The climatic condition influences and determines the various sectors in the economy. The emergence of weather derivatives in the financial market is the most palpable reflection of this reality. Derivative contracts climate use climate measures, analogous to the target asset for the pricing.An institution that wishes to eliminate the risk of a given weather event, such as a period with little/excessive rain or temperature can purchase weather derivatives contracts, adjusting the unfavorable weather conditions to the estimated lost value and the return of the contracts.

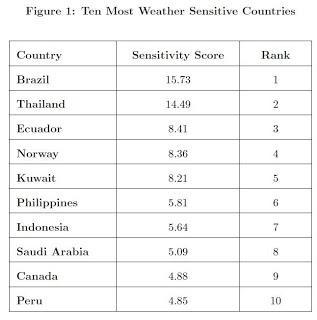

The climatic condition influences and determines the various sectors in the economy. The emergence of weather derivatives in the financial market is the most palpable reflection of this reality. Derivative contracts climate use climate measures, analogous to the target asset for the pricing.An institution that wishes to eliminate the risk of a given weather event, such as a period with little/excessive rain or temperature can purchase weather derivatives contracts, adjusting the unfavorable weather conditions to the estimated lost value and the return of the contracts. Global Weather SensitivitySummary: The Most Weather Sensitive Countries in the WorldLikewise these contracts are used to reduce portfolio risk in exposed weather events, are also used for speculation or strategic asset allocation.The dependence on weather events encourages extensive use of meteorological models for pricing these instruments.

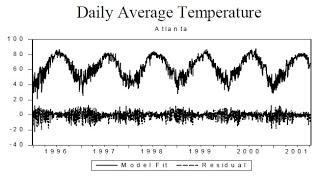

Global Weather SensitivitySummary: The Most Weather Sensitive Countries in the WorldLikewise these contracts are used to reduce portfolio risk in exposed weather events, are also used for speculation or strategic asset allocation.The dependence on weather events encourages extensive use of meteorological models for pricing these instruments. On Weather Forecast for Weather Derivatives, the author argues in favor of forecasting weather time series for pricing weather derivatives, suggesting that climatic time series contain information relevant to the pricing of these instruments.

On Weather Forecast for Weather Derivatives, the author argues in favor of forecasting weather time series for pricing weather derivatives, suggesting that climatic time series contain information relevant to the pricing of these instruments.Below I cite other studies, news and videos on the subject of Climate Derivatives for anyone interested in deepening.CME articles:What every CFO needs to know now about weather risk management - CME Group

Introduction to Weather Derivatives - CME Group

Weather Derivatives Markets at CME Group: A Brief HistoryAcademic articles:

Financial Management of Weather Risk with Energy Derivatives

Hedging Climate Risks with Derivatives

Modelling and Pricing Weather Derivatives

Pricing Weather Derivative: an Equilibrium Approach

To Hedge or Not Against an Uncertain Climate Future?

Evaluating the cost of protecting against global climate change: options pricing theory and weather derivatives

News:Come rain or shine– the economist

Buying a financial umbrella – the economist

UBS to launch global warming derivatives index – Financial Times

Sun shines again on weather derivatives – Financial Times

CME Targets Growth In Weather Derivatives – WSJ – June - 2006

No Snow, No Problem: How Wall Street Profits from Weird Weather - Time Bussiness and MoneyBanking On The Weather This booming derivatives market gives new meaning to rainy-dayfunds. - CNN Money