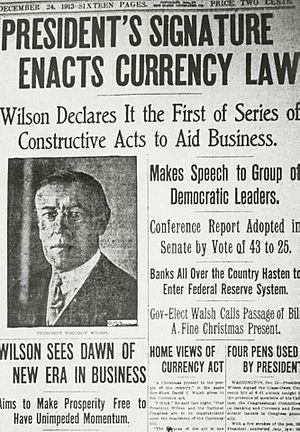

Description: Newspaper clipping USA, Woodrow Wilson signs creation of the Federal Reserve. Source: Date: 24 December 1913 (Photo credit: Wikipedia)

Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. In one of his articles after the recent “April Plunge” in the price of gold, he wrote:

“I was the first to point out that the Federal Reserve was rigging all markets, not merely bond prices and interest rates, and that the Fed is rigging the bullion market in order to protect the US dollar’s exchange value, which is threatened by the Fed’s quantitative easing.”

It’s one thing for people like the Gold Anti-Trust Action Committee (GATA) to claim that the gold and silver markets are rigged. It’s another thing entirely to have a former Assistant Secretary of the Treasury to make similar claims. Mr. Roberts’ credentials add much credence to the market rigging claims.

“With the Fed adding to the supply of dollars faster than the demand for dollars is increasing, the price or exchange value of the dollar is set up to fall.”

Of course, the dollar’s value is “set up to fall”. Government has been inflating the dollar steadily since 1971 and shouldn’t want to stop inflating—unless they want to declare bankruptcy and collapse the economy.

Being the world’s biggest debtor, the US government wants inflation so it can pay off its national debt with “cheaper” dollars. I.e., if the government borrows $1 billion and causes 10% inflation, it will repay “$1 billion” nominally—but the purchasing power (the real value) of those “nominal” (now, inflated) dollars will only be about $900 million. By means 10% inflation, the government can cut the real size of the national debt by 10%. By means of 20% inflation, the government can curt the real value of the national debt by 20%, and so on. If the real national debt isn’t $16 trillion (as claimed by Obama) but in excess of $200 trillion (as claimed by the Congressional Budget Office), there’s a powerful, irresistible incentive for government to inflate the dollar.

Government wants and needs inflation to reduce the national debt.

Therefore, I don’t see government wanting the dollar to become worth more. I see them wanting/needing the dollar to be worth less.

For me, a fall in the price of gold is contrary to the government’s own interests since that “April Plunge” is evidence of deflation and a more valuable dollar. Therefore, the April Plunge in the price of gold strikes me as at least surprising, seemingly irrational and presumably temporary—unless the government wants to collapse the economy.

“A fall in the dollar’s exchange rate would push up import prices and, thereby, domestic inflation and the Fed would lose control over interest rates.”

Given that fiat currency can easily flee over the internet to foreign countries, the Fed’s ability to change interest rates has become counter-productive or even largely irrelevant.

Historically, when money was physical gold and silver, that money was essentially “trapped” in the US. If an investor had a lot of gold or silver to lend and the Fed reduced US interest rates, the investor had only two choices: 1) lump it; or 2) move his money by means of steamship to a foreign country that paid higher interest rates. Unwilling to risk shipping their tangible money (gold/silver) to foreign countries, most US investors generally just “lumped it” and accepted lower interest rates as better than nothing. So long as the money was “trapped” within the US, the Fed’s control of interest rates provided them with a powerful tool for controlling the economy.

However, since physical money has been replaced by fiat and now digital currencies, fiat dollars can now be moved over the internet and around the world at the speed of light. Therefore, if the Fed reduces interest rates, lenders with large sums of money to invest are no longer “trapped” within the US. Instead, thanks to non-tangible currency, they can now move their currency to foreign countries paying higher interest rates.

Therefore, lowering interest rates is counter-productive and a less effective mechanism for “stimulating” the economy. Today, by lowering interest rates as a means to “stimulate” the economy, the Fed will actually drive currency out of the country, diminish the currency supply and thereby tend to slow the economy.

Control over interest rates is becoming largely irrelevant to controlling the economy. Lowering interest rates may still have some psychological effect in that it may persuade some that the Fed is working feverishly to stimulate the economy. But, so long as lenders’ currency can flee to foreign countries and the US is the biggest debtor in the world, low interest rates are more for show than for go.

Today, the only thing the Fed can legally control is the supply of currency. If the Fed wants to “stimulate” the economy, they print more currency to increase the currency supply. If they want to slow the economy, they can take more currency out of circulation and reduce the supply of currency.

No longer able to rely on interest rates to help legally control the economy, it appears that the Federal Reserve has sought other, even illegal, means of control—including market manipulation (fraud).

Mr. Roberts explains how that fraud was achieved with “naked shorts”:

“The Fed used naked shorts in the paper gold market to offset the price effect of a rising demand for bullion possession. Short sales that drive down the price, trigger stop-loss orders that automatically lead to individual sales of bullion holdings once their loss limits are reached.

“Normally, a short is when an investor thinks the price of a stock or commodity is going to fall. He wants to sell the item in advance of the fall, pocket the money, and then buy the item back after it falls in price, thus making money on the short sale. If he doesn’t have the item, he borrows it from someone who does, putting up cash collateral equal to the current market price. Then he sells the item, waits for it to fall in price, buys it back at the lower price and returns it to the owner who returns his collateral. If enough shorts are sold, the result can be to drive down the market price.

“A naked short is when the short seller does not have or borrow the item that he shorts, but sells shorts regardless.”

In other words, selling “naked shorts” is somewhat like selling the Brooklyn Bridge. If you don’t own that bridge, how can you sell it? You can’t sell what you don’t own. If I try to sell a car, a parcel of land, or even a “naked gold short,” I’m committing fraud—a crime. But if people associated with the markets sell naked shorts, it’s excused as standard business practices.

“According to Andrew Maguire, on Friday, April 12th, the Fed’s agents hit the market with 500 tons of naked shorts.

“In the paper gold market, the participants are betting on gold prices and are content with the monetary payment.”

The Fed’s “agents” aren’t “betting”. “Betting” presumes that the result is unknown. When they sell 500 tons of “naked gold shorts” (paper gold) into the market, they are controlling the market by the fraud of selling so much non-existent, “paper” gold into the market, that the price of existent, physical gold is made to plunge.

“In other words, with naked shorts, no physical metal is actually sold.”

If “no physical gold” is being sold, what is?

A: Paper gold. Certificates of gold. Pieces of paper that can be “spun” into existence almost as easily as the Federal Reserve “spins” paper dollars out of thin air.

In other words, the price of physical gold dropped nearly $200 in two days based on the sale of 500 “tons” of paper lies.

Result? Those of us who hold gold were robbed and defrauded by the Federal Reserve and our own government.

And why did the Federal Reserve and federal government defraud us out of some of the value of our physical gold? In order to protect their fraudulent, fiat monetary system. They committed a massive fraud on April 12th in order to protect the even more massive fraud we call Federal Reserve Notes and “fiat currency”.

The Federal Reserve has been reduced to an overt, criminal enterprise that relies on criminal fraud to sustain the economy.

“They are trying to destroy gold as a (safe) haven from the dollar . . . . That is what is driving the illegal policy of selling naked shorts in order to manipulate a market. If you and I were to do something like this without the government’s instruction or protection, we would be arrested. So the fact that it’s illegal, being done by the authorities, tells me that they are seriously worried about the dollar.”

For the Fed to risk the massive fraud on April 12th and 15th implies that the Fed is, indeed, desperate. Would the Fed risk committing a massive crime if it weren’t desperate?

If the Fed is desperate enough to engage in overtly criminal acts, that implies that there’s big trouble coming in the near future.

More, the “April Plunge” in gold prices seems to have backfired on the Fed. People are finally recognizing the difference between the prices of paper and physical gold. That recognition bodes ill for the Fed and the fiat dollar. As people increasingly move away from paper gold towards physical gold, the Fed’s ability to control the market price of physical gold will diminish.

If the Fed loses much of its ability to control the market price of physical gold (much like it’s lost some of its ability control the economy by means of adjusting interest rates), the Fed may be again forced to rely almost exclusively on controlling the economy by means of increasing or decreasing the currency supply. Then, if the Fed wants to stimulate the economy, their only workable option may be to print more fiat currency, devalue the dollar further, and opt for inflation or perhaps even hyper-inflation.

If the “April Plunge” has significantly reduced the Fed’s capacity to control the price of physical gold, then that Plunge may eventually be seen as evidence that the Fed took a foolish and unwarranted risk. They should’ve recognized that risk before they caused the April Plunge. If they recognized that risk and proceeded anyway, we can presume that the Fed is either stupid or desperate.

