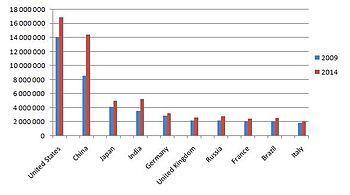

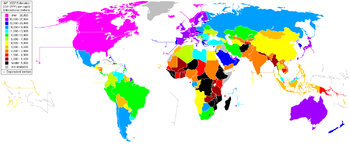

English: List of countries by future GDP (PPP) estimates (2009 and 2014). All of the figures shown are calculated by the International Monetary Fund, and are in millions of International dollars. (Photo credit: Wikipedia)

International Monetary Fund (Photo credit: Wikipedia)

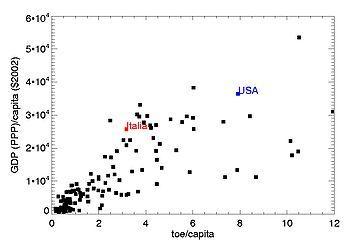

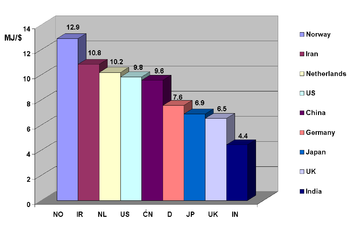

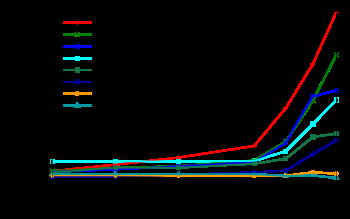

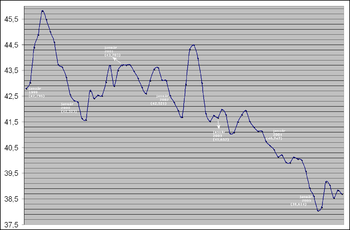

Graph of the Gross Domestic Product GDP (at Purchasing Power Parity-PPP), per capita, as a function of per capita Toes. Year 2004. Data available online at http://www.iea.org (Photo credit: Wikipedia)

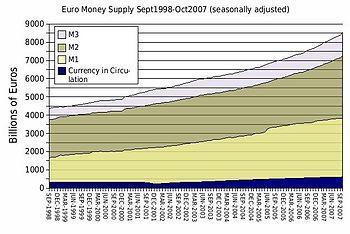

English: The Euro money supply from September 1998 through October 2007. (Photo credit: Wikipedia)

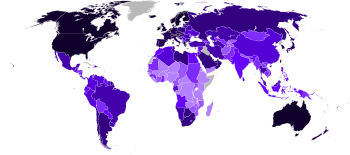

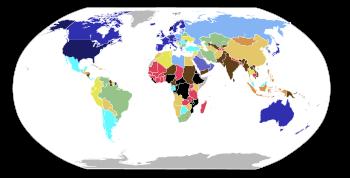

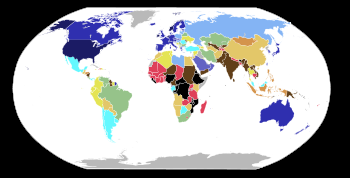

A world map of countries by gross domestic product at purchasing power parity per capita in 2007 from the International Monetary Fund. (Photo credit: Wikipedia)

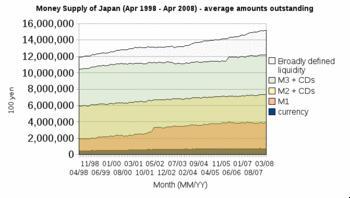

Japanese money supply (April 1998 – April 2008) (Photo credit: Wikipedia)

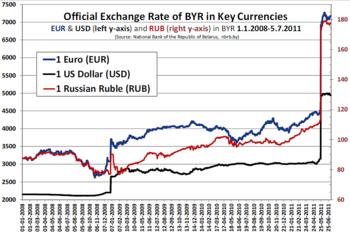

BYR Exchange Rate 1.1.2008- (Photo credit: Wikipedia)

