Things are still looking up.

Things are still looking up.

This morning, Japan revised their Q1 GDP Estimate from 5.9% to 6.7% as a huge splurge in consumption ahead of the sales tax increase shot Consumer Spending through the roof 3-6 months ago. It's a great indication of what insane amounts of stimulus can do (Japan is puming about 10% of their GDP into the economy vs. "just" 5% in the US and less than 2% in Europe). By contrast, Europe's GDP grew just 1% in that 18-country block and the US was down 0.1% during the same period.

Clearly stimulus works – so – the answer to everything is – MORE STIMULUS!!!

More stimulus, more stimulus and, when in doubt (or, when needing to hit your numbers) – even more stimulus! We saw the ECB get on that bandwagon last week and our Fed never stopped so, what can possibly go wrong in a global money-printing party. Other than this, of course (projections for Q2 in Japan):

Even Japanese traders wised up this morning as the Nikkei tumbled off the high of 15,235 back to 15,160 in the Futures (/NKD) but that's still high enough to give it an official 0.3% gain for the day. Other Asian indexes also sold off into the close, but not so much as to not print another bullish Monday as Chinese export growth (May) came in strong as well at 7%, after a very weak 0.9% in April.

This is what happens in a market that ignores bad news (the 0.9% disaster didn't take us down) and celebrates good news – there's literally nowhere to go but up! MSCI's All-World share index (.MIWD00000PUS on Bloomberg), which encompasses 45 countries and is generally seen as benchmark of global stocks, was up 0.1 percent at 426.77 points, just below its 2007 pre-financial crisis peak of 428.63 points.

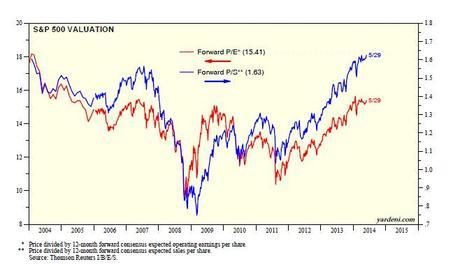

This chart is interesting as it gives us a view of both p/e, which has been boosted by stock buybacks and M&A activity, as well as price to sales, which isn't. The capacity for both investors and analysts (not Dr. Ed) to ignore this kind of information astounds me, as clearly we can see that we are now looking WORSE than we did in 2007, the last time stock buybacks and M&A were used to artificially boost the APPARENT p/e of so many stocks – to mask the fact that we were, in fact, heading into a crisis of biblical proportions. As Dr. Ed notes:

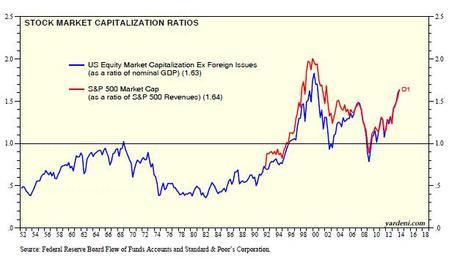

Many years ago, Professor James Tobin of Yale (and the chairman of my PhD committee) devised his Q Ratio, which is the total market value of a firm divided by the replacement cost of building the firm from scratch. When Q exceeds 1.00, entrepreneurs have an incentive to build it because its market value will exceed its cost.

That’s obviously a very theoretical construct used to explain the capital spending cycle. Nevertheless, the Fed’s Flow of Funds database includes two series that can be used to derive a Q ratio for the overall market showing the extent to which investors are either overvaluing or undervaluing the capital stock. I adjust it so that it has equaled 1.00 on average since the start of the data in 1952. During Q1, it rose to 1.56, the highest since Q4-2000.

But Q1 of 2000 was DOWN from the highs we hit in 1999 so perhaps this market madness has another rally leg to play out before correcting (and hopefully not 50% down to the mean line). That's the problem with being a Fundamentalist – we tend to lose interest in buying stocks long before they finally top out.

Of course, we're still able to find values – even in a crazy, over-bought market. This weekend I put up a Buy List for our Members with 29 stocks and option trade ideas for playing them. My plan is to be PATIENT and add a few to our Long-Term Portfolio, which now has $608,000 in virtual cash to deploy, up from our $500,000 base in December. As you can see from the opening dates of positions from the first half, slow and steady won that race - so no need to change strategies here – especially when we're concerned the market may pull back.

IN PROGRESS

Email This Post

Email This Post

Twitter

Twitter

LinkedIn

LinkedIn

del.icio.us

Google+

del.icio.us

Google+

This entry was posted on Monday, June 9th, 2014 at 7:43 am and is filed under Immediately available to public. You can leave a response, or trackback from your own site.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!