I doubt that they’re stupid.

If they were desperate, I doubt that their desperation has been relieved. Therefore, we can reasonably wonder what other assaults the Fed may have in mind for the next weeks or months.

“Unless the authorities have the actual metal with which to back up the short selling, they could be met with demands for deliveries. Unable to cover the [paper] shorts with real metal, the scheme would be exposed.”

That can’t be news to those who perpetrated the April Plunge. That means they’ve got something else up their sleeves in order to protect themselves from having to make good on physical delivery. If so, we should expect more drama.

I also doubt that the Fed can make good on all those “naked shorts”. If that’s true, why would they dare to make those naked shorts and risk bankruptcy or even criminal charges? Could it be that the Fed expects a law to be passed in the near future that would relieve them of the obligation of keeping their “naked short” promises to repay in physical gold? Could it be possible for government to pass a law that mandates that all gold market transactions be settled in paper dollars rather than physical gold? I understand that this speculation is improbable. Nevertheless, what else (besides a new law) can protect the Fed’s naked shorts from being settled in gold at fire sale prices?

On the other hand, if there’s no new law coming down the pipe or if the Fed doesn’t have a “Plan B” to provide the gold at some future date, when will April’s naked gold shorts become due? If physical gold is demanded and the Fed can’t or won’t provide physicial gold, might that moment mark the end of the line for the economy?

Just today, Jim Sinclair reported two instances where wealthy individuals tried to get their gold out of a Swiss bank and the London Bullion Market Association (LBMA). In the first instance, the bank refused to provide the gold to its rightful owner based on some governmental precaution to resist terrorism and money laundering. In the second instance at the LBMA, the investor was told he could not take physical gold, but his investment would be settled with cash.

These two instances are only anecdotes. They prove nothing. But they’re consistent with the theory that the “system” is about out of physical gold or is at least unwilling to part with whatever physical gold it still retains. If so, the risk of storing physical gold in someone else’s vault is rising.

“Andrew Maguire also reports that foreign central banks, especially China, are loading up on physical gold at the low prices made possible by the short selling. If central banks are using their dollar holdings to purchase bullion at bargain prices, the likely results will be pressure on the dollar’s exchange value and a declining market supply of physical bullion. In other words, by trying to protect the dollar from its quantitative easing policy, the Fed might be hastening the dollar’s demise.”

Exactly. The Fed is doing something that appears to be irrational, contrary to the Fed’s own interests, and is arguably self-destructive. Unless they’ve got another spectacular trick up their sleeves, it may be that the April Plunge fraud was an act of desperation that might buy the Fed a few more months but, in the end, may also seal the Fed’s fate.

The April Plunge may be evidence that the Fed knows that it’s damned if it does and damned if it doesn’t. Perhaps they took a huge risk because they had no other choice. If so, it’s conceivable that our economy may suffer some mortal wound within the next few months.

Paul Craig Roberts seems to agree:

“Possibly the Fed fears a dollar crisis or derivative blowup is nearing and is trying to reset the gold/dollar price prior to the outbreak of trouble. If ill winds are forecast, the Fed might feel it is better positioned to deal with crisis if the price of bullion is lower and confidence in bullion as a refuge has been shaken.”

“I see the orchestrated effort to suppress the price of gold and silver as a sign that the authorities are frightened that trouble is brewing that they cannot control unless there is strong confidence in the dollar. Otherwise, what is the point of the heavy short selling and orchestrated announcements of gold sales in advance of the sales?”

Confidence in gold was shaken by the April Plunge—but only temporarily. In the midst of the Plunge, dealers reported 50 buyers for every seller. That means confidence in gold stayed strong despite the Plunge.

As of today (April 23rd), gold has recovered $65 (almost 30%) of its $200 plunge. What the Fed was able to take down in just two days, normal investors appear able to slowly rebuild in two months. The Fed has more dramatic power than the private investors, but private investors have more persistence and determination. If the price gold recovers all of the $200 plunge within two months, the Fed’s naked short strategy will be shown to have been largely futile.

If the rising price of gold wipes out the April Plunge in two months, the only confidence that’ll be shaken will be that of the Federal Reserve.

But regardless of whose confidence is shaken, stirred or vaporized, the desperation that apparently motivated the Fed’s naked short selling has not been relieved.

Something big is still out there, not so far away, and it’s getting ready to bite.

Buckle up.