From Josh Bivins at the Economic Policy Institute:

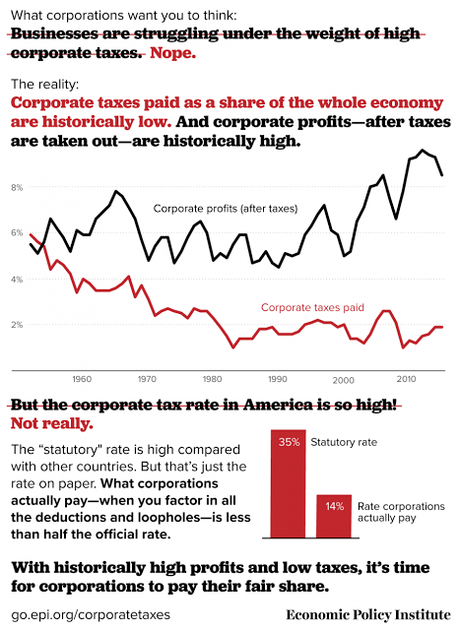

It is often claimed that American corporate tax rates are much-higher than our international peers, and that this has harmed U.S. corporations’ competitiveness. However, these claims are both factually incorrect and economically meaningless. On the facts, while the statutory corporate tax rate in the United States is 35 percent, after loopholes and deductions, the effective tax rate that corporations pay is only 14 percent. On the economics, even if U.S. corporations werepaying higher taxes than their international peers, cutting these rates will do nothing to help the vast majority of American families, but will exacerbate inequality by boosting the post-tax incomes of owners and managers of corporations

To help most American families, corporate tax proposals should focus on increasing, not decreasing, the taxes paid by corporations. The corporate tax system is so riddled with loopholes that it raises far too little revenue and doesn’t contribute enough to the need of the federal government to honor existing commitments to social insurance, income support, and public investment. If policymakers are going to push corporate “tax reform,” they should focus on requiring corporations to pay their fair share of taxes. For more on how cutting corporate taxes will hurt American families, read EPI’s recent research.