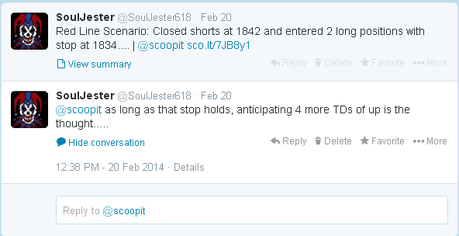

Here is the chart:

As you know if you follow me, my stops are manual and all exits (including stop outs) are posted when taken. However, as you can also see, my stop area was correct as today's low was 1836.78, well above the properly set 1834 stop area.

With this exit, I gained 15.90 points on the first position, and 15.90 points on the second position, for a total of 31.80 points. Accordingly, that leaves my total for 2014 at +155.31 SPX points (123.51 + 31.80 = +155.31), all posted real time and trading in both directions. Prior Calculation Post.

As indicated when I posted it, this was a short term trade into what I anticipate will be a ST cycle high this week.

As you know if you follow me, my stops are manual and all exits (including stop outs) are posted when taken. However, as you can also see, my stop area was correct as today's low was 1836.78, well above the properly set 1834 stop area.

With this exit, I gained 15.90 points on the first position, and 15.90 points on the second position, for a total of 31.80 points. Accordingly, that leaves my total for 2014 at +155.31 SPX points (123.51 + 31.80 = +155.31), all posted real time and trading in both directions. Prior Calculation Post.

As indicated when I posted it, this was a short term trade into what I anticipate will be a ST cycle high this week.

I am taking it off early because price wise we are close to my swing move despite that we are early in the time cycle. Here is the swing chart that I posted on a private blog on Friday:

That is basic trading and swing trading 101. You can see we broke the B wave pivot high of the leg down on the last leg up off February 20th, thus locking in the probabilities that it was an ABC correction down. Accordingly, the swing trade up was setup. On Friday, we closed below the daily mean, which gave an entire chart above for the bulls to ramp the swing move up. Did I know for certain it would work? Of course not.

Simply, those who say they are the world's greatest, or know with certainity what the market will do, are controlled by ego. I try to stay humble in front of the market, respect the scenarios, and understand that nobody knows the future. If one does not, the market will humble us. That is the law of ego and nature. For example, the World's Greatest Gollum who posts on an amature EW blog was certain that we would go down hard today, mocked my setup, despite that clear bullish trade setup. We also had the NYAD making new highs, which renders the odds of a new high not being made statistically small. Have you become that which you mock Gollum?

Remember my friend that when you gaze long into an abyss, the abyss also gazes long into you.

There is always a bear path and a bull path. We cannot know which path our future will choose. As always, do your own due diligence, read the disclaimer, and make your own investment decisions. Peace, Om, SoulJester