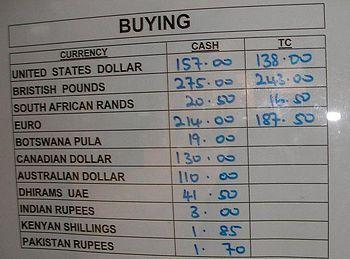

Exchange rates display, seen at Suvarnabhumi International Airport, Thailand (Photo credit: Wikipedia)

English: (Photo credit: Wikipedia)

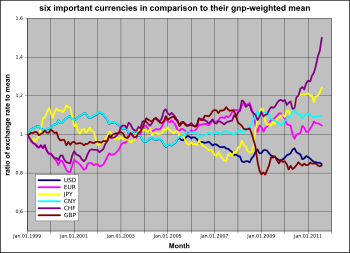

Exchange rate data were found here: http://www.oanda.com/lang/de/currency/historical-rates/. They were normalized with respect to their Jan. 1999 value and divided by the weighted mean of all. The weights are the GNP in relation to their GNP sum. GNP data from 2007 from CIA factbook (http://www.umsl.edu/services/govdocs/wofact2008/rankorder/2001rank.html). Calculation to be found here: http://www.box.net/shared/gry1nkry20tpodcfb9yt (Photo credit: Wikipedia)

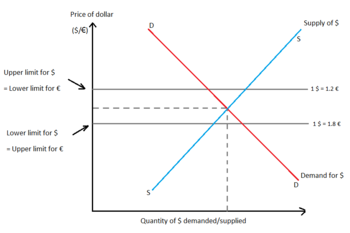

English: Mechanism of Fixed Exchange Rate System (Photo credit: Wikipedia)

Big Mac hamburgers, like this one from Japan, are similar worldwide. (Photo credit: Wikipedia)

English: Gross domestic product (at purchasing power parity) per capita between 1500 and 1950 in 1990 International Dollars for selected nations, depicting data excerpted from Contours of the World Economy, 1–2030 AD. Essays in Macro-Economic History by Angus Maddison, Oxford University Press, 2007, ISBN 978-0-19-922721-1, p. 382, Table A.7. (Photo credit: Wikipedia)

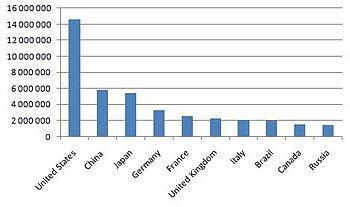

English: The ten largest economies in the world, measured in nominal GDP (millions of USD), according the International Monetary Fund, 2010 (Photo credit: Wikipedia)

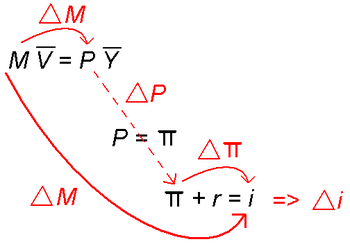

English: Fisher effect, image for illustrative purposes, money supply directly affects the nominal interest rate, or indirectly via P and pi (Photo credit: Wikipedia)

World map showing 2007 estimates about GDP (PPP) per capita (international dollars) {| style=”width: 100%;” |- style=”vertical-align: top;” | style=”width: 100%;” | |} —- (Photo credit: Wikipedia)

Graph (Photo credit: Wikipedia)

History Exchange Rate SKK EUR 1999 to 2005 (Photo credit: Wikipedia)

GDP (Gross Domestic Product) PPP (Purchasing Power Parity) per capita in the world. (Photo credit: Wikipedia)

English: Exchange rates for Malawi Kwacha posted by a currency trader in Lilongwe on October 7, 2008. (Photo credit: Wikipedia)

Exchange rates influence business activities and also affect demand for products. When a country’s currency is weak, the price of its exports declines, making the exports more appealing on world markets.

