Let’s say that you’re invested in a mutual fund and you think you’re doing pretty well, but you’re just not sure. One of the best way to see how you are doing is to calculate your annualized rate of return (let’s call this ARR for short) and then compare your results to other investments. You ARR is the interest rate at which you would need to invest your money at in a bank account to end up with the same amount of money at the end as you did in your mutual fund. This allows you to compare how you’re doing versus just putting the money in a bank CD, for example. It also allows you to compare different mutual funds.

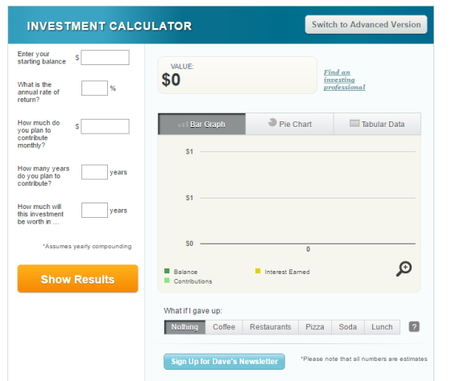

At this point I could give the formula for calculating ARR, but instead, let’s just use some of the tools already available to us from the net. On the right sidebar in the blogroll is a link to an Investment Calculator. Use that link or just click here. You should end up with a screen that looks like this, from the Dave Ramsey website:

Now let’s say that you started out ten years ago with $1,000 in a mutual fund and have been contributing $200 per month ever since. Let’s say that you now have about $41,000 in the account. Do the following:

- Put $1,000 in the starting balance box, 5% in the annual return box (this is the ARR), $200 in the monthly contribution box, and 10 years in the remaining two boxes.

- Press “show results.” This will then show the amount your investment would be worth after 10 years.

- Adjust the annual rate of return up if the total number is too low. Adjust it down if it is too high. In our example, we’re too low, so let’s adjust it up a bit.

- The final result for our example is shown below. I found that with an ARR of about 8.5%, I ended up with $40,892, which is close enough to $41,000 for our purposes.

So now that we know we made about 8.5% ARR for the period, which is quite a bit better than we would have done in a bank CD. For comparison, where would we have ended up if we had put the money in a bank CD making 1% interest? Change the ARR on the investment calculator to 1% and see the results. I now see that I’ll end up with only about $26,000, so the higher rate of return definitely helped me out (to the tune of about $15,000).

A word of caution here. While it is valid to determine a ARR for a portfolio of stocks or a mutual fund over a long period of time, like five to ten years, a mutual fund does not behave like a bank CD and pay steady returns. Instead, it may go up 30% one year, then down 15% the next. You cannot plug in 8.5% into the calculator now and try to predict where your fund will be three years from now or even five years. If you want to predict, you can do things like project out ten or twenty years and assume ARR limits of maybe 8% to 12% and get a rough idea of the range of portfolio values you might see for the mutual fund. You can use this as a guide to see if you need to be saving more to reach your goals or get an idea of when you might become a millionaire, but realize that your actual returns might be a little above or below that range. Stocks are unpredictable.

Finally, I now know that I’ve made an 8.5% ARR for the period of Jan 2007 to Jan 2017, but how did my fund do versus “the market?” Well, a good benchmark to use is the S&P500, which is an index of the 500 largest companies in the US markets and gives you a sense of where most of the money invested in the market did for the period. You can get the returns for the S&P500 index over any period of time through this calculator here. If I plug-in the start and end dates of Jan 2007 to Jan 2017 with this calculator, I find that the S&P500 had an ARR of about 4.8% over the period without reinvesting dividends, and 6.9% if dividends were reinvested. Since my fund made 8.5%, it did pretty well for the period.

Got a question or comment about personal finance or investing? Please leave a comment.

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.