Click here for part 1 of this week’s series.

This week, I’m working toward answering the question for this October’s “Session” post, presented by Derek from It’s Not Just the Alcohol Talking:

Many in the industry are starting to wonder when, and more importantly how, the growth is going to stop. Is craft beer going to reach equilibrium and stabilize, or is the bubble just going to keep growing until it bursts?

On Monday, we looked at the idea of saturation and what that could potentially mean for a beer bubble. Most notably, I’m working from the assumption that local saturation is most important. California has hundreds of breweries, but the interest and population to meet the demand. North Dakota doesn’t. Rather than keeping an eye on saturation from a national perspective, looking at it from your own backyard may be the best way to address the situation.

All politics beer is local, after all. Or should be, at least

But in order to hit saturation, the craft beer business would be dependent on an increase in breweries. There are already 2,538 in operation with about 1,500 more in planning, according to the Brewers Association.

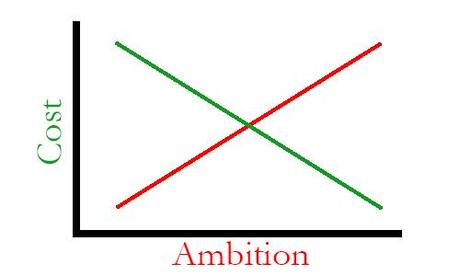

Why is this important? Because as the craft beer bubble continues to grow, here’s what I see as the potential issue at hand for businesses:

At a time when ambition to join the craft beer movement is rising thanks to incredible levels of interest, costs to get in the game may be going down. Does that just inflate the bubble even more? Or can our livers/wallets/interest handle it?

Investing in Beer

I’m sure if we stuck with the 2,538 breweries in operation right now, we’d still be a happy group of people. However, we’re now living in a time when anyone can go pro. And I wonder … is that the reality AND the problem?

“Inside every home-brewer, deep down, is somebody who thinks they can go pro,” said Todd Donnelly, a pharmacist who, in his free time, leads the SNOBs — the Society of Northeast Ohio Brewers.

“This is a very novel idea,” he said of the Platform project [a pseudo-contract brewing operation]. “It sounds like a fascinating model. I’m just curious if it would ever expand much beyond glorified hobbyist. The challenge you have right now is, if you walk into any store, there is a limited amount of space to sell on. That’s where what you’re starting to see right now is market saturation.”

The Platform project, like Kickstarter or CraftFund all present a way for small-timers to go big and make beer to sell locally. Other businesses, like Brew Hub, offer a means for extra capacity for local or regional breweries.

What’s the common denominator here? All these new businesses geared toward the craft beer industry are effectively lowering the cost of doing business. Established breweries can utilize the extra space and equipment at a lower cost than buying their own and newbies can walk in and brew their first commercial batch of beer to market locally.

So, is this lowering cost a good thing?

The spooky spectre that looms over all of this is what happened in the 1990s. An explosion of brewpubs followed a business trend and then bottomed out, with many closing their doors soon after. “Back then, everybody who thought they were a homebrewer could jump in and make commercial beer,” [says Mike Stevens, CEO of Founders Brewing]. “The new problem is everybody wants to get in the game, experienced or not.”

Last year, 1.7 percent of craft beer sold was contract brewed, but with costs going down, this means that “aspiring brewers only need to raise $50,000, not $500,000, to realize their dreams.” Now it’s incredibly easy to make beer – hopefully good beer – but also flood the market.

That’s where we get into the localized idea of saturation:

If you slept through your Economics 101 class in college, here’s the one thing you need to know about excess manufacturing capacity in any industry with high fixed costs (like the beer industry): When demand doesn’t keep up with the building of manufacturing capacity, you end up with oversupply, and prices fall. You may say, “Hey, that’s a good thing.” But in the long term, it means many breweries will start losing money. The result is a flood of bad or old beer showing up in the market. It happened in 1998. Will it happen again? It all depends on whether beer demand keeps up with the fast pace of supply creating.

Again, all this seems to point toward the fact that if these increases in breweries and beer happen in places where it’s easy to support, all signs are go. For fun, here’s a great map of ideal places to open a brewery, created by the folks at Sterr Bros Beer:

… and here’s how those states look from our handy chart on saturation and the beer bubble:

State

2010 pop

2012 pop

% pop increase

2011 breweries

2012 breweries

Brewery increase

Arizona

6,392,017

6,553,255

+2.52

34

44

10

Virginia

8,001,024

8,185,867

+2.31

40

48

8

Minnesota

5,303,925

5,379,139

+1.42

34

47

13

New York

19,378,102

19,570,261

+0.99

69

88

19

New Jersey

8,791,894

8,864,590

+0.83

25

26

1

Indiana

6,483,802

6,537,334

+0.83

43

54

11

Conn.

3,574,097

3,590,347

+0.45

15

21

6

Illinois

12,830,632

12,875,255

+0.35

52

67

15

Rhode Island

1,052,567

1,050,292

-0.22

6

8

2

While that map is from 2009, we also know that these states have increased their brewing industries in recent years. If you’re a native to any of these states, chime in. In my last post, Christie from Brewyourownium mentioned Virginia’s rise of breweries.

So while all this info may give us a decent base of what’s going on now, how can we map this out to the future? Is this bubble going to burst?

I’ll try my best to add to the conversation for Friday’s Session post, but please leave your thoughts/comments/suggestions below so we can give this the conversation it deserves.

+Bryan Roth

“Don’t drink to get drunk. Drink to enjoy life.” — Jack Kerouac