Happy holiday!

Happy holiday!

I hope everyone is having fun on one of our very rare days off. Asian markets were on fire this morning with the Hang Seng up 372 points (1.666%) and the Shaghai up 1.9% over the 2,800 mark but Japan failed to take out 10,000 (up 1%) and finished the day at 9,965 while the BSE only rose a quarter-point, to 18,814. Europe was very uninspiring with a half-point gain on the FTSE, 0.3% on the DAX and the CAC actually lost 0.1% – not a very inspiring performance, especially with the dollar down at 74.50, half a point below Friday morning’s highs.

I’ve taken the opportunity this weekend to get caught up on our Income Portfolio (cruising into the end of the year already with our mission accomplished) and our $25,000 Portfolio (cashed out with more than a double at $53,942) – so we are ready to go for it in the second half. As an added bonus, Stock World Weekly, which just launched it’s official web site two weeks ago – started off with a hell of a bang as 12 Dow put play featured in that June 19th launch issue made a very quick $6,720 for SWW readers – well worth the $49 monthly subscription!

Now that we’re ahead in our current virtual portfolios, much like last year when we decided to "go for it" with our $10,000 Portfolio, we are really just playing for bigger and better Christmas presents – which always makes things fun.

We planned on being bearish after the holiday but we may flatline into options expiration on the 15th – something that becomes more likely if we survive the next two days. We went more bearish into the weekend and we’ll have to scramble to find bullish bets if we break higher but I’m still not feeling it – here’s a little food for thought ahead of tomorrow’s action.

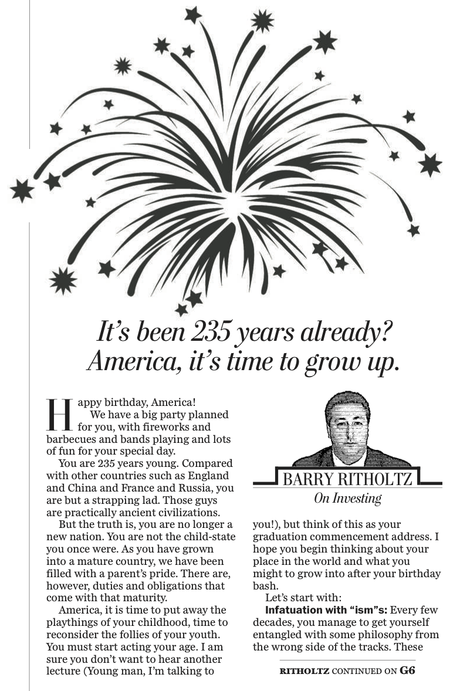

Barry had a front-page article in the Washington Post this weekend in which he points out, among other things, that America needs to grow up and recognize that: You cannot take over a country with a handful of under-equipped soldiers, tax cuts do not pay for themselves and there is no such thing as a “temporary” entitlement program. "Government is not the problem," Barry says, “bad government is the problem. There is an enormous distinction between the two."

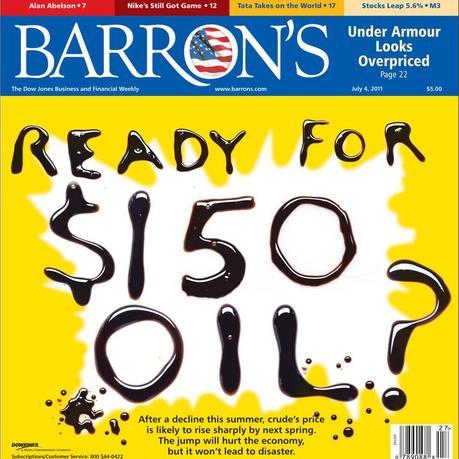

There used to be a distinction between a free press and Corporate PR but that’s long-gone now – as attested by the weekend Barron’s article on oil. As I mentioned to Members in Chat this morning (it doesn’t count as work when we’re just hanging out and talking, does it?) - CHECK THE AUTHOR!!! Gene Epstein wrote "Making Money in Commodities" as well as "Econospinning," which is a critique of the "Liberal Media". He’s also a proponent of the gold standard so, in short – this is just another guy talking his book – literally!

There used to be a distinction between a free press and Corporate PR but that’s long-gone now – as attested by the weekend Barron’s article on oil. As I mentioned to Members in Chat this morning (it doesn’t count as work when we’re just hanging out and talking, does it?) - CHECK THE AUTHOR!!! Gene Epstein wrote "Making Money in Commodities" as well as "Econospinning," which is a critique of the "Liberal Media". He’s also a proponent of the gold standard so, in short – this is just another guy talking his book – literally!

Really I’m not even going to bother pointing out that it’s pretty much been demonstrated by recent data, riots, revolutions, etc., that the World simply can’t afford $100 oil – where Epstein thinks we (as a planet) are going to come up with ANOTHER $4.44Bn PER DAY ($1.6Tn per year, not including another $2Tn of costs of items driven up by higher oil prices) to pay for oil is simply – Econospinning!

Well, at least "they" hired a guy who’s an expert at playing with numbers to "prove" the point. Unfortunately for the oil crooks, Asia and Europe aren’t as sheep-like as US investors and oil went pretty much nowhere today, finishing up still on the $95 line, while gasoline also zig-zagged back to $2.975, where we’re short below that line (see this morning’s Member Chat). We already caught a nice dip this morning down to $2.95, which is a nice move in gasoline futures so let’s see what the holiday driving numbers look like:

- California gasoline demand was down 2.7% in March (latest report)

- Gasoline demand in Hawaii is down 10% from 2006. CEO of Aloha Petroleum calls it "a shrinking market."

- Gasoline trading slipped in the EU this morning.

- AAA projects road travel this weekend would fall 2.5% from a year ago as expensive gasoline eats at driving demand.

- Also (same article): Analysts have pointed out the full volume of the 60 million barrel IEA release may not be absorbed due to globally weak demand. ROFL!!!

- Gene Epstein is a puppet-head tool and a sell-out.

Oh sorry, that last one was a conclusion, not a fact (although HUGE amounts of evidence seem to be there). Speaking of evil tools seeking to rob the American people by manipulating public opinion to achieve their own ends – Goldman Sachs also thought it was important to mention just ahead of Friday’s close that “New details on how global oil-stockpiles will be released suggest oil prices won’t see much of a decline," Goldman still expects rising prices, with Brent crude seen as high as $127/bbl in 2012!

Oh sorry, that last one was a conclusion, not a fact (although HUGE amounts of evidence seem to be there). Speaking of evil tools seeking to rob the American people by manipulating public opinion to achieve their own ends – Goldman Sachs also thought it was important to mention just ahead of Friday’s close that “New details on how global oil-stockpiles will be released suggest oil prices won’t see much of a decline," Goldman still expects rising prices, with Brent crude seen as high as $127/bbl in 2012!

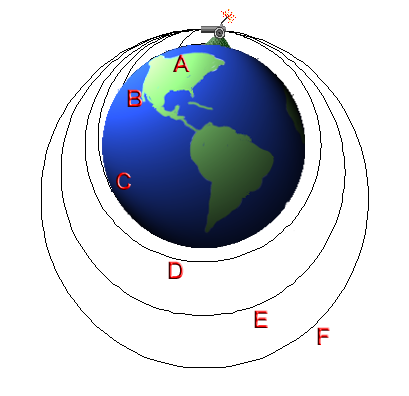

Well now I’ve read it in the WSJ (Blog section) AND Barron’s so it MUST be true. What I really love is the convoluted logic that the release of 60M barrels won’t have much impact on prices but, if there is a 2M barrel draw-down in oil inventories and oil goes up 5% in a single day – THAT seems perfectly natural to these jackasses… Of course all the World’s a stage and all commodities are a very large shell game, as noted in this Focus.com graphic (click to embiggen).

Gold is also laboring below the $1,500 mark and, with the Euro at $1.45, keep in mind that gold is very close to a fairly catastrophic failure of the 1,000-Euro mark, having already failed miserably to take out either 1,000 Pounds or 125,000 Yen. Dollar-centric thinking is the undoing of many commodities traders.

Of course, Morgan Stanley’s chairman in exile, Stephen Roach was another Gang of 12 Member chiming in this weekend – with a video, no less – titled (in case you don’t like subtlety) "A Failed Global Recovery." Roach argues (and it’s hard to disagree) that economic data clearly points to a weakened global economy that is approaching its “stall speed” of around 3% annual growth – the relapse could turn into the dreaded double-dip recession. That is the risk today. There can be no mistaking the decidedly subpar character of the current global recovery, says Roach.

If the IMF’s latest forecast proves correct, global GDP at the end of 2012 will still be about 2.2 percentage points below the level that would have been reached had the world remained on its longer-term 3.7% annual-growth path. Even if the global economy holds at a 4.3% cruise speed – a big “if,” in my view – it will remain below its trend-line potential for over eight years in a row, through 2015.

Most pundits dismiss the possibility of a double-dip recession. Labeling the current slowdown a temporary “soft patch,” they pin their optimism on the inevitable rebound that follows any shock. For example, a boost is expected from Japan’s reconstruction and supply-chain resumption. Another assist may come from America’s recent move to tap its strategic petroleum reserves in an effort to push oil prices lower.

But in the aftermath of the worst crisis and recession of modern times – when shocks can push an already weakened global economy to its tipping point a lot faster than would be the case under a stronger growth scenario – the escape velocity of self-sustaining recovery is much harder to achieve. The soft patch may be closer to a quagmire.

I love that. Stephen is a graduate student of my school of "Stock Market Physics" and he gets the "escape velocity" concept. As I said in my post of May 4th, when I predicted the coming sell-off at the time - another way to look at where the markets are as we attempt to get over those 5% lines (over our Must Hold levels) is "it’s still too heavy." As Stephen says: "Liquidity injections and bailouts serve only one purpose – to buy time. Yet time is not the answer for economies desperately in need of the structural repairs of fiscal consolidation, private-sector deleveraging, labor-market reforms, or improved competitiveness. Nor does time cushion anemic post-crisis recoveries from the inevitable next shock."

Of course Roach doesn’t mention the biggest obstacle to a Global recovery, which is Global Corporations, who have no interest at all in fixing anything but, rather, are engaging in an orgy of profiteering at the expense of World Governments and the people they govern, as noted by Jeffrey Sachs (4th video down), who says we "need to break the hold of the super-wealthy on the political process of the United States, which has gotten way out of hand." In Sach’s excellent article, "The Global Economy’s Corporate Crime Wave," Sachs says:

The world is drowning in corporate fraud, and the problems are probably greatest in rich countries – those with supposedly “good governance.” Poor-country governments probably accept more bribes and commit more offenses, but it is rich countries that host the global companies that carry out the largest offenses. Money talks, and it is corrupting politics and markets all over the world.

Corruption pays in American politics as well. The current governor of Florida, Rick Scott, was CEO of a major health-care company known as Columbia/HCA. The company was charged with defrauding the United States government by over-billing for reimbursement, and eventually pled guilty to 14 felonies, paying a fine of $1.7 billion.

The FBI’s investigation forced Scott out of his job. But, a decade after the company’s guilty pleas, Scott is back, this time as a “free-market” Republican politician.

When Barack Obama wanted somebody to help with the bailout of the US automobile industry, he turned to a Wall Street “fixer,” Steven Rattner, even though Obama knew that Rattner was under investigation for giving kickbacks to government officials. After Rattner finished his work at the White House, he settled the case with a fine of a few million dollars.

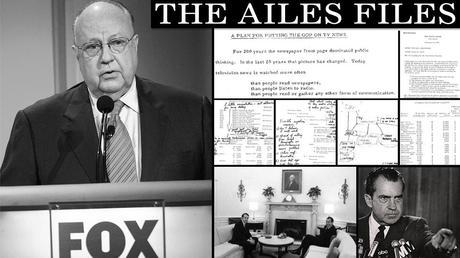

Speaking of despicable, corrupt, right-wing oligarchs who insinuate themselves at the seat of power in order to brainwash the masses and rob the American Middle Class – Roger Ailes (Rupert’s right-hand thug – allegedly!) is in the news this week as documents unearthed at the Nixon Presidential Library uncover the PLOT, yes the "nakedly partisan 1970 PLOT by Ailes and other Nixon aides to circumvent the "prejudices of network news" and deliver "pro-administration" stories to heartland television viewers. I KID YOU NOT!

Speaking of despicable, corrupt, right-wing oligarchs who insinuate themselves at the seat of power in order to brainwash the masses and rob the American Middle Class – Roger Ailes (Rupert’s right-hand thug – allegedly!) is in the news this week as documents unearthed at the Nixon Presidential Library uncover the PLOT, yes the "nakedly partisan 1970 PLOT by Ailes and other Nixon aides to circumvent the "prejudices of network news" and deliver "pro-administration" stories to heartland television viewers. I KID YOU NOT!

You can view the big picture here but the text is titled "A plan for putting the GOP on TV News" because domination of the newspapers was no longer enough to control the hearts and minds of the American people who were watching televisions news "more often than people read or gather any other form of communication."

The memo—called, simply enough, "A Plan For Putting the GOP on TV News"— is included in a 318-page cache of documents detailing Ailes’ work for both the Nixon and George H.W. Bush administrations that Gawker obtained from the Nixon and Bush presidential libraries. Through his firms REA Productions and Ailes Communications, Inc., Ailes served as paid consultant to both presidents in the 1970s and 1990s, offering detailed and shrewd advice ranging from what ties to wear to how to keep the pressure up on Saddam Hussein in the run-up to the first Gulf War.

The memo—called, simply enough, "A Plan For Putting the GOP on TV News"— is included in a 318-page cache of documents detailing Ailes’ work for both the Nixon and George H.W. Bush administrations that Gawker obtained from the Nixon and Bush presidential libraries. Through his firms REA Productions and Ailes Communications, Inc., Ailes served as paid consultant to both presidents in the 1970s and 1990s, offering detailed and shrewd advice ranging from what ties to wear to how to keep the pressure up on Saddam Hussein in the run-up to the first Gulf War.

The documents reveal Ailes to be a tireless television producer and joyful propagandist. He was a forceful advocate for the power of television to shape the political narrative, and he reveled in the minutiae constructing political spectacles.

He frequently floated ideas for creating staged events and strategies for manipulating the mainstream media into favorable coverage, and used his contacts at the networks to sniff out the emergence of threatening narratives and offered advice on how to snuff them out—warning Bush, for example, to lay off the golf as war in the Middle East approached because journalists were starting to talk.

He frequently floated ideas for creating staged events and strategies for manipulating the mainstream media into favorable coverage, and used his contacts at the networks to sniff out the emergence of threatening narratives and offered advice on how to snuff them out—warning Bush, for example, to lay off the golf as war in the Middle East approached because journalists were starting to talk.

There are also occasional references to dirty political tricks, as well as some positions that seem at odds with the Tea Party politics of present-day Fox News: Ailes supported government regulation of political campaign ads on television, including strict limits on spending. He also advised Nixon to address high school students, a move that caused his network to shriek about "indoctrination" when Obama did it more than 30 years later.

According to Gawker: "A Plan for Putting the GOP on TV News" (read it here) is an unsigned, undated memo calling for a partisan, pro-GOP news operation to be potentially paid for and run out of the White House. Aimed at sidelining the "censorship" of the liberal mainstream media and delivering prepackaged pro-Nixon news to local television stations, it reads today like a detailed precis for a Fox News prototype. From context provided by other memos, it’s apparent that the plan was hatched during the summer of 1970. And though it’s not clear who wrote it, the copy provided by the Nixon Library literally has Ailes’ handwriting all over it—it appears he was routed the memo by Haldeman and wrote back his enthusiastic endorsement, refinements, and a request to run the project in the margins.

The idea as initially envisioned doesn't appear to have gotten off the ground. But Ailes obviously did do "more work in this area," first with something called Television News Incorporated (TVN), a right-wing news service Ailes worked on in the early 1970s.

According to Rolling Stone, TVN was financed by conservative beermonger Joseph Coors, and its mandate sounds exactly like a privately funded version of Capitol News Service: "[TVN] was designed to inject a far-right slant into local news broadcasts by providing news clips that stations could use without credit—and at a fraction of the true costs of production." Ailes was "the godfather behind the scenes" of TVN, Rolling Stone reported, and it was where he first encountered the motto that would make his career: "Fair and balanced."

Though it died in 1975, TVN was obviously an early trial run for the powerhouse Fox News would become. The ideas were the same—to route Republican-friendly stories around the gatekeepers at the network news divisions. In Nixon's day, the only way to do that was to pump stories directly to local stations. By 1996, cable television offered a much more powerful alternative. And the whole project began—on the taxpayer's dime—in the White House under the direction of a Watergate felon. One can only imagine how Fox News would report a similar scheme hatched in the Obama White House.

I suspect there have been a number of conspiracies that never were described or leaked out. But I suspect none of the magnitude and sweep of Watergate. - Bob Woodward