In a survey conducted earlier this year, respondents indicated that one major element of the home-buying process held them back: having cash on hand. An astounding 55% indicated that saving for a down payment and paying for closing costs were the single largest obstacle to buying a home. While a down payment may seem daunting, taking small steps can help make it a reality. Prioritizing saving, combined with having a decent and stable income, mixed with a bit of advice and periodic reminders from home-owning friends and relatives can certainly help.

For those in less comfortable and supportive situations, homeownership can seem nearly impossible, especially for low-income earners who are often caught in a cycle of poverty. In an effort to help these individuals gain a foothold out this cycle, Dr. Michael Sherraden, Director of the Center for Social Development at the Washington University in St. Louis, developed the concept of IDAs in the early 1990s, as a way to help people in poverty to accumulate assets.

Individual Development Accounts (IDAs) are special savings accounts designed to encourage low-wage workers to build assets through matched savings, financial education, and financial coaching. In addition to saving for a home, IDA accounts can be used to launch a business, and applied to higher education costs.

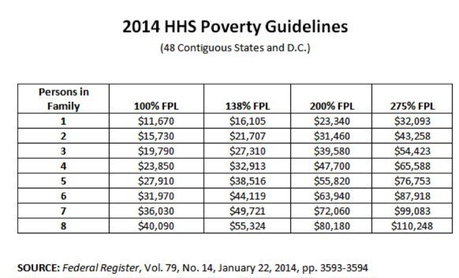

Participants in the program must have an income below 200% of poverty and commit to saving up to $480 per year. This amount is matched at a 3:1 rate for up to two years. Program participants also complete 28 hours of financial management classes and 10-14 hours of specific asset training classes, such as first time homebuyer, business development or career development.

In addition to helping participants to acquire assets, IDAs promote savings behavior and provide social support that contributes to sustainable economic self-reliance and asset-building. This is achieved by providing participants with no-fee bank accounts, which encourages regular savings, and providing financial literacy education and coaching. Frequently, the community organizations offering IDAs also offer other supportive services maximize long-term success.

There’s no doubt that real estate is now and has long been seen as one of the best ways to build wealth. With an IDA, the possibility is available to all. For more information, visit www.helpmnsave.org, or www.minnesotafaim.com.

Angela Anderson, Realtor, Results Support Services: EMAIL — BIO

Licensed Associate Working with Sharlene Hensrud of RE/MAX Results, and HomesMSP — Sharlene, John, Angela

RELATED ARTICLES:

- Down Payment Resource: Opening Doors to Home Ownership

- Renting vs. Buying a Home

- Are You Ready to Buy a Home?