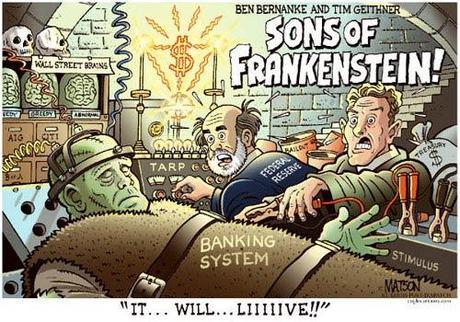

That's what Richard Gere said to Lou Gosset in "An Officer and a Gentleman" and that's what the markets are saying to us as the Fed attempts to force them into a no-lose situation in which there is literally nowhere else to put your money other than equities. The bank won't pay you interest, inflation erodes your cash, bonds pay next to nothing and margin interest has never been lower – why not play equities – you can't lose?

Or can you? As Dave Fry notes in his Dow chart, it's a micro-managed environment for equities and everyone knows "you can't fight the Fed" and bears can certainly attest to that this year as we've had a pretty relentless 3,000-point climb in the Dow. We did run into a spot of trouble in the Summer, but that was fixed in October as GS, NKE and V were added to change the mix, which helped to goose the index another 1,000 points.

It doesn't matter how the Dow gained 23% this year, as long as they get to print that fact on the brochures, right? Just like it didn't matter how Bitcoin came to print such a bullish picture as it rocketed up from $500 to $1,200, rewarding all dip buyers along the way. These things always work out fantastically well – until they don't!

It doesn't matter how the Dow gained 23% this year, as long as they get to print that fact on the brochures, right? Just like it didn't matter how Bitcoin came to print such a bullish picture as it rocketed up from $500 to $1,200, rewarding all dip buyers along the way. These things always work out fantastically well – until they don't!

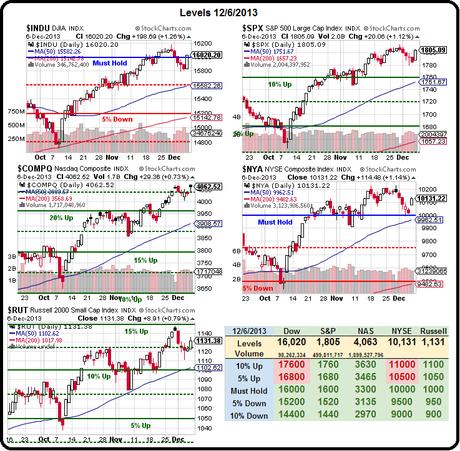

One of the hardest things to teach traders is the value of PRESEVING wealth, as opposed to just making more of it. If the market is going to go up and up and up in 2014, then we have hundreds of ways to make much, much more than 23%. I'm just putting together a list of those ideas for our Members and, just like the beginning of 2013, when I had 3 bullish picks on January 5th, we can start 2014 off with some bullish selections as well – especially since we have such lovely support levels (16,000 on the Dow, 1,800 on the S&P, 4,000 on the Nasdaq, 10,000 on the NYSE and 1,100 on the Russell) to let us know when it will be time to get out.

For now, HOWEVER, we are in cash or, in the very least, extremely well-hedged on our long positiions. Back in May I had said the markets could remain overbought for an extended period of time, but I certainly didn't imagine it would be THIS long! But, here we are – so no sense in whining about it, may as well just enjoy the ride and see where we wind up AFTER THE HOLIDAYS.

For now, HOWEVER, we are in cash or, in the very least, extremely well-hedged on our long positiions. Back in May I had said the markets could remain overbought for an extended period of time, but I certainly didn't imagine it would be THIS long! But, here we are – so no sense in whining about it, may as well just enjoy the ride and see where we wind up AFTER THE HOLIDAYS.

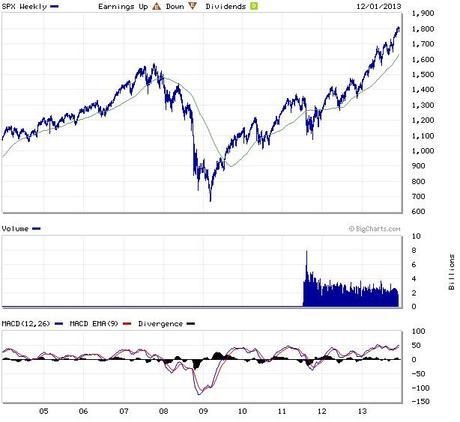

Why not just "go for it" now? Because, like Bitcoin, this market can implode at any time because, like Bitcoin, it's run up on thin volume, wild speculation, rumors based very loosely on facts and, of course, manipulation.

What worries us most about the recent market gains is they have been very much driven by Dollar losses and, as you can see from this very erratic Dollar chart – that's the one thing the fed does not have firm control of. As I often stress, equities are priced in Dollars and the Dollar is down 6.5% since July and the Dow is up 8% – usually it's a 2:1 ratio to the Dollar, so they're not even managing that.

