Forbes: Remember this categorical assurance from President Obama?

“We’ll lower premiums by up to $2,500 for a typical family per year. . . . We’ll do it by the end of my first term as president of the United States”

OK, it’s probably a little unfair to take some June 2008 campaign “puffery” literally–even though it was reiterated by candidate Obama’s economic policy advisor, Jason Furman in a sit-down with a New York Times reporter: “‘We think we could get to $2,500 in savings by the end of the first term, or be very close to it.” Moreover, President Obama subsequently doubled-down on his promise in July 2012, assuring small business owners “your premiums will go down.” Fortunately, the Washington Post fact-checker, Glenn Kessler, honestly awarded the 2012 claim Three Pinocchios (“Significant factual error and/or obvious contradictions”).

Unfortunately, this has never settled the debate. When the Society of Actuaries estimated spring 2013 that the ACA would result in increasing claims costs by an average of 32 percent nationally by 2017, such estimates could be dismissed as “projections” since at the time of this study, actual premiums in the Exchanges had not yet been announced. A subsequent plethora of studies showed there had been double-digit increases in premiums (when comparing actual Exchange premiums to previously-prevailing premiums in the non-group market). However, virtually all of these studies focused only on Exchange premiums rather than premiums in the entire non-group market (only half of which consists of Exchange coverage). As a consequence, Obamacare proponents tended to dismiss these studies either as partisan attacks or methodologically limited, making what amounts to apples-to-oranges comparisons.

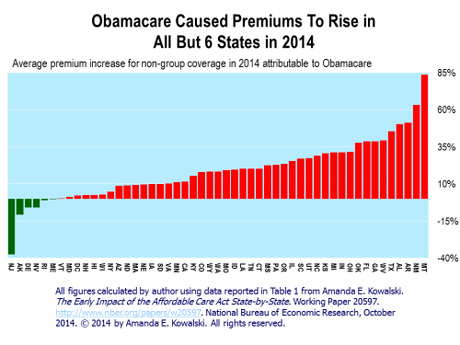

However, a new study from the well-respected and non-partisan National Bureau of Economic Research (and published by Brookings Institution), overcomes the limitations of these prior studies by examining what happened to premiums in the entire non-group market. The bottom line? In 2014, premiums in the non-group market grew by 24.4% compared to what they would have been without Obamacare. Of equal importance, this careful state-by-state assessment showed that premiums rose in all but 6 states (including Washington DC). It’s worth unpacking this study a bit to understand the ramification of these findings.

Non-Group Premiums Rose in 45 States Due to Obamacare

The non-group market can only be accurately assessed on a state-by-state basis. Obamacare. The law creates a single risk pool in each state for non-group coverage. That is, health insurers can sell policies inside or outside the Exchanges but they all are part of the same risk pool. Unlike virtually all other studies that have been conducted to date, this new study examined premium data from both Exchange and non-Exchange plans, i.e., providing a picture of the complete non-group market rather than one segment. This is crucially important since in nearly one third of states (16), Exchange coverage constitutes 40% or less of the entire non-group market (Table 1).

Of equal importance, unlike prior studies which simply compared pre-Obamacare premiums in 2013 to actual premiums offered on Exchanges in 2014, this new study isolates the causal impact of Obamacare statistically by using trend data in each state to figure out what non-group premiums in 2014 would have been in the absence of Obamacare. Thus, critics could dismiss many other so-called “pre-/post” studies by effectively saying “Well, premiums in the non-group have always gone up by a large amount, so what’s happening under Obamacare is no different.” Such criticisms cannot be levied at this study. All of the percentage changes shown in the chart below represent the net change attributable to Obamacare after accounting for all the other factors that would have made premiums go up.[1]

Clearly, the adverse impact of Obamacare on non-group premiums varies sizably across states. The law is estimated to result in lower premiums in only 6 states. However, it should be noted that while the author presented premium estimates for California and New Jersey, the data for these two states is incomplete due to anomalous data reporting requirements. Thus, the large estimated premium decline of 37.5% in New Jersey likely would be different were full data available, but there is no way of telling by how much.

What is disturbing is to see premium increases in excess of 35% in 9 states, including some of the nation’s largest states (Florida and Texas). Remember, these are increases above and beyond normal premium trends. No one can credibly claim that these massive premium increases would have happened anyway since the study was specifically designed to isolate the law’s impacts from all the other factors that have driven up premiums in recent years.

Taxpayers Will Pay About 24% More for Exchange Subsidies Due to Obamacare-induced Premium Increases

Of course, Obamacare enthusiasts will argue that I’m ignoring all the subsidies provided to Exchange members. It’s certainly true that for those lucky enough to qualify for such subsidies, the typical size of a subsidy in any given state would have been sufficient to protect such individuals from the premium increases shown in the chart above. But that ignores the fact that out of an estimated 13.2 million people covered in the non-group market in second quarter 2014 (Kowalski’s estimate), only about 7 million qualified for subsidies.[2] Thus, there were 6.2 million in the non-group market who had to absorb these premium increases without the benefit of any help from Uncle Sam.

Moreover, the fact that federal taxpayers were handed the privilege of having to offset such premium increases using their hard-earned tax dollars should in no way obscure the reality that Obamacare caused premiums to rise in the first place. Higher premiums are not what was promised when the law was enacted. Of equal importance, such subsidies represent a transfer that does not improve the welfare of the nation as a whole. A dollar given to an Exchange member to offset these higher premiums is simply a dollar taken out of the pocket of another American taxpayer. Indeed, had premiums not risen in the first place, the amount of subsidies required on the Exchanges could have been roughly 24% lower. Increasing the tab that taxpayers had to pay for such subsidies by roughly one fourth certainly in no way increased the nation’s welfare.

In short, it is harder and harder for champions of Obamacare to ignore the plain truth that this misguided law has increased premiums in the non-group market, a burden borne by millions who have to buy coverage in that market without the benefit of taxpayer subsidies and by the taxpayers who must bankroll subsidies for those who qualify. As I’ve demonstrated repeatedly, this law creates many more losers than winners. The many millions in the non-group market who are having to pay higher premiums due to Obamacare are just one slice of a much larger pool of losers. But until this increasingly incontestable reality are acknowledged by the law’s supporters there is no prospect of changing a law that continues (quite sensibly) to be opposed by the majority of Americans.

DCG