Please don’t run away! I know there’s a 99% chance that you hate thinking about money (especially if your biz isn’t making enough of it) but this is crazy important and pretty simple. It just requires a little bit of focus.

Stay with me.

We all know Finance 101 yeah? Income vs Expenses.

We’re starting with Expenses today, and will cover Income next week.

But first I want to have a little heart to heart wit-cha.

Let’s go back to your Goals from last week. One of your goals should have been a number…as in Income or Sales.

Be honest, did you randomly pull that number out of your a**?

Sort of.

Was it a number higher than anything you’ve achieved before or can honestly imagine reaching?

Or was it a “realistic” number, possibly a low-ball, that you are pretty damn likely to hit?

Umm…

Hey, I’m with you. The first time I met with a business coach he asked me what my 1st year projected sales would be. I looked at him with a straight face and said

“$500,000.”

His eyebrows lifted…”Really?”

“Yeah. ”

“Do you know what $500,000 in sales means?”

I glared at him. What a jerk. Did he think I was stupid?

Staring at the desk…”It means that I take home about 250k…” I couldn’t even look him in the eye.

“It means that you bring in about $42,000 per month. Is that feasible?”"

That was, like, waaaay beyond my reality. My last job paid me $25/hour.

While I was totally offended that I got called out, I also had never sat down to think about how my pipe dream could play out in real life. If he hadn’t asked me that question I would have continued on with a totally unrealistic expectation.

Don’t get me wrong – it IS possible to hit that number. Small businesses do it all the time. But they don’t hit those numbers by doing business as usual.

These aren’t your average solo-preneurs performing services for their community members. It requires a bigger idea, a strategic plan and the wherewithal to see it through.

On the flip-side: If you said $50,000 in sales because you did $48k last year – you are undermining your own abilities. Don’t do that either. The moral of the story is that you need to set yourself a goal that is both challenging and realistic. Can you do that? Of course. The following steps should help.

List out all your estimated baseline Expenses for next year.

You don’t have to know your marketing budget just yet, or the production costs of your ebook.

But you DO need to factor in your own salary. Be it meager or a hefty chunk of your expenses, you are not a negotiable part of your business therefore your salary is not negotiable either.

If you have been in biz for a while you already have a pretty good idea of what your operating costs are. If you’re new, do some research and guess.

Tally up this number by month and then by year.

This is the minimum amount that your business needs to survive.

Ain’t no great shakes.

The best way I’ve found to manage all of these numbers is a Profit and Loss Projection worksheet. I made you a fancy one (trust me, it’s way better than your Excel version) - download it here.

Now let’s start estimating the costs of your other goals.

Going back to last week’s example; If your goals are

1. Launch 3 digital products

2. Develop a virtual training program that operates a couple times a month

3. Pay off any business debt

4. Hire a virtual assistant to manage customer service and marketing

You best be saving up because none of those are free.

Estimate your costs for graphics, software and marketing costs for anything digital. Break down your biz debt by 12 months. Figure out how many hours you need an assistant, and the going rate [$18-35/hr].

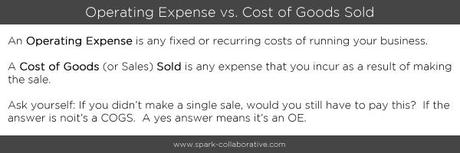

Some of these expenses are Operating Expenses, and some are considered Cost of Goods/Sales (COGS).

How do you tell the difference?

Your salary was calculated into the expenses, but if it wasn’t what you want to be making by the end of next year, add that in now.

I recommend you list this as a separate expense so you can modify it as needed later on. You can even call it something other than salary (like dividend or bonus).

Once you get these numbers all plugged in, you will have a heart attack, errr, I mean, you will have a much clearer idea of what your income/sales goal should be.

Next week we will figure out how to hit this number. It’ll be more fun, I promise.

Get the complete series delivered to your inbox! Don’t forget, we’re doing a giveaway at the end of the series and all you gotta do to enter is leave a comment below. Share your progress, questions, struggles or triumphs. We want to support you and get feedback too.