By James O. Gibson

The spirit of enterprise was a key message in Margaret Thatcher’s campaigning; the late British PM championed entrepreneurship as the way to revive the British economy. In the process, Thatcher’s government made two fundamental changes the mindsets of ordinary British people:

If you work hard, you’ll get rich. If you’re poor, it’s your own fault.

Every man’s a capitalist and should aspire for more and more.

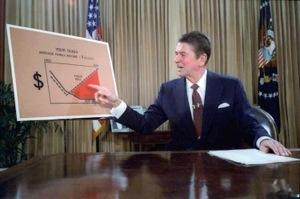

Because of these fundamental changes, the poor weren’t seen as unfortunates anymore, but people undeserved of the wealth enjoyed by a supposedly growing middle class. Through her policies and campaigns Thatcher reignited class warfare, however that’s a story for another article. In this post, I want to tell you how the neoliberal laissez-faire ideals breed doctrines very different from the intended outcomes. Margaret Thatcher and Ronald Reagan both promoted the idea of ordinary people being able to start up businesses and become rich inside an affluent host middle-rate taxpayers, however the policies they implemented had exactly the opposite effects. Whether you call it Thatcherism or Reagonomics, big businesses were empowered on an scale unprecedented since the industrial revolution as a result of tax cuts and widespread liberalization of some of the largest economies in the world (i.e. Britain and America). Tax cuts combined with continued deregulation of the Bank lead to the rise of new (and volatile) finance markets. Furthermore, hedge funds received increase interest as well as entirely new offerings in the increasingly complex finance sector.

After deregulation (started by Jimmy Carter) something very dangerous happened in America – the rise of the financial service sector. As crazy as it may seem, money in itself became a market. The finance markets became so complex that companies had to hire people with specialized knowledge in economics to be able to remain competitive against their rivals. This is still very true in the situation today. Every high-earning corporation has a dedicated team of finance specialists who are able to use their academic knowledge to increase profits for the business – obviously those economists will have to be paid a respectable amount. It gets worse though. There are investment firms who compromise entirely of these economists and finance specialists; exploiting trends in the market and ultimately making money out of money. Growth forever is impossible, and the rise of finance is likely a manifestation of that reality. We can’t build any more factories, as the workforce won’t be able to compete with cheap Asian labor. We can’t build any more shopping malls or call centers, since the demand isn’t growing as wages have stagnated. So if we can’t do any of this, how does the economy grow? Well the corporate elites had a solution, and that was to invest money in other ventures to make a profit – this can be scaled up and so we can create growth without the factories or shopping malls…

The investment firms also have shareholders though. It’s frightening to realize that there’s a chain of investors, investing in investors who are sometimes even investing in even more investors. The trading of assets has become extremely volatile in the process; the housing bubble being just one of the outcomes of this volatility. While the rise of finance markets (as a result of neo-liberalization) has made crises more frequent and more devastating, the rise has also created barriers for smaller businesses and ordinary people to actually embrace the supposed spirit of enterprise. The average Joe can’t afford to hire a team of financiers or make informed decisions in volatile markets. The average Joe also can’t compete with the huge corporate conglomerates which have been able to monopolize the markets because of tax cuts and deregulation. Okay, so Joe does get an extra £1000 a year from the same tax cuts, but the big corporations receive an extra £100 billion each. The amount of money given to the big businesses can be used to offset the amount of money given to the smaller businesses, thus allowing large companies to take hegemony over entire markets. These are state-financed corporate monopolies. So much for laissez-faire capitalism, eh?

Original: http://www.criticalproletariat.com/neoliberalism-breeds-state-monopoly-capitalism/