Aligning business intuition with financial arithmetic

You've got a brilliant idea. You make an excellent presentation to the board. A director asks: "What discount rate are you using for NPV over five years on this."

You’ve got no idea what he’s talking about. Your confidence slips. So does your momentum. You say you'll get back to him.

A lack of financial literacy won’t necessarily hold you back. There’s plenty of self-made business people with no business education. The issue often arises with success. You were a great salesmen and an even better marketing director but now you are running the whole shop. There are some things you are expected to know.

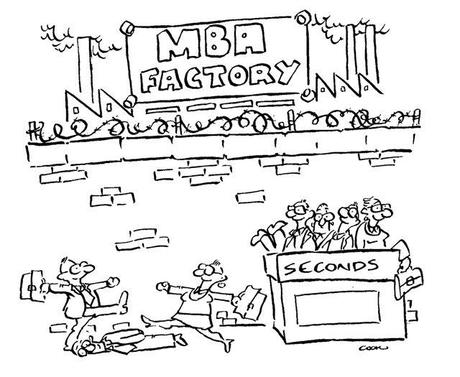

Entrepreneurs can struggle with this. Having built a successful company they now have to run it. Suddenly they are seeking mezzanine finance from a private equity firm and it’s all MBA-speak.

There are two reasons not to fuss about this.

- Most financial concepts are common sense. In many cases you already intuitively apply them.

- You don’t have to be an expert in working them out. You just have to understand the concept. Your success is more likely a function of strengths you have in other areas

Net Present Value (NPV) is one such concept. I get asked about it a lot. As an example of financial literacy, it’s worth revising how simple it is.

Like many business notions, NPV builds on the time value of money. Say you hold an IOU that pays $100,000 in 12 month’s time when term deposits are 8%. At most, the IOU is only worth about $92,500 today because if you put $92,500 on a 12 month deposit at 8% you’d end up with $100,000 anyway.

So it’s value today is less. If you gauge that risk at 15%, then it’s only worth $87,000. That’s its Present Value (PV). The higher the risk, the higher the discount rate and the lower the value.

NPV works out the value of an investment when a number of years or cash flows are involved. You work out the PV for each one, add them up and then net out the original investment. That’s the NPV.

If it’s positive, you have created value, if it’s negative, you’ve destroyed it. You might get someone else to work it out but that’s all it means.

Like a lot of business arithmetic, it comes down to risk

You consider business risk all the time and probably do it intuitively. While there are sophisticated ways of expressing it, you can boost your financial literacy just by starting to mentally express risk in percentage terms.

With any project you are looking at, focus on what sort of rate you think should apply. Is it low and close to a risk-free rate like a term deposit, or is it out there with an IOU and beyond?

Think about risk mathematically. Try this exercise. Work out what your business is roughly worth and see what your profit is as a percentage. Is your new project going to generate a better return than that, or a worse one? Does it add value to your business or not?

There are easy-to-understand applications of key financial concepts in my book, Recharge. You can buy it online, in hard copy or Kindle, by clicking here.