We're back!

We're back!

After taking two years off from publishing our morning posts on Seeking Alpha, we've begun sharing our PSW Reports again. The PSW Report is the morning market overview for our Members at Philstockworld published pre-market each day. Though it is only a small portion of what we publish for our Members, we still have plenty of actionable trade ideas to share early each morning. Now that we have two month of posts under our belt – it's a good time to review our performance from Month 1 and discuss our trading techniques.

April 22nd was our first day back at Seeking Alpha with "Market Manipulation Takes Center Stage" in which I noted what BS the low-volume moves up in the market were. We also discussed how easy it had been to "spoof" trades during the Flash Crash and often in our weekly Webinars (and we had happened to discuss it the day before) we show people how this sort of manipulation happens every day and learning to spot it can make for very profitable counter-trades – especially in the Futures. Our strategy was summed up nicely as I said:

Still, the best way to make money in these crazy markets is the Warren Buffett way, which is also my way – keep your cash ready and buy good companies when they get cheap, don't be greedy and sell risk premium to others. It's not complicated – it just takes a bit of discipline.

As examples I pointed out several stocks we liked that were already in our portfolios (IBM, LL, RIG, LQMT, ABX, CLF, USO, UCO, BHI, HOV, CIM, MAT, LULU). We use option spreads to give ourselves 15-20% discounts on our entries (see "How to Buy a Stock for a 15-20% Discount") and, as a new trade idea that morning, I suggested:

- Ultra-Long Oil ETF (UCO) July $5/9 bull call spread at $2.80, selling the July $5 puts for 0.14 for net $2.66, now $3.95 - up 48% (UCO reverse-split but the old options are still there)

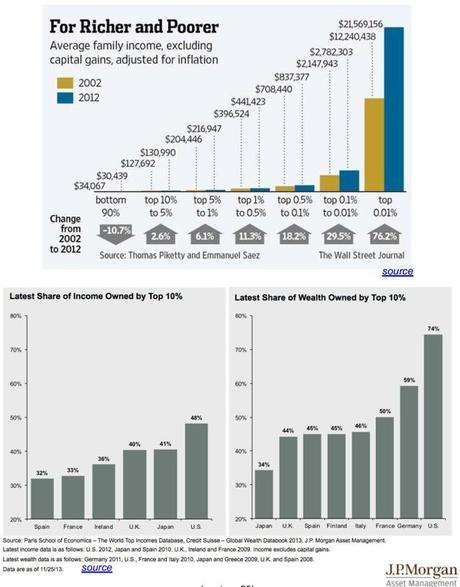

The next day, in "Bad News Is Still Good News In China As Poor PMI Boosts Market" we also discussed the Financial Engineering that S&P companies were/are engaged in to boost their books. We put that in context of Income Inequality and I don't just talk about these things to annoy Conservatives but because this is part of the Macro View (bottom 90% people don't have disposable incomes, companies serving the top 10% do well) that guides our long-term trading outlook. Our free ideas that morning were:

The next day, in "Bad News Is Still Good News In China As Poor PMI Boosts Market" we also discussed the Financial Engineering that S&P companies were/are engaged in to boost their books. We put that in context of Income Inequality and I don't just talk about these things to annoy Conservatives but because this is part of the Macro View (bottom 90% people don't have disposable incomes, companies serving the top 10% do well) that guides our long-term trading outlook. Our free ideas that morning were:

- Short S&P Futures (/ES) at 2,100, low 2,088 – up $600 per contract

- Short Russell Futures (/TF) at 1,260, low 1,250 – up $1,000 per contract

Remember, we are FUNDAMENTAL investors who use options to mitigate our risks and to leverage small amounts of cash to make large gains when we are right. Playing the Futures is somehting we do for fun on the side and we don't make technical plays, we make Fundamental plays when we see them heading the "wrong" way compared to the value we see in the market that day. The trick to playing the Futures is managing your money with tight entries and exits. If you are consistent with your cash then all we have to do is be right 60% of the time and it becomes a very profitable hobby! We often teach futures trading techniques in our weekly webinars (Tuesdays, 1pm).

April 24th we turned our attention to China's deteriorating Corporate Bond Market with "Kaisa Bond Default Underlines China Housing Crash" in which I pointed out that Chinese property defaults were ringing the same alarms that people failed to hear in 2007/8. Specifically, we looked at Kaisa Holdings who have since proven our worst fears but I warned it was the tip of the iceberg, saying:

I don't want to be overly dramatic about this stuff (and we are short on both China and Japan through FXI ($51.85) and EWJ ($13.26) as well as short the US markets as full disclosure) but I'm not going to let my people go through what people went through in 2008 if I can help it. If you remember, it was a very slow roll to collapse while the markets made record highs in 2007/8 as well.

