2011 was a bright year for Indonesia. The country’s economy achieved a 6.5% growth rate with a relatively low inflation rate of just 5.38%. This is achieved in the midst of a global economic recession and low-growth, high-inflation levels seen in much of the world, especially the among the developed economies of Europe and North America. It is even doing far better than its neighbors within Southeast Asia.

And the good news for Indonesia doesn’t end there. In mid-December last year, the ratings agency Fitch raised Indonesia to investment grade status, followed by Moody’s 5 weeks later, effectively putting it on the same investment grade as India. Albeit given the lowest investment grade possible, it is for Indonesia, a quantum leap of high significance. The country had lost that investment grade status during the Asian Financial Crisis of 1997, from which time Indonesia saw the some of the most turbulent periods in its post-independent history. Some of the marks of that tumultuous years can still be seen today. Poor infrastructure due to low government spending, daily corruption cases on the news, but also a much more decentralized government, the freest press in Southeast Asia and the most open democracy in the region.

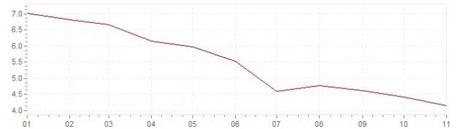

Rich countries are seeing a similar inflation trajectory, if only that you have to flip the picture right to left.

The country expects to see strong growth this year as well, although expectations of a continued global economic crisis meant a lower 6.3% growth to yesteryear’s 6.5%. As inflation is no longer a concern, a faster growth is definitely next on the objective. In order to meet that expectation and to curtail on the deflationary pressure, Bank Indonesia has slashed interest rates late last year by 25 basis points to 6.5%. The bank is expected to maintain that interest rate throughout at least 2012. Despite that, the inflation rate for 2012 is not expected to get higher than 5%. Indonesia is today, economically positioned to move forward from the crisis of 1997, from which it has spent the last 14 years healing itself from the effects.

In a welcomed move, the Senate has also approved a bill on eminent domain in mid-December, giving Indonesia a much needed tool to speed up infrastructure growth. With this, land acquisition for infrastructure development will no longer be the problem it once was. Already, a list of infrastructure projects has begun, mostly in highways, railways, ports and airports. Improving the flow of goods and people is a definitely a must if the economy is to keep growing. Already, the horrendous traffic (and by extension, commute time) in Jakarta is costing the economy billions of Rupiah each day. Solving such a problem can only be a good thing.

Why is Indonesia’s Economy Unaffected by the Global Economic Crisis?

Unaffected? No way is that true. Indonesia’s economy is definitely affected by the global slump. However, due to the overall makeup of the economy as well as the makeup of its exports, Indonesia is unlikely to be as badly affected as its neighbors by external shocks. Firstly, most of Indonesia’s exports consists of raw materials and basic goods. Raw materials are sold to manufacturing hubs of the world (read: China), so it will take time for the effects of a crisis in nations that consumes end products (read: USA, EU) to reach Indonesia. Certainly, such crisis will have to first affect countries like China before it can affect Indonesia on a similar level.

The second part of Indonesia’s exports are essential goods. Things people cannot live without, such as foods. Certainly, people can live without jewelries and the latest computers but no one can live without eating. As such, the crisis meant that consumers would first cut down on luxury items before they would cut down on essentials. In the long-run, this will still have detrimental effects on Indonesia but over a short term, the country would not be as badly affected by external crisis.

The main and biggest reason why Indonesia is relatively unscathed by the Global Economic Crisis however, is something that has traditionally been considered its weakness. The country isn’t as plugged in into the global economy as most countries in Asia. The main driver of Indonesia’s economy has been its huge domestic consumption fueled by its 242 million-strong consumers. In fact, domestic consumption makes up 70% of the country’s economic activity. Still, in the long run, the Global Economic Crisis will affect the confidence of Indonesian consumers, leading to a slump in domestic consumption. Indonesia’s economy is by no means bulletproof to the storms outside its borders, it is just better able to weather them than most others.

So, the country’s doing great then?

With all the good points said, Indonesia is still far from perfect. Many luxuries people in the developed world take for granted is a scarcity in Indonesia. Good governance and the ability of the goverment to provide opportunities for the aspirations of its people are high on the list of such things. As are equitable development, good education, a convenient public transportation system, national cohesiveness and many, many other things. But, I shall leave those for the articles to come.

Indonesia as a country and an economy is still very much a work-in-progress. Patchworks are being placed here and there, improvements being made one by one. Sometimes setbacks wiped an entire floor clean and work had to be restarted all over again. The country is in a constant transition with ideas and ideologies clashing at every opportunities. Sometimes they get violent, other times they are peaceful. Still, it is an interesting time to be here and witness this change. Where the winds will take the country and its people I cannot predict exactly. I just hope that whatever forms it will take, Indonesia will come out well-poised for the challenges of the 21st century and beyond.