Mainland China (the Shanghai) will be closed all week for the Lunar New Year (horse) and the Hang Seng is closed today, so we don't know what the tone will be when the sleeping giant awakens and reacts to our ugly closing out in January.

As you can see from our Big Chart, we have a classic "vomiting cobra" pattern, where the "spitting cobra" doubles over in pain and drops to the previous floor – all very scientific – like any TA pattern…

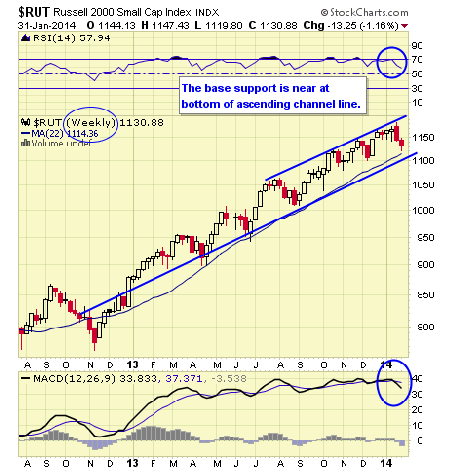

Now, as long as the S&P Futures (/ES) hold 1,780, we can enjoy the ride up but, if the RUT is rejected at 1,130 (/TF) and the Dow fails at 15,700 and the Nasdaq fails 3,525 (/NQ) and the S&P fails its line then the Russell will make an excellent short on the way back down.

A flat year (post-correction) is exactly what I predicted for 2014 so this is fine with us. We love flat markets, they are much easier to make money in since we KNOW how to buy stocks for a 15-20% discount and we KNOW how to BE THE HOUSE – and sell premium to others and collect steady fees in a flat market. It's been…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.