EWJ is now $12.85 (up 3% on the short) and FXI has fallen to $46.79 (up 9.7%) – interestingly enough while our own markets have continued to ignore the slow roll that's going on in Asai – just as we pointed out two months ago!

Monday, April 27th, we had two posts. Our usual Morning Report was "Counting Down Greece's Final Moves" a warning that needs no explanation in retrospect. The chart on the right says it all as this farce plays out into the end game. While I warned how dire the Greek situation was getting, I also pointed out that our markets were likely to ignore the gathering storm right up until the moment they are swept up in it.

Monday, April 27th, we had two posts. Our usual Morning Report was "Counting Down Greece's Final Moves" a warning that needs no explanation in retrospect. The chart on the right says it all as this farce plays out into the end game. While I warned how dire the Greek situation was getting, I also pointed out that our markets were likely to ignore the gathering storm right up until the moment they are swept up in it.

There were no trade ideas in the morning post but that afternoon we featured "3 Of Our Top Trade Ideas (another one of our subscription packages) You Can Still Act on Today." The premise of this article was to take our 3 worst-performing Top Trades and take advantage of the better entries. They were:

- Sell 5 Lumber Liquidators (LL) 2017 $28 puts at $6.90 ($3,450) and buy 10 long 2017 $30/40 bull call spreads at $3.46 ($3,460) for net $10, now -$4,280 – down 4,270%

Well, we live by the leverage and we die by the leverage, right? I'm not defending the trade, as we were wrong (so far, we doubled down though) but I will defend the concept because, on the whole, we were only obligated to buy 500 shares of LL for net $28.02 and LL is now at $20.71. 500 straight shares at $33 would have lost $6,145 so the spread lost 30% LESS than a straight stock play while tying up 99.9% less cash (though there is margin, of course). That's what we mean by using options for leverage AND to mitigate risk!

- Selling 10 IRobot (IRBT) 2017 $28 puts for $3.30 ($3,300) and buying 10 2017 $28/35 bull call spreads for $3 ($3,000) for a net $300 credit, still $300 credit – even

- Buying 1,000 shares of Verizon (VZ) at $50.03 ($50,030), selling 10 2017 $47 calls for $4.90 ($4,900) and selling 10 2017 $47 puts for $4.35 ($4,350) for net $40.78 ($40,780), now $38.86 ($38,860) – down 4.7%

0 for 3 on gains so far on that set but, then again, they are 2017 trades and I still like them, despite the weak market. VZ will pay us $2,200 in annual dividends, but you can see why we took a conservative entry, selling the $47 calls despite the fact that the stock was at $50.03 at the time. As I said at the time "you never do trades like this with stocks you don't fully intend to double down on if they get cheaper."

0 for 3 on gains so far on that set but, then again, they are 2017 trades and I still like them, despite the weak market. VZ will pay us $2,200 in annual dividends, but you can see why we took a conservative entry, selling the $47 calls despite the fact that the stock was at $50.03 at the time. As I said at the time "you never do trades like this with stocks you don't fully intend to double down on if they get cheaper."

That means, if your full allocation is going to be $50,000, you don't start with $50,000 but with $15,000 so you are HAPPY to buy more if it gets cheaper. If it doesn't get cheaper, then the leverage we emply gives you fantastic returns. The setup of these trades triggers us to double down (in 2017) only if the stock is cheaper than our original entry, though with LL we pulled the trigger early as we don't think it will stay this low for very long.

The next day it was "Technical Tuesday: 2,100 Still The Line To Beat On The S&P" and we had just hit 2,120 on Monday and I expressed my skepticism that low-volume rallies could drive us to sustainable highs. We discussed the support levels of the Futures and the deteriorating conditions in Japan but we had no free trade ideas for our morning post, rather calling it a "watch and wait" kind of day as we remained "Cashy and Cautious."

Wednesday morning (4/29), I had already tweeted out our pre-pre-market commentary (you can follow us on Twitter here) which I considered important enough to also publish as a "Stock Talk" on Seeking Alpha. We discussed the API Report and decided the GDP Report would be disappointing that morning (8:30) so our Trade Ideas were:

Wednesday morning (4/29), I had already tweeted out our pre-pre-market commentary (you can follow us on Twitter here) which I considered important enough to also publish as a "Stock Talk" on Seeking Alpha. We discussed the API Report and decided the GDP Report would be disappointing that morning (8:30) so our Trade Ideas were:

- Short Russell Futures (/TF) at 1,260, low of 1,212 - up $4,800 per contract

- Short S&P Futures (/ES) at 2,110, low of 2,070 – up $2,000 per contract

By the time I wrote the morning post "GDP Disaster: Following Up On This Morning's $1,000 Gain", just ahead of the GDP at 8:30, we were already up $500 on /TF and $250 on /ES for each contract but the GDP came in poorly and the gains were great, even for those who were late to the party as the lows came over the course of the next two days of selling. Of course, we don't generally hold our Futures overnight so not many made the maximum gains but, obviously, when you get the direction right it's VERY profitable! In the morning post, I also elaborated on how much I love that LL trade and why. So far, so wrong on that one!

