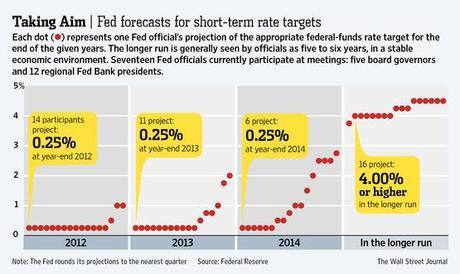

Federal Reserve officials said they expect to keep short-term interest rates near zero for almost three more years and signaled they could restart a controversial bond-buying program in yet another campaign to rev up the disappointing economic recovery.

The Central Bank's pronouncements came after a two-day policy meeting from which officials emerged still frustrated at the slow pace of growth and a bit more confident that inflation is settling down after climbing last year. The combination of persistent slow growth and low inflation, Fed Chairman Ben Bernanke signaled in a news conference after the meeting, could give the Fed leeway to take more action to support the economy, though he didn't commit to it.

A bond-buying program—also meant to push down long-term interest rates—could be the next step. Mr. Bernanke said there would be a "very strong case" for even more action by the Fed "if the recovery continues to be modest and progress on unemployment very slow and inflation appears to be likely to be below target for a number of years out."

What amazes me is not one reporter at yesterday's news conference asked Dr. Bernanke what is COSTS to ARTIFICIALLY keep rates 3.75% what his own board considers "normal" for another 3 – 4 years. Maybe that's because we don't know what it cost already, do we? We do know the Fed now has a $3Tn balance sheet. Since I don't recall a bake sale at which the Fed sold $3Tn worth of cookies, I have to imagine that money was borrowed from somewhere and don't things that are borrowed eventually need to be paid back?

I mean, I understand that, since Reagan, there has been a massive effort to destroy the American Education system and make the beautiful sheeple as dumb and compliant as possible (a less crazy article on the subject here) – but surely there must be some reporter who was accidentally exposed to some rudimentary economics who can come up with a better question than "when in 2014?"

IN PROGRESS

Once upon a Great Recession, while I pondered Global Depression,

Over what the New Year's markets may have yet in store,

…