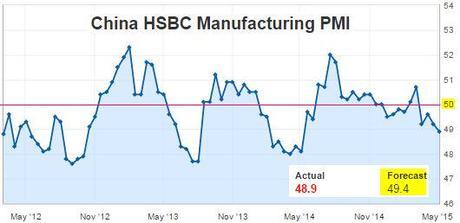

Chinese manufacturing keeps contracting.

Chinese manufacturing keeps contracting.

A 48.9 level for April is the worst in a year and the 4th consecutive month of declines as demand faltered and deflationary pressures persisted. That is TERRIBLE news – unless, of course, you are an investor in the top 1% - in which case this means China is likely to throw more money at the problem, which will allow you and the companies you invest in to grab their share and keep acting like everything is fine for another quarter.

The latest indication of deepening factory woes raises the risk that second-quarter economic growth may dip below 7 percent for the first time since the depths of the global crisis, adding to official fears of job losses and local-level debt defaults. "China's manufacturing sector had a weak start to Q2, with total new business declining at the quickest rate in a year while production stagnated," said Annabel Fiddes, an economist at Markit. "The PMI data indicate that more stimulus measures may be required to ensure the economy doesn't slow from the 7 percent annual growth rate seen in Q1."

We'll get our own Factory Orders data at 10 this morning and I don't think it's going to be good because they scheduled Chicago Fed Dove Evans to speak at noon, followed by San Francisco's Dove Williams at 3pm. The main focus for the week will be US Employment and Productivity – any sign of wage inflation could push the Fed to act sooner, rather than later.

IN PROGRESS

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!