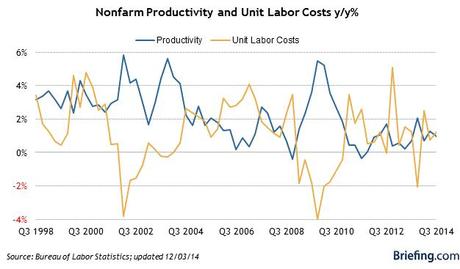

Productivity was down and costs were up.

Productivity was down and costs were up.

That's the news we got yesterday as we say a 30% drop in productivity, from 2.9% to 2% along with a drastic increase in unit quarterly labor costs – from -0.5% to 0.3%, which bumped the annual labor costs up by 60%, from 1.5% to 2.4%. Not surprisingly, this led to employers cutting the number of hours worked by 0.2% to save some of the rising costs that they have been unable to pass on to consumers.

Keep in mind that we're hitting these highs only after a TREMENDOUS amount of stimulus from Japan and Europe on top of very doveish outlook from our own Fed (even though they have stopped increasing QE – it's not over by a mile).

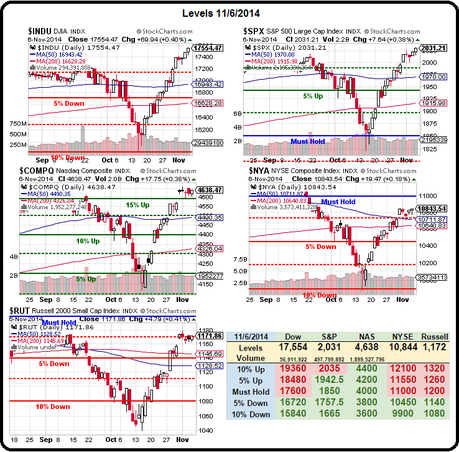

As tempting as it is for us to cut our bearish positions and join the party, here we face another weekend full of Global uncertainty, so we're going to stay covered and watch to see if the S&P can hit our 2,035 goal (see Wednesday's predictions) and actually hold it.

Now that we're here, we'll be looking for the following retracements next week:

- S&P 2,035 is our 10% line and we'll be looking for a pullback to 2,018 (weak) and 2,000 (strong).

- Dow 17,600 is our Must Hold and that makes a weak pullback 17,250 and 16,900 would be a strong retrace.

- Nasdaq 4,600 is our 15% line and we're over that without a retrace (so far) to 4,480 (weak) or 4,360 (strong).

- NYSE Must Hold 11,000 (it's been there before) and below that we look for 10,760 (weak) and 10,520 (strong) for pullbacks. The fact that the NYSE is in a range such that even our strong pullback isn't 5% is a bullish indicator for the rest over the long-term and our long-term

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!