Not that it matters ahead of our GDP report but Asia was off just a bit but Europe is down 1% as the BOJ offered no new candy at their meeting this morning. The Nikkei fell from 14,100 (in giddy anticipation of more free money) all the way back to 13,900 but only down net 1%. Our own indexes were up in giddy anticipation of a 2.8% GDP number but, as we discussed in Member Chat (and I tweeted the comment for the general public):

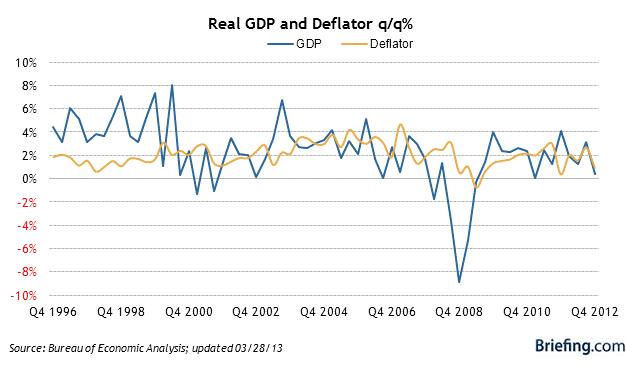

GDP – I think we got weak Durable good, less exciting jobs, lower Corporate Revenues and Sequestration should lower Government spending and even oil was cheaper so another downer. Makes it very hard to imagine that we'll hit the very high expectations of 2.8% from 0.4% last Q. This is the main reason I can't let go of our beaten-up shorts yet.

Are we really going to flip from 0.4% to 2.8%. Last Q1 was 2% and Q3 was our best at 3.1% so it's asking a lot. The big move up was nonresidential investment (apartments) which bumped 13.2% and, by itself, added 1.28% to the GDP. Personal consumption sucked and should continue to suck and I doubt exports will save us (to who?).

We'll see shortly but this is not a market that's pricing in a bad GDP number and the data we've been seeing for the past two months doesn't really build the case for it. Of course, sometimes the GDP goes up due to one big metric move – especially the counter-intuitive inventory builds and all those unsold items on store shelves due to poor retail sales could lead us to a pretty big build in inventory. Inventory builds are considered bullish as we still labor under the myth that markets are efficient but they're not efficient when companies can build inventory on sub-2% loans – that doesn't give you a real picture of selling pressure, does it? Inventory is also a factor of farmers re-filling their silos after last summer's drought. Without the EXPECTED 1% boost from farm inventories alone – growth would be under 2% at best.

That's why we're skeptical and that's why we've been hanging on to our bearish hedges, even as we get yet another re-test of our market tops. The Nasdaq hit our 3,300…

That's why we're skeptical and that's why we've been hanging on to our bearish hedges, even as we get yet another re-test of our market tops. The Nasdaq hit our 3,300…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.