What a spectacular month we had!

What a spectacular month we had!

We're starting May off at new highs in both of our paired portfolios. The Short-Term Portfolio finished up 123.9% at $223,925, up $2,535 (1.1%) since our last review 12 days ago. That is FANTASTIC because that's our bearish portfolio which, fortunately, we had adjusted to be not too bearish as the S&P bounced hard off that floor and is now back at the top of the channel.

Because we cashed out our aggressive naked index shorts and retreated to longer-term spreads where we are BEING THE HOUSE – Not the Gambler (our core strategy), the market chop ended up being good for our wrong-way index shorts since it was worse on the calls we sold than the calls we bought. See what a simple strategy this is?

Meanwhile, we went on a shopping spree in the well-protected Long-Term Portfolio, adding 3 new short puts, one new dividend-payer and one new spread for 5 new positions in 3 weeks and the LTP finished the day yesterday up 51.3% at $756,472 and that's up $8,898 (1.2%) in the same 12 days. Making money on both our bullish and bearish portfolio at the same time is quite a feat and our combined total of $980,397 is now up 63.4% from our $600,000 start in late Novemeber of 2013 (17 months).

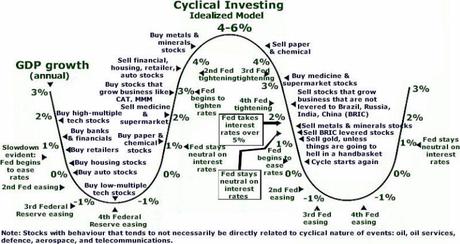

While the chart above serves as a guidline in "normal" markets, this market is far from normal – so take it with a grain of salt but I do want to illustrate that stock sectors do tend to have cycles and our very simple philosophy when we cashed our most of our Long-Term Portfolio on March 24th was that our underperforming Energy and Material stocks were going to come around if we gave them time and…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!