Brent wrote the other day about how he has a mindful investment strategy. I like his strategy, I can get behind it, it’s easy to follow, and it’ll make us money (theoretically… there’s always that chance that it won’t make us money, and we’ll lose money, in which case, I’ll air our dirty laundry for all to see, and that’ll be fun for everyone).

But I’m new to investing, and I find it to be scary. I can’t help but think of movie stockbrokers who are on the phone yammering about some shady deal, and it all feels a little over my head.

Which is why I’m revisiting Jemstep (my affiliate link). Read my first review here. Jemstep is the opposite of mindful investing, and that’s okay. Let’s go through it together!

Adding Another Account

I had to switch to a Roth IRA this year, because by the time I get married, I’ll no longer qualify for a Traditional (first world problems!). So now’s a great time to look at how Jemstep works.

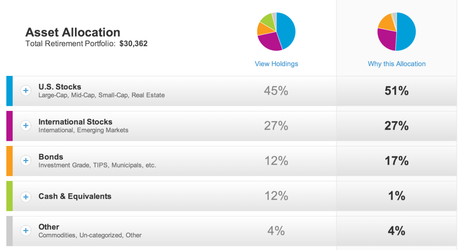

They take a look at where the money is (in my case, it’s in cash reserves) and tell you that using their service will make you more money than leaving things where they are.

You can tell that I’ve already taken their advice. When I first signed up, and was in that freedom 2040 fund, my current holdings were nowhere near this diverse. But the beautiful part is what happens next: they tell you exactly what to sell, exactly what to buy (although Brent’s 401(k) did not play nicely with Jemstep’s recommendations, so yours might not either!) and how to do it.

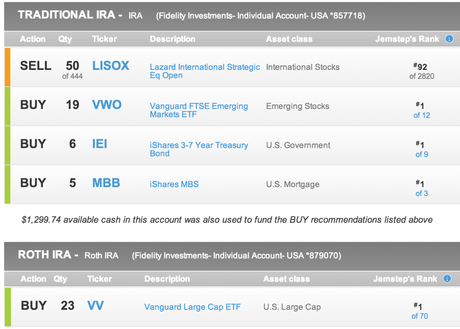

Here’s what they recommended for me:

Now, it’s just a matter of going back to Fidelity and figuring out what, exactly, they mean. If you’ve never been to Fidelity’s website, here’s how I imagine it came about. Two dudes were sitting around (with expensive vodka) trying to figure out the most complicated way to help people allocate their retirement funds. “Let’s take a bank’s website, and use investor Swedish Chef speak so those suckers will never know what they’re doing!”

“Right-o! And while we’re at it, let’s make everything so complicated that we need to have a 24-hour live chat helper there!”

Creating jobs, those two imaginary Fidelity jerkos. Anyway, the point is, actually following the Jemstep plan is easy, even if you’re lucky enough to have to deal with Fidelity’s website.

So, I did what they told me to do, and now I wait.

Concerns About Jemstep

One thing I didn’t realize when I was getting started was that every time I buy, Fidelity charges $7.95. It’s not a big deal when there aren’t many recommendations, but holy smokes I bet I spent $100 when I moved away from the target date retirement fund and into this balanced portfolio.

I’ve heard that Fidelity charges more than the others, so that could be my own limitation, but it sounds too complicated to switch — has anyone ever done that? Switched from Fidelity to Vanguard?

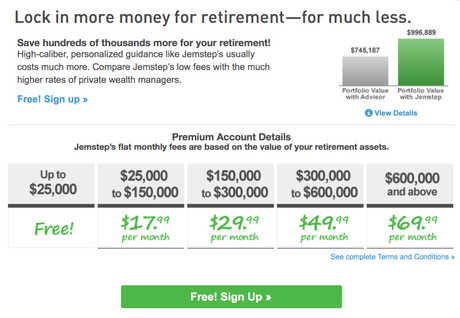

The other concern I have is that they charge a monthly fee. Now, sure, their fee is low (super low, if you don’t think about the $7.95 per trade that Fidelity gets), but you should not be rebalancing your portfolio monthly.

I don’t like paying for things that I’m not using that much. In my ideal world, I’m rebalancing my portfolio quarterly, or semi-annually, if I decide to max out my IRA in one or two lump sums. So, why should I pay x dollars per month for something I’m not using monthly?

Another concern is that they recommend actively managed funds with high expense ratios.

Jemstep’s Pricing

It’s funny — I’d be much more willing to pay a check-in rebalancing fee a few times a year than to let something as expensive as a gym membership sit idle.

However! It’s free if you’re ahem, behind on your contributions, or you’re a youngin’ (and if it’s the latter, then GET OFF MY LAWN). I really like the service. It makes me feel like I know what’s going on, when I clearly don’t. I can say my portfolio is diversified.

Now, here’s the part where I tell you that Jemstep gave me the free plan (I’m kind of a big deal), even though my balance is a little higher than their limit for free. However! All opinions are mine. Except the actively-managed fund thing. That was Brent’s thought. I don’t know how to tell which funds are actively managed or not.

Also, I have an affiliate relationship with them, which means if you click my links, not only will your hair be shiny and your skin will be more radiant, but I’ll get a little kickback from the nice folks at Jemstep. Which, again, doesn’t change my opinions. Truly.