I have no reason presently to even consider the bear market scenarios. I will do an update if that ever changes. As a reminder, here was the work coming into the low. I anticipated a breathtaking bull run off the 30% Fibonacci/10% correction per the 1926 long term Dow analog and the July 2009 wave 2 analog.

Here are the charts now that the bull is likely confirmed:

I have no reason presently to even consider the bear market scenarios. I will do an update if that ever changes. As a reminder, here was the work coming into the low. I anticipated a breathtaking bull run off the 30% Fibonacci/10% correction per the 1926 long term Dow analog and the July 2009 wave 2 analog.

Here are the charts now that the bull is likely confirmed:

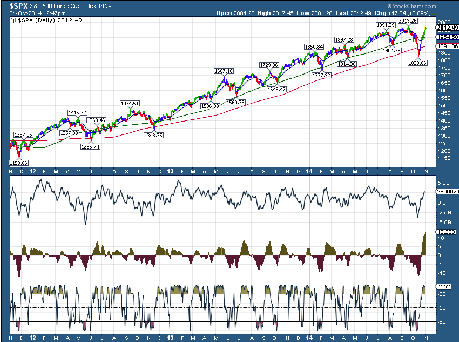

Remember that I count the move off the 2012 lows because my primary count is that was the end of the complex correction and the end of the bear market. Complex correction--Long term Bull Market Primary. Here is the update to the long term chart:

Remember that I count the move off the 2012 lows because my primary count is that was the end of the complex correction and the end of the bear market. Complex correction--Long term Bull Market Primary. Here is the update to the long term chart:

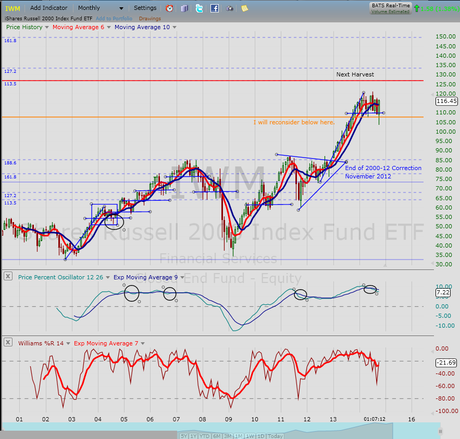

It would take a move below the October low now for me to consider any alternate to the primary bull market count. As I previously posted, I have a target of 126 on IWM for the next move. Here is the chart:

It would take a move below the October low now for me to consider any alternate to the primary bull market count. As I previously posted, I have a target of 126 on IWM for the next move. Here is the chart:

There is always a bull path and a bear path. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester

There is always a bull path and a bear path. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester