Analysts have been predicting a crash in the stock market for days, if not weeks.

Today, it happened.

Since the last financial crisis of 2008, investors have flocked to the stock market because of the Federal Reserve keeping interest rates artificially low, resulting in interest rates that approach zero for bank savings and certificates of deposits, as well as U.S. Treasury notes and bonds.

reports that stocks plummeted for a second straight day today, with the Dow industrials closing at 16,459.75, having lost 530.95 points or 3.1%. The S&P 500 dropped 64.84 points, or 3.2%, to close at 1970.89. The Nasdaq Composite fell 3.5%, or 171.45 points, to 4706.04.

The Dow's more than 1,000-point drop this week was the largest weekly drop since the week ended Oct. 10, 2008, which began the Great Recession. U.S. oil prices also briefly dropped below $40 a barrel today, again a level not seen since the 2008 financial crisis.But it's not just the U.S. stock market. The global market is crashing.

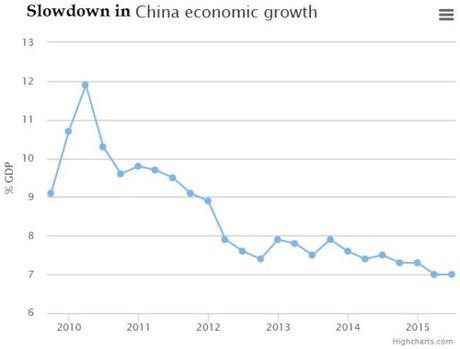

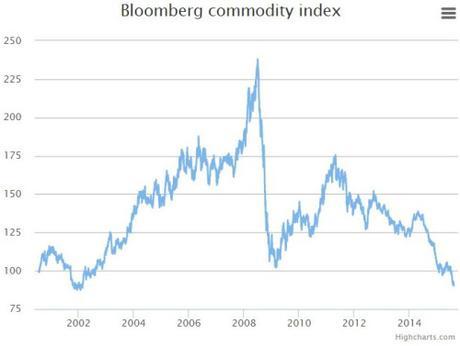

Signs of a sharp slowdown in China's economy, the world's second-largest, have unnerved investors since Beijing's devaluing of its currency last week. China's factory activity fell to a 6½ year low in August. Shares in the U.S., Asia and Europe have tumbled, along with commodity prices , as investors fretted about waning Chinese demand just as supplies are surging:

- The pan-European Stoxx Europe 600 ended the session 3.3% lower, closing out its biggest week of losses since August 2011.

- The Shanghai Composite Index tumbled 4.3%, hitting its lowest level since March, despite Beijing's efforts to prop up the market in recent weeks.

- In Japan, the Nikkei fell 3% to a six-week low.

"Now we've had some harder evidence that China is slowing relatively fast, people have chosen to get out," said Kiran Ganesh, a multiasset strategist at UBS Wealth Management, which oversees around $2 trillion of assets.

Waning Chinese demand, in turn, is fueling a rout in commodity markets. Oil prices continue to drop: Brent crude oil, the global benchmark, fell 2.5% to around $45.48 a barrel, its lowest level since January. Industrial metals prices also fell. "Commodity markets are telling us this is quite serious," said Neil Dwane, head of European equities at Allianz Global Investors, which oversees EUR412 billion ($463 billion) of assets.

Paul Wiseman and Joshua Goodman report for , Aug. 21, 2015:

The damage spans the globe....In emerging markets worldwide, currencies are plunging over fears that developing economies are on the verge of a crippling fall. Success stories until recently, emerging economies are seen as casualties now - of slower growth in China, plunging prices for commodities like oil and iron ore, the prospect of higher U.S. interest rates and homegrown threats.

The damage has spilled across oceans, with the turmoil jolting investors in New York, Tokyo and Europe. Investors there worry that China and other major emerging economies will reduce their imports. They also fear a trade-disrupting currency war as some countries desperately lower their currencies' value to gain a competitive edge. A lower-priced currency makes a country's goods cheaper for foreigners....

Hung Tran, an executive managing director at the Institute of International Finance, expects developing countries to post 3.8 percent economic growth this year, down from 4.3 percent in 2014. The institute is on the verge of cutting that forecast further.

Analysts point to a primary culprit:

"It's all coming from China," says Masamichi Adachi, an economist with JP Morgan Chase in Tokyo. "Brazil, South Africa, many countries are commodity exporters, and the final destination is all going to China."

The Chinese economy is slowing more sharply than most people had expected from the double-digit growth rates of the mid-2000s. The world's second-biggest economy is expected to grow 7 percent this year, which would be its slowest pace since 1990.

Beijing is trying to manage a transition from rapid growth based on exports and often-wasteful spending on factories, real estate and infrastructure to slower, steadier expansion based on consumer spending.

That transition means China would need fewer raw materials - Chilean copper, Nigerian oil, Brazilian iron ore. That helps explain why China's pullback has loosed carnage in global commodity prices : The Standard & Poor's GSCI commodity index, which tracks 24 commodities prices, is down nearly 20 percent this year.

Emerging markets were already feeling the squeeze , when China devalued its currency , the yuan. That step ignited a semi-panic.

"The devaluation is a red flag about China's current economic situation ," says Kurt Braybrook, who runs a Shanghai company that does quality control work. A falling yuan raises the risk that other countries will devalue their currencies to catch up.

Four days ago, in an article for the London Telegraph cheerfully titled " Doomsday clock for global market crash strikes one minute to midnight as central banks lose control," John Ficenec pointed out that "When the banking crisis crippled global markets seven years ago, central bankers stepped in as lenders of last resort. Profligate private-sector loans were moved on to the public-sector balance sheet and vast money-printing gave the global economy room to heal."

Then is then, and now is now.

Ficenec warned that today,

The great props to the world economy are now beginning to fall. China is going into reverse. And the emerging markets that consumed so many of our products are crippled by currency devaluation. The famed Brics of Brazil, Russia, India, China and South Africa, to whom the West was supposed to pass on the torch of economic growth, are in varying states of disarray. [...]

From China to Brazil, the central banks have lost control and at the same time the global economy is grinding to a halt. It is only a matter of time before stock markets collapse under the weight of their lofty expectations and record valuations.

Meanwhile, a new study by the non-partisan Government Accountability Office (GAO) finds that as many as half of all households with Americans 55 and older, i.e., Baby Boomers, have no retirement savings at all.

Here are some more dismal data about Boomers' precarious finances (source: GAO via ZeroHedge):

- Only 35% own their home free and clear from debt. 24% are still saddled with mortgage debt. 41% do not own a home, which means they have to pay rents that continue to outpace any wage gains.

- The median net worth of those 55 and older is $34,760 , which is basically one small illness from bankruptcy, which also means half of Boomers have net worth of less than $34,760. The median annual income of boomers is $18,932 which makes them part of America's low-wage earners.

- 48% have some retirement savings, though not much. 23% have a pension but no retirement savings. 29% have no pension or IRA or 401(k) or retirement savings.

All of which means most Boomers will either have to continue to work and never retire (assuming they can find work), or depend entirely on Social Security as their primary source of income into old age. Social Security is expected to go broke 19 years from now, in 2034. But with Congress' recent ingenious (sarc) solution to the bankruptcy of Social Security Disability Insurance by merging it with the (retirement) Social Security, expect Social Security to go broke earlier than 2034. See: