Today is the day Jesus died.

Today is the day Jesus died.

Well, sort of.. I’m not referring to the resurrection on Sunday but the fact that it might have been a Friday, based on John 19:42 and it might have been in the year 33 although it could have been 34, it’s hard to tell but it sure wasn’t likely to have been the 22nd of April, just as Washington’s actual birthday isn’t actually on a Monday every year (it’s Feb 22nd, 1732).

The thing is that the Julian calendar, which we use today, wasn’t widely used at the time and a Julian year is 365.25 days (an adjustment each leap year), which gives us a 500 day drift over the intervening 2,000 years. Also, if the Last Supper was, in fact, a Passover meal, the Jewish calendar (which hasn’t changed in 5,000 years) makes the whole thing a Saturday, which actually makes sense because there’s no point in crucifying people when everyone has to work – it was kind of a weekend event.

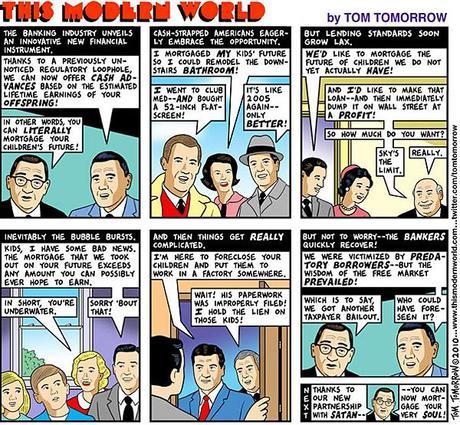

I mention this to illustrate that even something as widely studied as the last days for Christ, something that has had 2,000 years of scholarly review by some of the finest minds that ever lived – still can’t get definitive expert agreement on something as simple as the date, day or year. How then – WHY then – do we rely on "experts" to give us reliable market data on the fly? The failure of the modern stock market to act as an "efficient pricing mechanism" is due, in parts, to the volume of information (too much), the quality of information (too little), the speed of information (too slow) and the speed of the auction process (too fast).

Add to all that the sheer impulsiveness of the generally untrained and often unseasoned modern investor and you have a recipe for disaster in which those dice are rolled every millisecond of every day. It’s not amazing that the market crashes in panics – it’s amazing that it doesn’t happen more often! The statement that information is power has never been more true than it is today. There are hundreds of people reading this article right now who own $1M worth of KO, AXP, MCD, TM, AAPL, GE etc. but have never set foot in their corporate offices, have never spoken to even mid-level executives and have never even bothered to attend a shareholder meeting or listened to a conference call.

Who makes money in horse racing? Not the 10,000 gamblers – or at least not enough of them to merit attention. No, the money is made by the OWNERS of the horses with some of it going to the jockeys who, like our CEOs, ride whatever horse they are assigned and pretty much do whatever the owner wants them to do with the horse and the people who own the track and take the bets get to rake it all off the top (Banksters).

I spend most of my time at PSW trying to teach our Members to BE THE HOUSE – not the gambler. There’s a well-known term: "The House ALWAYS wins." It’s been around long enough and repeated often enough without the sense of irony that we can be pretty sure that the House must usually win and even the most casual examination of who is on the Forbes 400 List makes it very obvious that it is actually better to receive dollars than to bet or spend them. Larry Page and Michael Dell are the only Billionaires under 50 in the top 30, they are joined by Mark Zuckerberg (26) at #35 with $6.9Bn, Pierre Omidyar (43) at #47 with $5.5Bn and finally, all tied at 74 are the 3 Ziff Brothers, with $4Bn each – and they are the first and only young investors in the top 100 but they started with billions of Ziff-Davis family money – although they have done very well with it this decade.

I bring this up to remind the young speculators that there are not very many old speculators and there are also no young investors that rise to the top. Investing is a game that gets it’s rewards much later in life, after many years of growth and patience and hard work. This is why we ask all new Members to watch "The Man Who Planted Trees" – it is the best allegory I know of to convey what a proper long-term wealth-building strategy needs to be. It’s a holiday, so let’s take a little time to watch it:

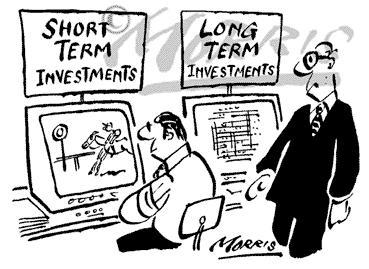

Investing is about digging and planting and watering and WAITING. Even after your investments take root they still need to be tended but it all begins with getting your seeds (money) and placing it in fertile ground (good investments) where the conditions will be favorable enough to let it grow well enough to begin producing more money on its own. When all you ever do is make short-term investments – it’s like doing all the work (research, timing) to plant a tree and risking your seeds (capital) and then yanking out the tree the moment it bears fruit only to go back and risk what few seeds you were able to reap on the next planting. It’s a stressful life that leaves you nothing to fall back on if things go poorly.