Devaluation is the intentional lowering of the value of a currency by the nation’s government. This gives domestic producers an edge in world markets, but also reduces citizens’ buying power.

Revaluation is the intentional raising of the value of a nation’s currency. This increases the price of exports and reduces the price of imports.

Exchange rates affect the profits earned abroad when repatriated by the parent company into the home currency. Translating subsidiary earnings from a weak host country currency into a strong home currency reduces earnings, and vice versa.

There are many reasons for currency Stability and Predictability:

1. Stability makes for accurate financial planning and cash flow forecasts.

2. Predictability reduces odds the probability that a company will be caught off-guard by unexpected rate changes. It also reduces the need for costly insurance (currency hedging) against possible adverse exchange rates.

An exchange rate (also known as a foreign-exchange rate, forex rate or FX rate) between two currencies is the rate at which one currency will be exchanged for another. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date; 30, 60 or 90 days.

Many factors determine exchange rates. Exchange rates do not guarantee or stabilize the buying power of a currency; purchasing power fluctuates.

Ideally, the exchange rate should reflect the law of one price. Law of one price means that an identical product must have an identical price in all countries when expressed in the same currency. The product must be identical in quality or content and be entirely produced within each country. If price were not identical in each country, an arbitrage opportunity would arise. Traders would buy in the low-priced market and sell in the high-priced market; buying drives up the price in one market and drives down the price in the other.

Purchasing power parity (PPP) is a technique used to determine the relative value of different currencies. This postulates that in some circumstances it would cost exactly the same number of US dollars to buy euros and then to use the proceeds to buy a market basket of goods as it would cost to use those dollars directly in purchasing the market basket of goods. The concept of purchasing power parity allows one to estimate what the exchange rate between two currencies would have to be in order for the exchange to be at par with the purchasing power of the two countries’ currencies.

GDP (Gross Domestic Product) PPP (Purchasing Power Parity) per capita in the world. (Photo credit: Wikipedia)

The Economist publishes its “Big Mac Index” using the law of one price to determine the exchange rate between the U.S. dollar and other currencies. The index takes its name from the Big Mac, a hamburger sold at McDonald’s restaurants.

PPP is the relative ability of two countries’ currencies to buy the same “basket” of goods in those two countries. Tells how much of currency “A” a person in nation “A” needs to buy the same amount of products that someone in nation “B” can buy with currency “B.”

Inflation erodes purchasing power. If money is injected into an economy not producing greater output, a greater amount of money is spent on a static amount of products. Demand soon outstrips supply and prices rise.

Governments manage the supply of and demand for currency with policies that influence the money supply.

- Monetary policy refers to activities that directly affect a nation’s interest rates or money supply. Governments buy or sell government securities on the open market to influence the money supply.

- Fiscal policy involves using taxes and government spending to influence the money supply indirectly. Governments can increase or lower taxes, or increase or decrease government spending.

The threat of a company moving abroad will impact unemployment and interest rates. If a company moves abroad for lower wages, it holds down wages at home. Companies don’t have to raise prices to pay higher wages, lowering inflationary pressures.

- Low unemployment puts upward pressure on wages. To maintain profit margins with higher labor costs, producers pass the cost of higher wages on to consumers in higher prices, causing inflationary pressure.

- Low interest rates encourage consumers and businesses to borrow and spend, causing inflationary pressure.

Exchange rates adjust to different rates of inflation across countries, which is necessary to maintain purchasing power parity between nations.

- For example, if inflation in Mexico is higher than in the United States, the exchange rate adjusts to reflect that a dollar will buy more pesos due to higher inflation in Mexico.

- U.S. goods become more expensive for Mexican firms, and Mexican goods become cheaper for U.S. companies.