What does this mean? It might mean that they have completely run out of "legitimate" ways to boost the market (stimulus, earnings, upgrades, happy talk) so now it's time to change the unit of measurement to make the graph look like it's still going up, even though it flatlined 6 months ago. As Bill Gross notes, saying "What Keeps Me Up At Night":

What does this mean? It might mean that they have completely run out of "legitimate" ways to boost the market (stimulus, earnings, upgrades, happy talk) so now it's time to change the unit of measurement to make the graph look like it's still going up, even though it flatlined 6 months ago. As Bill Gross notes, saying "What Keeps Me Up At Night":

Yet this now near 5-year migration across the global asset plains in search of taller grass and deeper water has had limits, both in price and real growth space. If monetary and fiscal policies cannot produce the real growth that markets are priced for (and they have not), then investors at the margin ? astute active investors like PIMCO, Bridgewater and GMO ? will begin to prefer the comforts of a less risk-oriented migration. If they cannot smell the distant water or sense a taller strand of Serengeti grass, astute investors might move away from traditional risk such as duration as opposed to towards it. Deep in the bowels of central banks research staffs must lay the unmodelable fear that zero-bound interest rates supporting Dow 16,000 stock prices will slowly lose momentum after the real economy fails to reach orbit, even with zero-bound yields and QE.

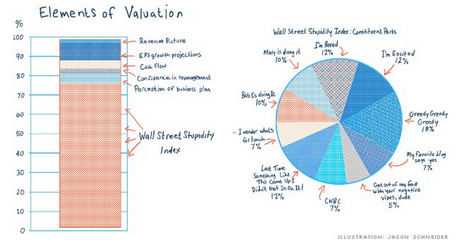

Doug Short summed up "6 Things to Ponder: Bulls, Bears, Valuations and Stupidity" and, as usual, the bullish case boils down to "THE FED" and the "improving economic climate" – but how can you tell it's improving if it's based on Trillions of Dollars of Global Stimulus until you remove that Global Stimulus? As you can see from our Central Banksters' recent actions – they have INCREASED stimulus Globally this quarter and decreased NOTHING!

Doug Short summed up "6 Things to Ponder: Bulls, Bears, Valuations and Stupidity" and, as usual, the bullish case boils down to "THE FED" and the "improving economic climate" – but how can you tell it's improving if it's based on Trillions of Dollars of Global Stimulus until you remove that Global Stimulus? As you can see from our Central Banksters' recent actions – they have INCREASED stimulus Globally this quarter and decreased NOTHING!

The image on the left is from a Forbes slide-show titled "High Five, What Stimulus Means for Global Stock Markets." From A Capitalist Tool's perspective, the Fed dilluting your life saving by another 6.5% to prop up the holdings of the top 1% by 8.5% is a clearly winning strategy and they, along with these floor traders, are celebrating it. And why not? It's only other people's money they are playing with.

Germany is backing away from austerity, raising the mininum wage and adding Billions in infrastructure projects. The BOE has pumped $579Bn into the UKs $2.4Tn GDP (25%) since 2009 and the FTSE is up 37.5% so well worth it for those who own stocks.

In the US, the Fed is pumping $85Bn PER MONTH into securities and that's over $1 TRILLLION per year, or 6.3% of our GDP yet, just last week, we had a party because our GDP grew 3.6%, barely half of the stimulus rate.

In the US, the Fed is pumping $85Bn PER MONTH into securities and that's over $1 TRILLLION per year, or 6.3% of our GDP yet, just last week, we had a party because our GDP grew 3.6%, barely half of the stimulus rate.

That, of course, is nothing compared to Japan, where the current $75Bn in monthly stimulus may not be $1Tn ("just" $900Bn a year), but they topped it off with another $189Bn in other stimulus this week for $1.19Tn of 2013 stimulus in a $6Tn economy (20%). When 20% of your GDP is stimulus, who in their right mind can pontificate about the health of your economy?

There are two ways to look at things. A rising economy lifts most ships and this game can go on for quite a long time (see 1998 and 1999) but it's SMART to FEAR the downside because, when it comes – it's very likely to look like Bitcoin's or, even worse, like 2008! Just look at this weekly S&P chart and look at Bitcoin above – see any familiar patterns?

There are two ways to look at things. A rising economy lifts most ships and this game can go on for quite a long time (see 1998 and 1999) but it's SMART to FEAR the downside because, when it comes – it's very likely to look like Bitcoin's or, even worse, like 2008! Just look at this weekly S&P chart and look at Bitcoin above – see any familiar patterns?

I guess an optimist would take that as a reason to BUYBUYBUY Bitcoin and keep right on buying the S&P because, after all, the Fed has your back, right? A pessimist might note:

- Weak holiday spending

- Weak Q3 earnings

- Lower Q4 guidance (Shiller p/e now 25 on the S&P, market cap to GDP at record highs, price to revenue at record highs)

- Upcoming debt ceiling

- Rising Oil Prices

- 7% unepmployment (it was 4% in 2007)

But who wants to be a pessimist, especially at Christmas? Better to cash in those stocks and be a market agnostic, spreading a little Christmas cheer and getting ready to shop in January, when we can hopefully buy a few things on sale.