Devastating financial crises were responsible for causing both the Great Depression and the Great Recession of 2008/09, among other historic economic downturns. These monumental economic events resulted from the bursting of speculative bubbles. Deeper understanding of what causes financial panics and transfers them to the wider economy is essential for preventing future calamities of this kind. In his book, Manias, Panics, and Crashes, Charles Kindleberger presents a historical account of financial crises in the context of a model that explains their origins. The famous Dutch Tulip Mania of 1636 is the earliest example of a large financial bubble and crisis, and the dot-com boom and bust of the late 1990s and early 2000s is a more recent incarnation of this phenomenon (Kindleberger, Aliber 8-9). The anatomy of a typical financial crisis based on the model endorsed by Kindleberger accurately describes the Great Depression and the Great Recession of 2008/09, as well as other financial panics.

Kindleberger borrows his model of financial crises from Hyman Minsky, and in general he suggests that a financial crisis is caused by pro-cyclical adjustments in the availability of credit. The contour of a crisis has phases, which Kindleberger identifies as ‘overtrading’, ‘revulsion’, and ‘discredit’ (Kindleberger, Aliber 16). Preceding the crisis is a time of rising optimism that spurs investment. The expectation of rising prices puts the emphasis on investment for short term capital gains, rather than on dividends from normal business earnings. The supply of credit grows during this phase because lenders lose their risk-aversion and relax the standards for borrowing. The amount of speculative investments that are financed with debt grows and over-leveraging occurs. The mania is triggered by a shock to the economy, or displacement, such as the introduction of revolutionary technology, the beginning or end of a war, or a dramatic swing in crop production. The expansion in credit during a boom is unstable and precarious. When the increase in prices for stocks, real estate, or other assets goes beyond what is warranted by likely future income earned for ownership a bubble has formed.

The frenzied rises of investment spending during manias typically center on one or more objects of speculation. In 1716 the Scotsman John Law was given permission by the French government to set up a bank that would circulate paper notes backed by commodities, and within a year he secured a monopoly on trade between France and its North American colonies. Law’s venture, the Mississippi Company, ultimately cornered virtually all of France’s non-European foreign trade. This market dominance was financed by waves of investors who speculated in the Mississippi Company, and share prices increased by 190% in 1719. The bubble reached its peak early in 1720 because profit taking by investors turned shares into gold while also triggering a slide in stock prices. In an attempt to shore up the stock price, Law’s bank notes were turned into legal tender and their issuance for the redemption of the company’s shares doubled the money supply in France (Moen). The Mississippi Bubble had many of the characteristics ascribed to financial crises by Kindleberger, from the euphoria of speculators to the apparent swindles that some of the investment schemes turned out to be.

Eventually the realization that future earnings will not support the prices for assets causes the demand for those assets to drop. Insiders typically get out of the market first, but at some point the steady exit of capital turns into a rush for the door in order to get out before the roof caves in. Liquidation results in bankruptcies and once this picks up speed there is a pull back in the availability of credit. Banks see the falling prices and become averse to lending against collateral that is likely to lose value. This period, referred to as revulsion and discredit by Kindleberger (32) is the heart of a financial crisis. In the case of the Mississippi Bubble, John Law lost control of the company and the new owners repossessed any shares that were purchased on margin. The French economy was heavily damaged and would not return to experimenting with paper money for another eighty years (Moen).

