This is not a good trend.

This is not a good trend.

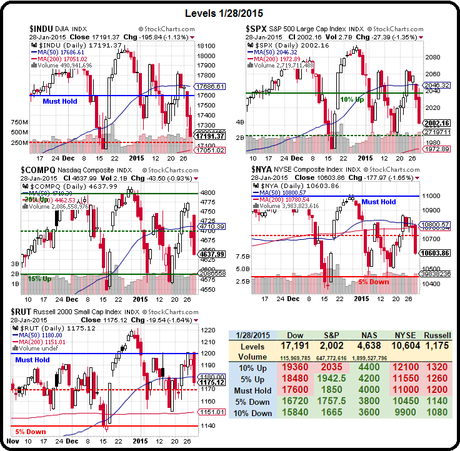

We are making lower highs and may be on our way to lower lows as the weak bounce lines we predicted two weeks ago (using our fabulous 5% Rule™) begin to fail. In case you need a refresher, our technical lines in the sand are:

- Dow 17,280 (weak) and 17,460 (strong)

- S&P 2,006 (weak) and 2,027 (strong)

- Nasdaq 4,608 (weak) and 4,656 (strong)

- NYSE 10,560 (weak) and 10,670 (strong)

- Russell 1,172.50 (weak) and 1,185 (strong)

Looks like it's just those last 3 weak bounce lines holding us up but, as noted in previous posts, we already flipped back to bearish as our strong bounce lines failed – that's what they are there for! Tuesday, for example, I told you we were shorting Dow Futures (/YM) at 17,550 and yesterday we fell below 17,100. Futures contracts on the Dow pay $5 per point so that 450-point dip was good for a quick $2,250 per contract profit in less than 48 hours. Our call to short /TF (Russell Futures) at 1,200 have already produced $3,000 per contract gains as well.

I sent out an Alert to our Members from our Live Member Chat Room this morning calling for long plays on /NG (Natural Gas Futures) at $2.85 and /CL (Oil Futures) at $44.25 and we've already had some nice runs and are looking for re-entries ahead of today's Natural Gas Report (10:30).

I sent out an Alert to our Members from our Live Member Chat Room this morning calling for long plays on /NG (Natural Gas Futures) at $2.85 and /CL (Oil Futures) at $44.25 and we've already had some nice runs and are looking for re-entries ahead of today's Natural Gas Report (10:30).

On the whole, the Global Macros are still weak, US Data is Weak and Earnings are disappointing so we see no reason to expect those weak bounce lines to hold up, which makes bullish commodity betting very tricky.

As noted by Dave Fry, perhaps the 200 dma at 1,988 (our 7.5% line on the Big Chart) will provide some support but, if not – we're likely to see the 5% line tested at 1,942.50. Coming off 2,000 this morning, the /ES short would pay $2,875 per contract for that drop or you could just pick up the SPY Feb $198 puts at $3, which would be $3.75 in the money at $194.25 for a 20%(ish) gain on a 2.5% drop in the S&P – that's pretty good leverage for a hedge.

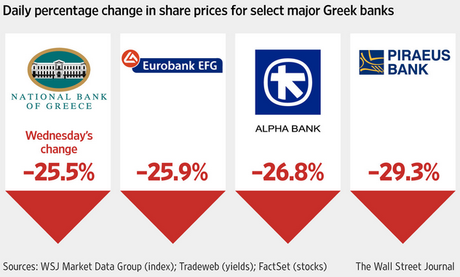

Not to beat a dead horse but Greece is still the word in Global Catastrophes in Progress as their market dropped 10% yesterday, led down by their 4 major banks who dropped 25% or more as the top 10% begin a run for the borders on the election of the Socialist party. The super-rich of Greece fear that the Government may decide to tax them to help balance the budget – so they are on the run – taking Greece's money with them.

Not to beat a dead horse but Greece is still the word in Global Catastrophes in Progress as their market dropped 10% yesterday, led down by their 4 major banks who dropped 25% or more as the top 10% begin a run for the borders on the election of the Socialist party. The super-rich of Greece fear that the Government may decide to tax them to help balance the budget – so they are on the run – taking Greece's money with them.

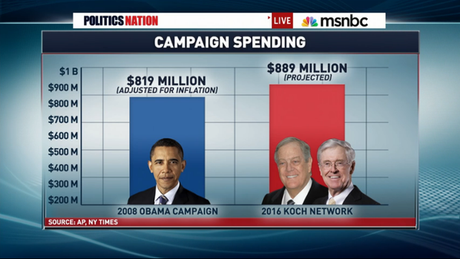

We don't need to fear that happening in the US because, rather than pull their $100Bn out of the US, the Koch Brothers have decided to spend almost $1Bn making sure the US remains a safe environment for to top 0.0001% so that they may continue to rape our environment and put the screws on the bottom 90% so more of their declining wealth can find it's way into the Kochs' pockets.

This is NOT a democracy folks – not even close. How can you even delude yourself that you live in a "one man, one vote" society when two men can spend more money than the ENTIRE 2008 Presidential Election Campaign in order to push their own agenda?

This is NOT a democracy folks – not even close. How can you even delude yourself that you live in a "one man, one vote" society when two men can spend more money than the ENTIRE 2008 Presidential Election Campaign in order to push their own agenda?

The short story is that no one wins the GOP nomination without their endorsement so we have 2 guys who get to approve who your President will be – is this what our Founding Fathers fought for? What a joke! This is Citizens United gone wild, already. Of course, you don't hear a lot of complaining about it in Rupert Murdoch's ($12.5Bn) Wall Street Journal or Michael Bloomberg's ($31Bn) Bloomberg News or David Thomson ($23Bn – Thomson/Reuters) or even Ted Turner's ($2.2Bn) CNN – the fix has been in the media for years now and most brains have been thoroughly washed to the point where the American sheeple actually think this stuff is normal in a "Democracy".

Greece was run for many years for the benefit of the Billionaires and, rather than "trickle down" their wealth on the bottom 99%, it turns out that (funny story!) the Billionaires decided to keep their money and now that a less wealth-friendly Government is in place – the top 1% are taking their gains out of the banks and out of the country, leaving a nation of impoverished and unemployed people in their wake.

Greece was run for many years for the benefit of the Billionaires and, rather than "trickle down" their wealth on the bottom 99%, it turns out that (funny story!) the Billionaires decided to keep their money and now that a less wealth-friendly Government is in place – the top 1% are taking their gains out of the banks and out of the country, leaving a nation of impoverished and unemployed people in their wake.

Sound familiar? It's our present AND our future! If we let evironmental rapists take control of our Government at this CRITICAL TIPPING POINT for the World's climate – there may not be a future to worry about anyway.

So much for long-term investing plans…

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!