The interest rate a bank quotes a borrower is the nominal interest rates. ”The international Fisher effect (sometimes referred to as Fisher’s open hypothesis) is a hypothesis in international finance that suggests differences in nominal interest rates reflect expected changes in the spot exchange rate between countries. The hypothesis specifically states that a spot exchange rate is expected to change equally in the opposite direction of the interest rate differential; thus, the currency of the country with the higher nominal interest rate is expected to depreciate against the currency of the country with the lower nominal interest rate, as higher nominal interest rates reflect an expectation of inflation.”

1. The Fisher effect is the principle that the nominal interest rate is the sum of the real interest rate and the expected rate of inflation over a specific period.

2. The international Fisher effect is the principle that a difference in nominal interest rates supported by two countries’ currencies will cause an equal but opposite change in their spot exchange rates.

PPP assumes no trade barriers. But a high tariff or outright ban on a product can impair price leveling, causing PPP to fail to predict exchange rates accurately.

EVOLUTION OF THE INTERNATIONAL MONETARY SYSTEM

A. Early Years: The Gold Standard

1. Gold was internationally accepted for paying for goods and services. Pros: its limited supply caused high demand and it can be traded, stored, and melted into coins or bars making a good medium of exchange. Cons: its weight made transport expensive, and if a ship sank, the gold was lost.

2. The Gold standard was an international monetary system in which nations linked the value of their paper currencies to a specific value of gold. The gold standard operated from the early 1700s until 1939.

3. The value of a currency expressed in terms of gold. All nations fixing their currencies to gold also indirectly linked their currencies to one another. Thus, the gold standard was a fixed exchange rate system—one in which the exchange rate for converting one currency into another is fixed by international governmental agreement.

4. The U.S. dollar was fixed at $20.67/oz of gold, the British pound at £4.2474/oz.; exchange rate was $4.87/£ ($20.67 ÷ £4.2474).

5. Advantages of the Gold Standard:

a. Reduced the risk in exchange rates because it locked exchange rates between currencies. Fixed exchange rates reduced the risks and costs of trade and grew as a result.

b. Imposed strict monetary policies that required nations to convert paper currency into gold if demanded by holders of the currency. This forced nations to keep adequate gold reserves on hand. A nation could not let paper currency grow faster than the value of its gold reserves, which controlled inflation.

c. Helped correct a nation’s trade imbalance.

If a nation imports more than it exports, gold flowed out to pay for imports. The government must decrease the supply of paper currency in the domestic economy because it could not have paper currency in excess of gold reserves. As the money supply falls, so do prices of goods and services because fewer dollars are chasing the same supply of goods and services. Falling prices make its exports cheaper on world markets and exports rise until the nation’s international trade is in balance.

In the case of a trade surplus, the inflow of gold supports an increase in the supply of paper currency. This increases the demand for and cost of goods and services; exports fall in reaction to their higher prices until trade is in balance.

The collapse of the Gold Standard was initiated when nations in the First World War financed the war by printing paper currency. This caused rapid inflation and caused nations to abandon the gold standard. Britain returned to the gold standard in the early 1930s at the same par value that existed before the war. The United States returned to the gold standard at a new, lower par value that reflected the inflation of previous years.

The U.S. decision in 1934 to devalue its currency and Britain’s decision not to do so lowered the price of U.S. exports and increased the price of British goods imported. It now took $8.24 to buy a pound ($35.00 ÷ £4.2474).

Countries retaliated against one another through “competitive devaluations” to improve their own trade balances. Faith in the gold standard vanished, as it was no longer an accurate indicator of a currency’s true value.

The Bretton Woods Agreement in New Hampshire in 1944, was an accord among nations to create a new international monetary system based on the value of the U.S. dollar. Designed to balance strict discipline of the gold standard with flexibility to manage temporary domestic monetary difficulties. Bretton Woods faltered in the 1960s because of U.S. trade and budget deficits. Nations holding U.S. dollars doubted the U.S. government had gold reserves to redeem all its currency held outside the United States. Demand for gold in exchange for dollars caused a large global sell-off of dollars.