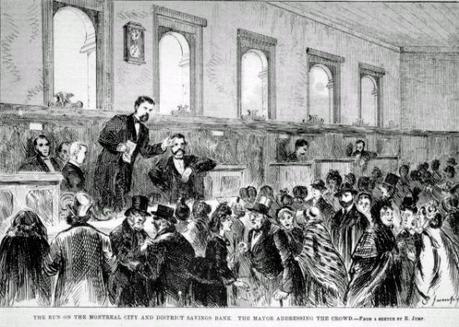

A major financial crisis, that fits the mold outlined by Kindleberger, was a substantial factor in the Great Depression. In the years prior to the Great Crash of 1929 the most significant objects of speculation were stocks, with prices increasing by four-fold within the decade (Romer 3). Kindleberger suggests that the displacement in the 1920s economy that led to this exuberance was the emergence of pervasive new innovations, such as automobiles, the expansion of roads, and the widespread electrification of America (Kindleberger, Aliber 26). The manic quest for capital gains is soundly demonstrated by the incredible bounce in the price of the stock for Radio when it went from 85 to 420 in 1928. This is without once paying a dividend. A significant factor in the across the board rapid growth in stock prices by this time was the purchasing of assets on margin, or with bowered funds (Galbraith 17-18). Eventually this overtrading could not be sustained when it was clear that realistic earnings in the times ahead did not validate the price inflation. Banking panics came in four different waves in the early 1930s (Romer 3), and the sight of a run on a bank surely invokes the revulsion and discredit that Kindleberger describes.

The Great Recession of 2008/09 was triggered by a financial crisis that can also be understood within the model endorsed by Kindleberger. The objects of speculation in the most recent panic were real estate, in combination with several related esoteric derivatives products, such as mortgage backed securities (MBS), collateralized debt obligations (CDO), and credit default swaps (CDS). In 2007 the CDS market reached $45 trillion in capitalization, while the stock market was only valued at $22 trillion (Morrissey). The displacement was caused by changes in the regulatory environment, such as the repeal of Depression era laws. For example, in 1999 the Glass-Steagall Act’s prohibitions on the intermingling of deposit banking and investment banking were ended (Bowring). In addition there was the dramatic rise of the completely unregulated and non-transparent derivatives market. The lending standards for mortgages became virtually non-existent with the introduction of ‘liar loans’ which allowed a borrower to virtually avoid all financial disclosure (Isidore). This is the opposite of risk-aversion. A major reason for this bad lending behavior was the euphoric demand for the mortgage securities, which could be diced up and squeezed into tranches that were supposed to mitigate risk while maintaining high returns. Eventually the lax lending standards were revealed by the spectacular rise in home foreclosures. This instigated a loss of confidence and then liquidity in the derivatives markets, and to make a complex story simple, government sponsored bank bailouts became absolutely necessary all over the world to avoid a complete collapse of the entire global financial system. This was overtrading, revulsion and discredit on a massive scale not seen since the Great Depression.

I think that it is extremely important to heed the lessons of past financial crises, especially the most recent incident, and restore the proper constraints to the system. Financial reform has continually been watered down Washington and Wall Street, and it is disturbing to see the vehement opposition to reform from the financial industry itself after receiving such unprecedented assistance from the public. The financial system is not just another sector of the economy, but a part of the economic infrastructure. When the availability of credit is disturbed the way it was in 2008/09 the repercussions are felt by everyone and this results in a recession, or even a depression. Regulation is required to prevent financial schemes which put the whole global economy in perilous jeopardy just so that a few bankers and investors can reap millions and billions in quick gains at the expense of the wider well being of the world.

Jared Roy Endicott

Works Cited

Bowring, Philip. “Too Big to Succeed”. New York Times, NYTimes.com. 4 Nov. 2009. Web. 22 Apr 2010.

Galbraith, John Kenneth. The Great Crash 1929. Boston: Mariner Books, Houghton Mifflin Company, 1997 (orig 1954). Print.

Isidore, Chris.. “’Liar Loans’: Mortgage Woes Beyond Subprime”. CNNMoney.com. 19 Mar. 2007. Web. 22 Apr 2010.

Kindleberger, Charles P., and Robert Aliber.Manias, Panics, and Crashes: A History of Financial Crises. Fifth Edition. Hoboken: John Wiley & Sons, Inc., 2005. Print.

Moen, John. “John Law and Mississippi Bubble: 1718-1720”. Mississippi History Now. Oct. 2001. Web. 22 Apr 2010.

Morrissey, Janet. “Credit Default Swaps: The Next Crisis?”. Time, Time.com. 17 Mar. 2008. Web. 23 Apr 2010.

Romer, Christina D.. “Great Despression”. Encyclopedia Britannica. 2003. Web. 27 Mar 2010.