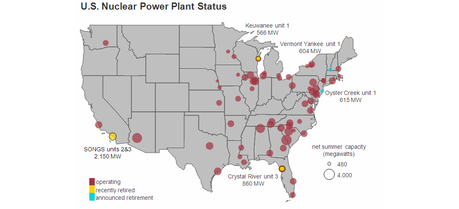

U.S. nuclear power plants, highlighting recently and soon-to-be retired plants, as of 2013 (Source: U.S. Energy Information Administration).

U.S. nuclear power plants, highlighting recently and soon-to-be retired plants, as of 2013 (Source: U.S. Energy Information Administration).Due to abundant shale gas reserves, natural gas prices in the U.S. continue to remain low. Because of this, natural gas is positioned to rival coal consumption as well as take share from oil on the global stage. According to Vault Energy Solutions, a Texas based energy consulting company, nuclear energy is also not immune to the impact of low natural gas prices.

Citing low wholesale electricity rates among other factors, several nuclear power plants across the country have been scheduled for retirement in the past year. In total, five reactors representing a total capacity of around 4,200 megawatts have been slated for shutdown. In each case, for various reasons, the owners of the plants feel that they can no longer make money in the current environment.

Nuclear reactors are expensive undertakings. They required massive amounts of capital and years to build. It’s not common to see them retired and their owners don’t take such decisions lightly. The current round of retirements represent the first nuclear power plant shutdowns in the U.S. Since 1998.

The largest recent retirement is the San Onofre Nuclear Generating Station (SONGS) near San Diego. Southern California Edison, the owner of the facility recently made the decision to retire two reactors (units 2 and 3) totaling a combined output loss of 2,150 MW. The two units have been offline since January of 2012 awaiting repairs.

While the company had originally planned to restart the reactors after repairs were made, they have recently changed course and decided that the cost of repairs and length of the regulatory approval process involved in restarting the units make them no longer viable.

While there were a number of complicating factors leading to the shutdown of the SONGS units, the owners of the Vermont Yankee facility in Vermont are laying the blame for their recently announced shut down specifically on low natural gas prices and what they call “wholesale market design flows” that have kept wholesale electricity rates low in the region. Consequently, they didn’t feel like the facility could continue to be economically viable. They will start decommissioning in the fourth quarter of 2014.

This article was originally posted on Vault Energy Solutions.