In investing, volatility is synonymous with risk. Things like common stocks have high amounts of volatility, which means they can change in price rapidly. As we’ve seen this week, individual stocks can change in price by 20%, 30%, or even 50% or more in a month or even a few days. If a significant bad event happens at a company, the common stock price can drop by 75% or more in a few minutes.

In investing, volatility is synonymous with risk. Things like common stocks have high amounts of volatility, which means they can change in price rapidly. As we’ve seen this week, individual stocks can change in price by 20%, 30%, or even 50% or more in a month or even a few days. If a significant bad event happens at a company, the common stock price can drop by 75% or more in a few minutes.

Volatility also provides the opportunity for gains, however. Individual stocks can also double or even triple in a single year. If you buy a bond, your return will be limited to 8-10% per year, with perhaps some change in the price of the bond if interest rates change or the company’s financial health improves. With stocks, there is a factor called the beta, which measures how volatile the stock is compared to the market in general. Those with a beta above 1.00 are more volatile than the market, while those with lower betas are less volatile than the market. Studies have shown that over long periods of time, a group of stocks with higher betas outperform a group with lower betas. The problem is some of the stocks with higher betas may implode, so buying a stock just because it has a high beta can be risky.

Doing well when investing is all about managing risk, which means managing volatility. When you are investing for a long time, like 20 years, you don’t really care if the value of your portfolio fluctuates a lot as long as the general direction is up. You can therefore invest in such a way that you’ll see high volatility if you can get higher returns. If you are a few years away from retirement, however, and have just enough to live on, you can’t afford to see the value of your portfolio swoon by 30% in a bear market. You may also find that you don’t like to see your portfolio value change a lot, and are therefore willing to give up a bit of return to sleep better at night. The way to control volatility is through diversification and asset selection.

Diversification

Diversification is the buying of several different assets, ideally those that are not correlated. This does two things. the first is to reduce the risk posed by special situations. For example, if you have all of your money in company XYZ and they post bad earnings for a quarter, you may see the value of your entire portfolio drop by 25%. If you have only 10% of your money in company XYZ and the rest in nine other stocks, you would only see a 2.5% decrease in your portfolio value due to the earnings miss. Even more devastating without diversification would be a major disruption – for example the Trans Ocean/BP Oil spill in the gulf that resulted in large drops in their stock prices.

The more diversification you add, the more your returns will approach those of the market of the assets you are buying. If you buy 100 large cap US stocks, your return will approach that of the S&P 500. If you buy 100 homes scattered throughout Pittsburgh, your return will approach that of the average home price change in Pittsburgh. If you bought several small cap stocks, you would have more volatility than you would have if you bought several large cap stocks since small caps move around more in general, but you would have less volatility than if you just bought a few small cap stocks. An easy way to get diversification is to buy a few different mutual funds or ETFs since they each contain dozens to thousands of stocks.

Many people would say that you should always have a great deal of diversification since that will ensure you get market returns and avoid the risk of coming up short. Concentrating a bit when you don’t have much money to protect, however, can make sense for some people. For example, if you have $2,000 to invest, you can put it into a mutual fund and make 10% per year, ending up with $4,000 in about 7 years, or you could put it into a single stock and perhaps double your money in a year or two. In this case, because it is a small amount of money involved compared to many people’s income, it might be worth the extra risk. then again, you are taking a risk of losing it all, which would be basically impossible in a diversified mutual fund.

Asset Mix

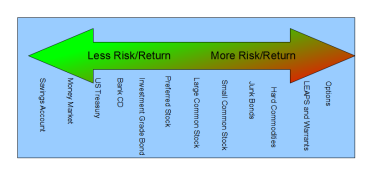

The second way to reduce volatility is in the mix of assets you buy. If you buy only stocks, you’ll do better over long periods of time than you will if you buy a 50-50 stock/bond mix, but you will also see a lot more volatility. In fact, holding a portfolio of 70% stocks and 30% bonds will reduce volatility greatly over a 100% stock portfolio while only giving up a couple of percentage points of return.

When you have several years before you’ll need to draw from your portfolio and you have a steady income from a job to pay the bills, you can afford to have a lot more volatility, so most wise people would mainly hold stocks. As you approach retirement age, however, or if you’re using the money for other things like college, you need to start shifting to bonds and dividend paying stocks to reduce the volatility and decrease risk. Adding some cash to the mix for bills that will be due soon also makes sense. In the case of paying for college, for example, going to all cash (or a staggered set of bank CDs) before your (or your child’s) Freshman year may make sense since then you will be guaranteed to have the money available when you need it and there will be little inflation over a four-year period. Going into a long retirement, you’ll need some growth to keep up with inflation, so a mixture of stocks, cash, and bonds of different maturity dates makes more sense.

Got something to add? Got and investing question? Please leave in a comment or send it to [email protected].

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.