The future belongs to fuel efficient cars

In June, the Obama Administration proposed substantial changes to the Corporate Average Fuel Economy standards (known by the acronym CAFE). The changes would require a near doubling in the fuel efficiency, measured in miles per gallon (mpg), for passenger cars and light trucks. The automobile industry, represented by most of the major auto manufacturers (Volkswagen being the major exception), is supporting the new CAFE standards (with a few modest adjustments). As announced in late July, the fleet average fuel efficiency for new passenger cars and light trucks by 2025 will have to be 54.5 mpg. This follows on the heels of earlier regulations that will require new cars and trucks to have a fleet average fuel efficiency of 35.5 mpg by 2016.Earlier this month the president announced the first ever fuel efficiency standards for heavy trucks (18-wheelers, tankers, etc.). These standards would require percentage improvements in fuel efficiency and greenhouse gas (ghg) emissions by 2018 based on the type of truck and how it will be used. The American Trucking Association (ATA), an industry advocacy group representing trucking companies and commercial truck owners, is supporting the new standards.

The immediate objective of these new rules is to reduce gasoline consumption and ghg emission, with the larger goal of increasing energy independence, spurring the development of clean car technology, and improving air quality. As with all federal rules, there will be numerous loopholes, exemptions, options to pay penalties in lieu of compliance, and complicated methods for actually measuring fuel efficiency and vehicle emissions. However, assuming these new rules are fully (or even largely) implemented, there will be major ramifications for the vehicles you and I buy and drive over the next fourteen years (and beyond). But perhaps an even bigger effect will be not to the vehicles we drive in, but to the roads we drive on.

Positive Outcomes

Auto manufacturers will greatly improve the fuel efficiency of their future vehicle models. These improvements are technically feasible - at a cost. That cost will be passed along to buyers. Auto makers will come out even. Consumers will have to pay more up front, but over the life of the vehicle, will save significant sums from buying far less gas (and one would hope from better overall quality). As a consumer I would expect to come out even (more or less), especially over time as auto makers learn how to make more efficient cars, well, more efficiently (i.e. at a lower cost).

Trucking companies will be forced to pay substantially more for new, more efficient, and cleaner tractors. However, the Administration expects that fuel savings will quickly offset the upfront costs. I hope that's true, otherwise the trucking industry will pass along the higher overhead to their customers.

In the end, car and truck technology will be improved, and fuel use and ghgs per vehicle will be substantially reduced. That's all good, and something that readers of this blog know I support.

Unintended Consequences

However, there are unintended consequences of these new rules that the Obama Administration has not addressed. Currently, most roadway maintenance and construction is financed through federal and state taxes applied to gasoline. The federal tax is $0.184 per gallon and hasn't been raised since 1993. Overall, the average American spends $0.47 per gallon on gasoline taxes. These taxes account for the vast majority of federal (and state) transportation revenues. Think about how the new fuel efficiency rules will undermine this income.

As fuel efficiency increases, the amount paid in tax per mile decreases. This means that on a per-mile-traveled basis, the amount of funding available will be greatly reduced. There's many ways to calculate these impacts, but one study I read indicates that revenues will decrease by more that 26% with the new rules compared to without them. This is a huge concern.

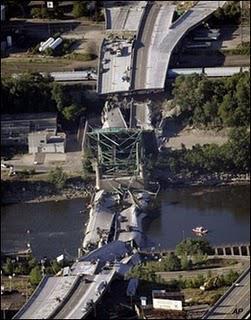

I-35 is symptomatic of America's aging infrastructure

There are two massive highway infrastructure issues that have to be solved in the coming decades. The first is maintaining existing roads and structures. Americans were shocked to see the I-35 bridge collapse into the Mississippi River in Minneapolis in 2007. This spectacular failure made the nation look harder at its aging infrastructure, recognizing the thousands of existing structures and thousands of miles of existing roads that have reached, or soon will reach, the end of their designed lifespan. Structures need to be rehabilitated or rebuilt and highways need to be reconstructed.Second, the existing road network needs to be enhanced to facilitate the better movement of people and goods. An increasing population and increased trucking are putting more vehicles on the nation's roads every day. Congestion is already a major problem in most urban areas. Future economic growth will be hindered unless roads are easier and faster to use.

There's nowhere near enough money to address these two needs. Nationwide, current shortfalls between needs and available funds are in the tens of billions of dollars, and these shortfalls are only going to increase in coming years.

What's the Solution?

Typical congestion on Washington's Capital Beltway

So what's the solution? Fuel efficiency is going up and the resulting gas tax revenues are going down. This is an unsustainable path. After all, what roads will those improved, efficient vehicles of the future travel on? Perhaps the most obvious approach is to increase the gas tax. But this is losing proposition. The current public attitude toward taxing - of any kind - makes raising taxes unlikely. As stated above, the federal gas tax hasn't been increased in 18 years and many state gas tax rates have been similarly static. The gas tax should have been indexed to the price of fuel when it was established. Now it's unlikely to be raised at all, let alone to the level that would meet funding needs. Plus increasing fuel efficiencies lead to ever higher levels of taxes need just to "stay even". Gas taxes aren't the solution for the future.The answer to this dilemma must be alternative funding approaches. The best solution that I'm aware of is direct user fees. You already pay these on toll roads, where toll revenues are (almost always) legally obligated to be used on the roads on which they are applied. Mileage-based fees take this idea a step further. Under such a scheme, users would pay a certain rate based on the specific roads and times that they travel and the vehicles they drive. This approach could be implemented in any number of ways, but in all cases could offer two important benefits:

- drivers would better understand the actual cost of driving (as opposed to the indirect cost of the gas tax) since fees could be set based on a variety of factors that better relate to the actual cost of driving and the incurred cost to the roadway; and,

- the system would allow for higher charges to be applied to travel on the most popular roads at the most popular times, providing an incentive for drivers to change travel patterns, with the ultimate result of reducing overall roadway congestion.

The problem, unfortunately, is that there has been little interest from the Obama Administration in exploring increased use of user fees (mileage-based or other). The Administration is even hostile to implementing the much less complicated and very proven approach of simple road tolling. Certainly administration officials are aware of the transportation financial shortfalls and are familiar with the connection between fuel efficiency and gas tax revenues. If improvements to fuel efficiency are going to be mandated, the improvements to roadway funding must follow. Otherwise, you'll have lots of shiny new cars jostling along more and more miles of deteriorating roads.