One of the first questions many potential first-time home buyers ask is if they make enough money to qualify to buy a home.

One of the first questions many potential first-time home buyers ask is if they make enough money to qualify to buy a home.

It's a good question, but income is only one part of qualifying. When you talk to a lender they will take many things into account before approving you to buy a home, including...

- Income

- Debts and other financial obligations

- Cash available for down payment

- Credit score

After evaluating your unique situation your lender will let you know how much you may qualify for in a mortgage to buy a home, as well as how much cash you will need to close depending on your loan scenario.

What is probably most significant at this point is what price home you may qualify for... which may or not be realistic in your market and will play a big role in deciding whether it makes sense for you to buy at this time.

You probably have a pretty good idea yourself of how much you can afford in a monthly housing payment... and of course don't forget to factor in utilities and maintenance costs as well.

Online calculators often only calculate principal and interest payments... you will also have property taxes, homeowner's insurance and if you are making a down payment of less than 20% you will also have mortgage insurance.

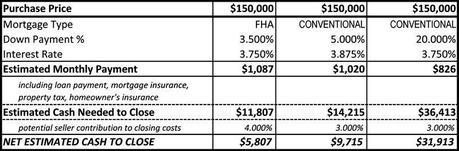

Below is a ballpark estimate of your estimated monthly payments and cash needed to close for a sale price of $150,000, which was the median sale price in the Twin Cities last year. Sellers can contribute towards buyer's closing costs to help reduce the amount of cash needed to close... maximum of 6% with FHA financing and typically 3% maximum with conventional financing. However, it is rare to be able to get the full 6% so I estimated 4% with FHA financing.

Remember, these are estimates only... talk to a lender to learn more about your situation!

Sharlene Hensrud, RE/MAX Results - Email - Minneapolis Buyer's Agent