- Failure to document cash flow projections is a disaster. No matter how small your company is today, there are more moving financial parts than you can manage dynamically in your head. Of course, you can’t predict everything, but writing down what you know will identify existing problems sooner, and allow other team members to help.

- You can be on budget, and still run out of cash. In the real world, spending seems to happen fast, and money coming in happens slowly. Thus your monthly budget may balance, but if planned income comes later than planned expenses, you have a short-term cash flow surprise shortage. Neither banks nor investors will help you on this one.

- Your startup may be profitable, but broke. Profits don’t necessarily translate into cash. You can make profits without making any money, since the first priority of most startups is to reinvest everything back into the business for growth. There are lots of accounting tricks to make you profitable, but it takes real cash to pay the bills.

- Seasonal sales fluctuations eat cash. Fluctuating sales means more inventory is required to cover the ups and downs. Every dollar in inventory is a dollar less in cash available, maybe even two dollars less if your gross margin is 50%. If you try to vary the number of employees to match, that costs even more cash for hiring, firing, and layoffs.

- Unanticipated expenses and emergencies drain cash. The chance of unanticipated expenses, in my experience, is close to 100%. It could be a natural disaster, like a flood or wind storm, or loss of key personnel, equipment failure, or a major customer complaint on the Internet. Every startup has an unplanned pivot, and these all drain cash.

- New businesses don’t get “normal” terms. It’s easy to forget that your new office rent asks for first, last, and security; new utilities require an escrow account; and new vendors want immediate payment for the first couple of months, before they offer the normal net 30 terms. On the other side, your new customers expect a free trial period.

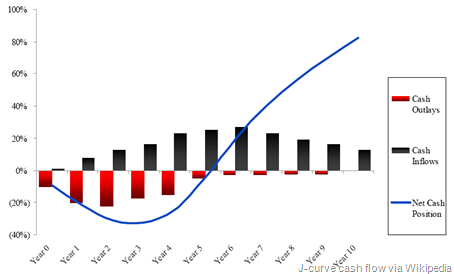

- Sales volumes are still ramping up while marketing expenses are at max. In the early days of a new business, and every time you make changes, sales volumes slip just when you need them most to cover the extra marketing expenses and new infrastructure. Your old “cash cows” are dying, while the new ones are still being fed heavily.

- Even good customers don’t always pay on time. The Kauffman Foundation reports that late payments are among the biggest challenges facing startups. According to FundBox, 64 percent of small businesses wait well beyond their contracted terms for payments. If they are dealing with distributors, that wait can easily be four or five months. One way to defer some of these costs, as outlined by ProOpinion, is to provide alternative compensation methods (equity or compensation based) to your new employees.

- Higher than anticipated growth has put you in cash flow hell. The faster you grow, the more cash you need, to build product, facilities, staff, and service. These are “up front” costs that can’t wait the four or five months before the sales and revenue catch up. If you can’t deliver to match the growth, your house of cards comes tumbling down.

- Bankers and investors hate negative surprises. If your execution doesn’t include the expected cash flow management, investments can get withheld, and executives lose their jobs. I recommend that you buffer your initial requests for funding by 25%, and then add a line of credit, to cover contingencies and minimize the chance for negative surprises.