in the Colorado River each year, yet there is far less water in the Grand Canyon than there is in Lake Mead behind the Hoover Dam. The difference is that in one case the water is allowed to flow right through, where in the second it is stored.

People who have high incomes tend to drive fancy cars, have big houses, eat at expensive restaurants, and wear expensive clothes. People who have large amounts of wealth tend to drive modest cars, have modest houses, eat at home a lot, and wear average clothing. There are a few extremely wealthy individuals who do display their wealth somewhat, but even then the cost of their lifestyles are well within their income level.

Luckily, you don’t need the income of Bill Gates to become wealthy. You just need to start storing some of your income, then invest to increase your income. This is not an overnight process – it takes time. Decades, in fact. But with a bit of persistence and patience, most people can join the ranks of the wealthy. Because most people spend all that they make and then borrow more, it isn’t that difficult to become one of the top 10% or even top 1% of wealthy individuals, currently around $1 M and $8 M, respectively.

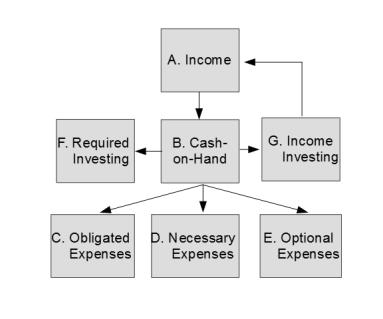

Now let’s get to the heart of the matter – the cash flow diagram. A lot of people create budgets. Budgets are fine, but a budget is a flat canyon with no dam – you balance inflows and outflows with nothing saved and stored up when you’re through. A cash flow diagram directs your money into investments, which in turn create more income, increasing the size of the stream entering your canyon. In this chapter we’ll introduce the diagram and give an overview of each of the boxes that comprise it. Then, for the rest of the book we’ll go into each of the boxes in detail and show how to setup your own cash flow to build wealth.

A basic cash flow diagram is shown in Figure 1. Income flows in through Box A, rests briefly in Box B (Cash on Hand), then is distributed to various expenses or savings/investments. Income includes your paycheck, any income you make from side jobs, investment income, alimony, and gifts from uncle Bob. Cash-on-hand is your bank account or checking account – money that you have readily available for use whenever you want. Expenses are money flowing out of your bank account, never to be seen again. Investments are places where you put money at risk in order to generate more income.

Cash flow through your cash-on-hand is required to follow the familiar PISO equation:

Production + Inflow = (Change in) Storage + Outflow.

This says that all money produced by your investments, plus any inflow from salary and other sources, must equal the change in your cash-on-hand plus outflows to expenses. Rearranging we have:

(Change in) Storage = Production + Inflow – Outflow.

In other words, if you want to increase your storage of money (your wealth), you need to make the sum of your production of money (investment returns) plus your income (salaries, etc…) exceed your outflows (expenses). Or, as your grandma used to say,

“Spend less than you make.”

What a simple concept: If you want to increase the amount of wealth you have, spend less than you make. And yet few people ever build any real wealth over their lifetimes, so few people follow this principle. In fact, most people spend more than they make, so they are destroying wealth before they ever have the chance to earn it. No wonder the fiscal health of society is so poor!

OK – so this all makes sense, but what does it have to do with Figure 1, the cash flow diagram? Well, your inflows – your income – is given in Box A. Box B is your change in wealth storage. Boxes C, D, and E are expenses, which are outflows of cash. Finally, Boxes F and G are investments, producers of wealth.

Notice that there is an arrow from Box A to Box B. This means that Box A increases Box B – your income increases your cash on hand, just as inflows increase the storage of wealth. There are arrows from Box B to boxes C, D, and E. These are the outflows, which decrease the amount of wealth you have stored. If the cash flowing in from Box A exceeds the cash flowing out through to Boxes C, D, and E, your wealth will increase. If the opposite is true and the flows to Boxes C, D, and E exceed cash flowing in from Box A, your storage of wealth will decrease. When everything is balanced, such that inflows from Box A exactly equal outflows to Boxes C-E, then your wealth will remain constant.

Going back to our vision of the river and the canyon, the canyon is Box B. The water flowing into the canyon is the arrow from Box A into Box B. Water flowing out of the canyon are the arrows to Boxes C-E. If you have a small salary, the money flowing from Box A to Box B will be small – a creek. If you have a large income, it will be substantial – a raging river. It doesn’t matter how much money is coming into Box B from income, however, if the amount flowing out of Box B to C-E is equal to or greater than the amount flowing in – the water in the canyon will never rise, it may even decline. The amount of wealth stored in Box B will never increase or it will even decrease until there is no more stored wealth.

Please contact me via [email protected] or leave a comment.

Follow me on Twitter to get news about new articles and find out what I’m investing in. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.