The World Bank was created to fund national economic development. The immediate purpose was to finance European reconstruction after the Second World War and later shifted its focus to the general financial needs of developing countries. The World Bank finances economic development projects in Africa, South America, and Southeast Asia, and offers funds to countries unable to obtain capital for projects considered too risky. It often undertakes projects to develop transportation networks, power facilities, and agricultural and educational programs.

The International Monetary Fund was created to regulate fixed exchange rates and enforce the rules of the international monetary system. Purposes of the IMF are to:

Promote international monetary cooperation.

Facilitate expansion and balanced growth of international trade.

Promote exchange stability with orderly exchange arrangements, and avoid competitive exchange devaluation.

Make resources temporarily available to members.

Shorten the duration and lessen the degree of disequilibrium in the international balance of payments of member nations.

Between 1980 and 1985 the U.S. dollar rose against other currencies, pushing up prices of U.S. exports and adding to a U.S. trade deficit. The Plaza Accord (1985) was an agreement among the largest industrialized economies known as the G5 (Britain, France, Germany, Japan, and the United States) to act together in forcing down the value of the U.S. dollar. The Louvre Accord (1987) was an agreement among the G7 nations (the G5 plus Italy and Canada) that affirmed the dollar was appropriately valued and that they would intervene in currency markets to maintain its current market value.

Today’s Exchange-Rate Arrangements remains a managed float system, but some nations maintain more stable exchange rates by tying their currencies to other currencies. The Pegged Exchange-Rate Arrangement “peg” a country’s currency to a more stable and widely used currency in international trade. Many small countries peg their currencies to the dollar, euro, the special drawing right of the IMF, or

other individual currency. Others peg their currencies to “baskets” of currencies.

The European Monetary System was created in 1979, to stabilize exchange rates. It was ended in 1999 when the EU adopted a single currency.

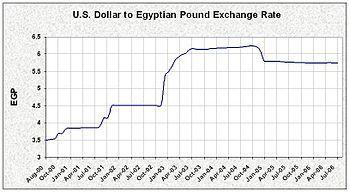

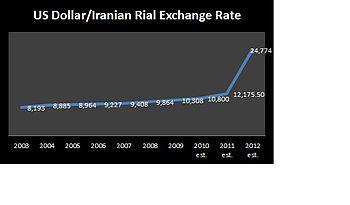

- English: US dollar/Iranian rial exchange rates (2003-2010). Note: Iran has been using a managed floating exchange rate regime since unifying multiple exchange rates in March 2002. (Photo credit: Wikipedia)

The world has seen several recurring currency crises. Recent financial crises underscore the need for managers to fully understand the complexities of the international financial system.

Related articles

Strong US dollar reflects everyone else’s weakness

Strong US dollar reflects everyone else’s weakness Swiss will vote on Nov. 30 for gold backed Franc

Swiss will vote on Nov. 30 for gold backed Franc Vietnam’s currency devalued

Vietnam’s currency devalued The Big Mac index

The Big Mac index The Big Mac Index – A Feast of Burgernomics

The Big Mac Index – A Feast of Burgernomics Big Mac currency index updated … the AUD is undervalued!

Big Mac currency index updated … the AUD is undervalued! The Dollar May Remain Strong For Longer Than We Think

The Dollar May Remain Strong For Longer Than We Think Imprecise Timetable For Cuban Currency Conversion – Analysis

Imprecise Timetable For Cuban Currency Conversion – Analysis Rupee impact: The Free fall continues, small snag on equities

Rupee impact: The Free fall continues, small snag on equities The World’s Richest Countries

The World’s Richest Countries

COMMENTS ( 1 )

posted on 29 November at 05:53

It's actually a nice and helpful piece of information. I'm glad that you simply shared this useful information with us.

Please keep us informed like this. Thanks for sharing.