You're here to make money, right?

You're here to make money, right?

We do a lot of educational posts on various topics but, once in a while it's a good idea to put these concepts to some kind of practical use. Recently we discussed "How to Get Rich Slowly" and, in that post, we talked about the great value of making a consistent 20% annual return and, to start the year off, we've put up over 20 long-term trade ideas for our Members in our Live Chat Room, as well as some in our Top Trade Alerts (Members Only).

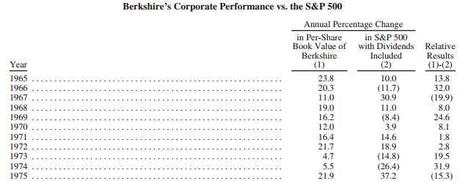

Our entire Long-Term Portfolio was up 20% last year, as was our Income Portfolio when we closed it and our smaller, Short-Term Portfolio managed to bring that net up over 25% for the year. As always, our goal is to make 20% a year and it's OK not to make 20% EVERY year, what you really want to avoid is losing money. Warren Buffett wasn't a famous investor in 1965 – or 1975 for that matter and, in fact, 1973 and 1974 were poor years for Berkshire – but they avoided losses – and that's the key!

Buffett is also a value investor who plays the slow and steady game in accumulating wealth. Not every year is going to be a big winner and not every year will beat the S&P because we HEDGE our bets and the same hedges that stop you from losing too much on the way down, stop you from winning too much on the way up. That's OK though, because it's the CONSISTENCY that makes you rich. While virtually unknown in 1975, by 1985 Warren Buffett was known as one of the greatest investors of all time.

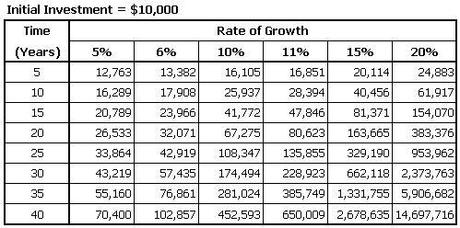

Why is that? Did he do anything different? No, not at all. What Buffett did was simply to continue to grind out those wins and let the magic of compound returns do the rest of the work for him. As you can see from the chart on the left, even making 20% for 10 years doesn't seem that dramatic (500% total gain, avg 50% a year) but, give it 10 more years and you have a 3,700% gain, averaging almost 200% a year.

Why is that? Did he do anything different? No, not at all. What Buffett did was simply to continue to grind out those wins and let the magic of compound returns do the rest of the work for him. As you can see from the chart on the left, even making 20% for 10 years doesn't seem that dramatic (500% total gain, avg 50% a year) but, give it 10 more years and you have a 3,700% gain, averaging almost 200% a year.

Our goal for 2015, at Philstockworld, is to teach you to embrace the concept of getting rich slowly and, to do that, I need you to understand how PAINFUL that process seems in the early stages. Because our long-term trades take a long time to resolve themselves, 90% of the time we end up discussing short-term trades – even Futures trading, but these are FUN trades we do while we wait for our major, long-term trades to pay off – they are NOT the point of this site. Never lose sight of that!

That being said, rather than do a trade review for the first time this year (which only our Members could see), I'm going to start the year off reviewing the review we did last year, on December 15th, to illustrate how these "boring" trades work once you give them a bit of time.

That being said, rather than do a trade review for the first time this year (which only our Members could see), I'm going to start the year off reviewing the review we did last year, on December 15th, to illustrate how these "boring" trades work once you give them a bit of time.

The trade ideas featured were from October (we're always a month or two behind) and I'm only going to pull the trades which had at least 6 months left at the time (12/15) starting from the entry any FREE READER could have picked up from reading the review – even after missing the initial gains our Members benefited from. So we're using the 12/15/13 prices, NOT our initial entries. And let's say, for arguments' sake, we put $10,000 cash into each trade for diversity.

- 60 TASR 2015 $12 puts short at $1.50 ($9,000), now $60 – up $8,940 (99%)

- 26 DDD 2015 $45 puts sold for $3.80 ($9,880), now $12.50 – down $32,500 (328%)

- 1,400 NLY at $9.94, selling 2015 $10 puts and calls for $2.70 for net $7.24/8.62 ($10,136), now $10 – up $5, 264 (55%)

- 1,000 AA at $9.51 ($9,510), now $16.11 – up $6,600 (69%)

- 6 AAPL 2016 $350 puts sold for $16.70 ($10,020), now $240 – up $9,780 (97%)

- 2 Oil Futures short at $103.50 ($9,000 margin), now $48.21 – up $110,580 (1,228%)

- 50 INTC 2016 $18/25 bull call spread, selling $20 puts for net $2.05 ($10,250), now $6.34 – up $31,700 (309%)

- 120 F 2015 10/15 bull call spread, selling 1/2 Jan $16 calls for $1.33 for net .85 ($10,200), now $5 – up $49,800 (488%)

- 14 (post-split) AAPL 2015 $67.14/85.71 bull call spreads, selling 2016 $50 puts for net $6.47 ($9,058), now $18.17 – up $16,380 (180%)

- 2,400 LACO at $4.18 ($10,032), now $6.85 – up $6,408 (64%)

- 3 ISRG 2016 $290 puts sold for $31.90 ($9,570), now $3.50 – up $8,520 (89%)

- 5 TSLA 2015 $190 calls sold for $19 ($9,500), now $18 – up $500 (5%)

So there's 11 long-term trade ideas (not including our Futures play on oil) from a single post covering a 2-week trading period that turned $110,000(ish) into $221,392 – up $111,392 (101%) on cash less than 13 months later. Our Futures play alone on oil, had you stuck with it straight through, would have added another $110,580 to that pile. That's without stopping out the lone loser or making ANY adjustments all year long!

So there's 11 long-term trade ideas (not including our Futures play on oil) from a single post covering a 2-week trading period that turned $110,000(ish) into $221,392 – up $111,392 (101%) on cash less than 13 months later. Our Futures play alone on oil, had you stuck with it straight through, would have added another $110,580 to that pile. That's without stopping out the lone loser or making ANY adjustments all year long!

As I noted above, we didn't make 100% because we hedged our bets to make sure we didn't lose (as well as margin limitations) but, as long as we fill our Long-Term Portfolio with trades that have this kind of upside potential, we have a very good chance of putting in a strong performance year after year – like Buffett! Those gains then compound over time and, over the long run, this trading strategy will outperform short-term traders – even those who do, occasionally, post triple-digit returns.

It was no accident that we picked AAPL twice in two weeks – after all, it was our 2014 Trade of the Year and it just so happens to be our 2015 Trade of the Year yet again (why not, when you can make so much money on it?). Here I am on TV discussing it on Money Talk with Kim Parlee:

That trade will take 2 years to fully resolve but our 2013 Trade of the Year (yes, AAPL again!), was up 614% for those who were patient enough to wait until 2015 to cash out and our 2014 Trade of the Year is well on it's way to a better than 500% gain so PATIENCE is what I want to teach you in 2015 – plant those trees and then BE PATIENT – good things really do come to those who wait.

We will have dozens of other long-term opportunities for you in our Live Member Chat Room as well as our Top Trades Alerts throughout the year. Earnings season is upon us and we are bound to find plenty of good stocks going on sale, which will present us with both long and short-term opportunities – this is always my favorite time of year!

Wishing you a very healthy and prosperous 2015.

All the best,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!