Divergence!

Divergence!

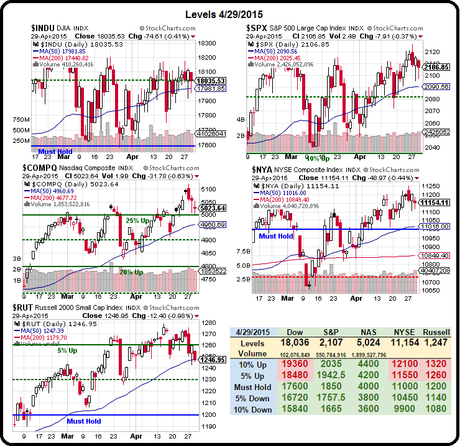

After making a mighty break from the pack in March to run up with the Nasdaq for a month, the Russell has now fallen back and is, in fact, leading us lower – failing to hold the 50-day moving average yesterday by just a half a point. But it was a very significant half a point since this is the first time any index has failed to hold the line in a month.

This morning the Russell Futures (/TF) are at 1,235, which is up $2,000 per contract from where we called the short in Tuesday morning's post (you're welcome) as well as our Live Trading Webinar, where we demonstrated the shorts on the Russell and the S&P (/ES Futures), which are down from 2,107 to 2,092 for a 15-point gain at $50 per point, per contract (+$750) and you are welcome again!

1,230 is the 2.5% line on the Russell, according to our fabulous 5% Rule™, which we discussed in great detail in this morning's Live Member Chat Room regarding the S&P's past and future inflection points.

1,230 is the 2.5% line on the Russell, according to our fabulous 5% Rule™, which we discussed in great detail in this morning's Live Member Chat Room regarding the S&P's past and future inflection points.

There's not going to be much support for /TF (Russell Futures) between 1,230 and 1,200 (another $3,000 per contract if you catch that move) and, since we've fallen all the way from 1,275 we're looking for a weak bounce to 1,239 (call it 1,240) and a stronger one to 1,250 and we're not going to be impressed by less than 1,250 at tomorrow's close.

Anything below that and we stay bearish into the weekend and, meanwhile, we'll be looking to see if our other indexes are going to confirm the Russell's slide. Nasdaq is now our lone high-flyer at 5,024 and you know 5,000 (25% over the Must Hold with AAPL providing 15% of it – up from $75 to $130 since last year) must hold up to impress us. The S&P, like the Nasdaq less AAPL, is up 14% at 2,110 but, as we noted, the /ES Futures, which predict the June 30th finish, are already down to 2,095 – also bouncing along the 50 dma at 2,090 – a very precarious position.

Clearly the Fed was no help yesterday and we discussed that to death in Member Chat, so I won't rehash it here. If we ignore the Fed and we ignore the terrible GDP Report we got yesterday morning we can shift our focus to this morning's Employment Cost Index which, according to the earnings reports I've seen so far, is going to be up higher than the 0.6% (q/q) and 2.2% (y/y) expected. That (paying those pesky workers) is going to put pressure on margins going forward.

8:30 Update: Employment costs are indeed rising, up 0.7% from last Q and on pace for a 3% gain on the year but we already know that major employers like MCD, TGT and WMT are planning on raising their base wages and not by just 3% so expect a lot of margin pressure in the 2nd half of 2015 as our Corporate Masters are running out of unemployed people to take advantage of with low wage offers.

In fact, unemployment claims just came in at 262,000 – the lowest level since Bill Clinton was President 15 years ago. Hopefully the GOP will be successful and prevent us from returning to those terrible days, when the average person had a good job and could afford to save a little money for retirement while our Federal budget was running a surplus - oh the horror!

Unfortunately, what's good for human beings is not good for corporations so our premise that the market is due for a bit of a sell-off remains intact.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!