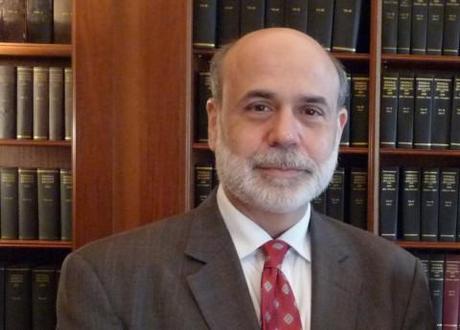

Trust Ben? Ben Bernanke, chairman of the Federal Reserve. Photo credit: Israeli Ministry of Finance

Trust Ben? Ben Bernanke, chairman of the Federal Reserve. Photo credit: Israeli Ministry of Finance

The background

Chairman of the US Federal Reserve Ben Bernanke announced another round of “quantitative easing” on Thursday, the Fed’s open-ended effort to stimulate the sluggish economy and, most importantly, boost job growth.

Wall Street rallied on the news, but already, Republican presidential hopeful Mitt Romney is branding the move “another bailout” for the “Obama economy”, Chinese financial observers are claiming that QE3 may actually hurt more than help, and other analysts are worried that it might not meet expectations.

What is QE3?

This is the third round of what’s called “quantitative easing”, essentially, and injection of new money into a financial system by a central bank through purchasing assets, or in other ways. Bernanke has promised that the Fed will buy $40 billion in mortgage-backed securities until the end of the year and to continue pumping money into the economy until the job market improves substantially. It’s open-ended because Bernanke didn’t exactly define what “substantially” means. The first round of QE took place after the Lehman Brothers collapse in 2008, when the Fed started buying up securities; the second round was in November 2010. The question now, is, will this time around work?

Fed is doing what it can because Republicans won’t

The New York Times, in a leading editorial, praised the Fed’s efforts, claiming that the institution has had to step up because fiscal policy makers have failed, “largely because Republicans have refused to even consider measures to hire teachers, rebuild schools and otherwise create jobs.” It’s not going to be enough, the paper seemed to think, but at least it’s doing something.

It will help – as long as the Fed keeps it up

Bill Conerly, writing at Forbes, tended to agree, noting, “If you set your expectations low enough, you will not be disappointed.” He added, “QE3 will help the economy, but it will not fix all of our problems. It will help get the economy growing faster, but with a long time lag. So a year from now, look for better growth. Will it get us back down to low unemployment and full usage of our manufacturing capacity? Nah. The Fed will get nervous about inflation long before that, stop easing, and we’ll be back to our underperformance.”

What’s the difference this time?

The difference in this round is the open-ended nature of the program, Christopher Matthews wrote at TIME. Here’s the theory, he explained: “Open-ended purchases of mortgages will have the effect of lowering interest rates, helping more people qualify for mortgages or refinance. But more importantly it will — in theory — have the effect of creating an expectation of generally higher asset prices in the future, which will motivate people to get off their duffs and spend money now. If companies and individuals are indeed convinced that prices will rise in the future, that would encourage them to spend, hire, and jump-start the economy out of its chronic underperformance.” Will it work? Only time will tell.