Uh-oh!

Uh-oh!

The Russell 2000 (we're short) went negative for the year on Friday. How long until the other indexes begin to follow? Even with incredibly low oil prices ($56.25 overnight lows) the Transports just gave up the 20% line, less than two weeks after giving up the 25% line. The Dow (we're short) itself is up just over 4% for the year now, S&P 8.5% and Nasdaq 11.5% (we're short them too).

The question before us now is – "How low can we go?" So far, we're not even close to the drop we just had in October. For the Transports, that would be a tragic 15% drop from where they are now, as they led the rally off those lows.

The other indexes are about 10% above those levels and we'll see if Santa has completely forsaken the markets over the next couple of weeks but the technical damage is done and fear has come back to the markets with the VIX rocketing up to 23 on Friday, settling into the close at 21.

That's going to make is a fantastic time for us to sell some long-term options and we'll be looking into our "Secret Santa's Inflation Hedges" next weekend in a post but during the week in our Live Member Chat Room. We don't do them every year, the last time we called for inflation was back in 2011, when our 5 hedges averaged over 200% returns for the year – THAT's the way to hedge against inflation!

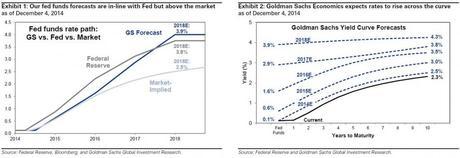

As we were discussing in Member Chat this weekend (thanks ZZ), we may be approaching a Bondocalypse, the likes of which we haven't seen since the collapse of the bond market in 1994. While the MSM is burying the news, the 2-year notes are now at a level not seen since 2011 (when we last became justifiably concerned about inflation) with expectations of Fed Funds climbing to 1.375% by the end of next year – up over a point and all the way to 2.875% at the end of 2016!

Such a rapid (and necessary) rise would CRUSH the bond market, where people have sold 10-year notes for…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!