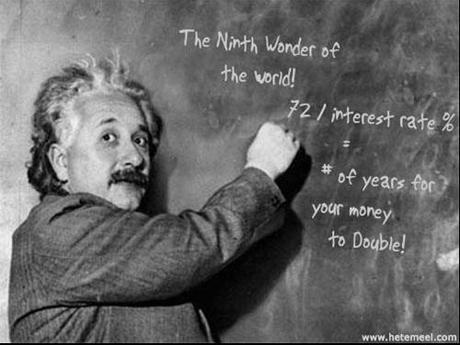

Those are the fruits that sprout from your investing orchid if you take the time to plant it. Invest $21.50 now and get a 22% annual dividend return in 20 years that is very likely to keep up with inflation. If you reinvest just $1 of the dividends each year (annual addition on the calculator), you end up with $207.64 in 20 years. Now you know why there are many, many 70 and 80 year-old INVESTORS in the Forbes 400 and very few speculators – over time, even the most wildly successful speculators are unable to keep up with the gains that can be made through a steady investing strategy.

Unfortunately, we have not been trained to be proper investors have we? When you sit down with a financial planner – what do they tell you? They say "how much do you need to retire" and they pick a number that is about your salary and maybe a bit for inflation and tell you that’s all you need to save for. They don’t tell you that you should double that number – just in case, along the way, the market crashes and you lose half – do they? They don’t (unless you are rich) even suggest you plan for your children and grandchildren’s future beyond college. Why is that? Because we are a nation (a World actually) of selfish babies, who wouldn’t sacrifice a week of our time for a grandchild that hasn’t been born yet. In fact, we do the opposite and take on debt burdens that our children and grandchildren will have to pay.

Let’s pretend, for a moment, we were willing to sacrifice for future generations. Now, I’m not going to ask you to use less fuel or pollute less or recycle your trash or any other liberal hippie crap that benefits the whole planet – I’m talking about making a sacrifice for your grandchildren, Prescott Bush style – so your grandchildren and their grandchildren will be able to afford the best of everything thanks to your sacrifice today. What kind of sacrifice am I asking for? How about 5% of your salary? Let’s say you simply put aside $5,000 and invest it at an 8% average return (100-year norm) and every year you add $5,000 for 40 years. How much money is that? According to the handy compound rate calculator, after 40 years you will have put away $1,500,000.

Starting our calculator with $270,000 and then adding $9,000 a year (one child’s $5K from you and their own average $4K) and letting that grow at 8% for 20 years and now we’re up to $1.7M in the bank by the time our kids are 40. Don’t you wish your Dad had done that for you? If your kids are successful at 40 and keep putting in $10,000 a year after you stop, then their kids will have $8.6M 20 years down the road. See – anyone can come from a wealthy family if the first two generations set out to build one!

That’s what you can do with consistent, steady, long-term investing strategies. We talked about them two weeks ago in our Investing for Income Portfolio (and I’ll be updating that this weekend) and we also had our Inflation Hedges on 12/25, Breakout Defense Plays on 12/11 and 2/5, our Dividend Defense Portfolio on 10/23, a more aggressive September’s Dozen on 9/3, another Dividend Defense Portfolio on 8/29, our Dow Portfolio on July 7th, the Top 20 Buy List of June 7th and June 26th, our Down and Dirty Buy List of May 26th and that’s going back a year already so I’ll stop but they are all there under the Portfolio Tab for our Members along with 2 (two) aggressive short-term portfolios – last year’s $10,000 Portfolio, which finished at $36,000 and was rolled into the current $25,000 Portfolio – where we are, so far, giving the money back!

There’s plenty of risk and reward in long-term investing to keep you excited – it’s just your time-frame expectations that need to be adjusted! That’s not going to happen for you until you learn to think, plan and live for the long term. I urge you to play with that compound rate calculator, especially the Annual Addition item and think about how powerful it is to cut $1,000 here and $1,000 there – not to buy a better car or boat or sit in first class – but to put it to work for you and your family.

The American system of taxes and the distribution of wealth in this country favors the wealthy at a level that ranks us first (or last, depending on which side you are on) in the world in income inequality. The rich get richer – money attracts more money and short-term investing is a suckers game – it’s a casino and it can be fun and entertaining, but please do not confuse it with wealth-building and investing. We play short-term trade ideas every day because they are fun and sometimes profitable – but I think today is a good day to remember why it was hard work and SACRIFICE that built this country, not betting it all on the latest hot company which, in 1776, would have been pewter mugs, wagon wheels, tri-corner hats or horseshoes, which were hot growth items compared to shipping, tea and other food items, real estate (they were giving land away), farming or coal – which were all labor intensive with a lot of competition and "limited growth prospects."

It’s OK to have fun, but if you want to be remembered as a great contributor to the family tree – you need to lay a foundation that will last for generations instead of borrowing from the future to pay for today’s passing fancies.