The next day (4/30) it was "Falling Thursday: Russell Leads Us Lower" as the selling continued and, with the Russell at 1,235, we discussed our 5% Rule indicating more pain ahead and I said: "There's not going to be much support for /TF (Russell Futures) between 1,230 and 1,200 (another $3,000 per contract if you catch that move)." As noted above, we did get to 1,212 that day, so +$1,800 per contract not bad – even for those who missed the tweet the day before.

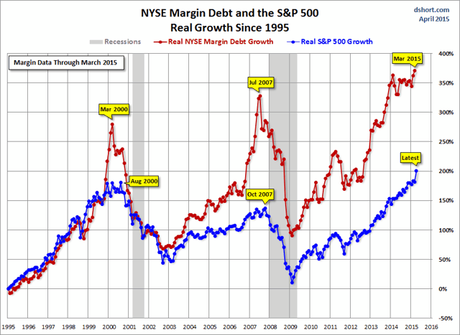

On May 1st we turned our attention to margin debt as I noted "Investors Are All In On Margin Debt As The Fed Lowers Q2 GDP Forecast By 73%." I mentioned some stocks I thought were on sale like: LinkedIn (NYSE:LNKD), Twitter (NYSE:TWTR), Yelp (NYSE:YELP), Lumber Liquidators (NYSE:LL), Chipotle (NYSE:CMG), Wynn (NASDAQ:WYNN) but just for watching as I noted:

On May 1st we turned our attention to margin debt as I noted "Investors Are All In On Margin Debt As The Fed Lowers Q2 GDP Forecast By 73%." I mentioned some stocks I thought were on sale like: LinkedIn (NYSE:LNKD), Twitter (NYSE:TWTR), Yelp (NYSE:YELP), Lumber Liquidators (NYSE:LL), Chipotle (NYSE:CMG), Wynn (NASDAQ:WYNN) but just for watching as I noted:

Plenty of opportunities to go shopping – AFTER things calm down. Meanwhile, we're certainly enjoying the show much as we're enjoying this Futures pop in the S&P (2,090 on /ES) and the Dow (17,900 on /YM) – because we're looking for an index to short this morning.

Monday, May 4th, it was "Monday Madness: Weak Chinese Data Spurs Stimulus Hopes" and we discussed the irony that the HORRIBLE GDP Report and declining Chinese PMI clearly indicated that there was a Global Economic Slump yet that was being taken as good news by the markets – who were simply hoping for more Central Bank Stimulus to offset it. No trades as we thought it was all BS – just like it was when the MSM told us to ignore the obvious warnings of the last crash:

The Daily Show

Get More: Daily Show Full Episodes,The Daily Show on Facebook,Daily Show Video Archive

5/5 we were back at "Toppy Tuesday: 2,120 And Bust, Again..." and my summary note and overview said it all:

- Fake pre-market rallies and MSM carnival barkers lead retail lambs to the slaughter.

- Meanwhile, China's bubble is bursting.

- And economic confidence is falling off a cliff.

Another big push as pre-markets attempt to engineer a new high. As with most up days, yesterday's low-volume fiasco had us punching 2,120 at the open, followed by a whole day of institutions selling to all the people Cramer and Co. could manage to chase into the market, following their promise of pots of gold at the end of the rainbow.

Cramer looks a bit like a Leprechaun, who are famous for tricking people with false promises of easy money as well. We don't promise easy money here, we teach people "How to Get Rich Slowly," using sound investment strategies and we DISCOURAGE the kind of hot money chasing that is the hallmark of CNBC and the rest of the MSM's advice. We are currently VERY CONCERNED with the level of froth we're seeing in the markets and we've moved our member portfolios mainly to CASH!!! for the duration of earnings season (the rest of May).

The move back up finally gave us some entry points we were happy with and our trade ideas were:

The move back up finally gave us some entry points we were happy with and our trade ideas were:

- China ETF (FXI) June $50 puts at $1.07, closed at $3.21 – up 200%

- S&P Futures (/ES) short at 2,104, low of 2,061 – up $2,150 per contract

- Oil Futures (/CL) short at $60.45, high of $61.10 – down $650 per contract

That oil contract was our first loss in the Futures all month so I was, of course livid. Rather than dumping our positions, we pressed them and I noted the next day (inventory day) that there were "400 Million Fake Orders For Oil At The NYMEX" and I detailed the in and out moves we had made in our Live Member Chat room on the contracts and called for a reload short - and this time we got it right:

- Oil Futures (/CL) short at $62, low of $58 – up $4,000 per contract

That led to

IN PROGRESS

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!