What's going on here? Read this post to find out. Note: In researching spending by MillerCoors, multiple references to "MillerCoors LLC" and "MillerCoors" were found, so both are referenced in this information. All charts are clickable to enlarge. MillerCoors LLC

What's going on here? Read this post to find out. Note: In researching spending by MillerCoors, multiple references to "MillerCoors LLC" and "MillerCoors" were found, so both are referenced in this information. All charts are clickable to enlarge. MillerCoors LLC Campaign finance, from 1989 through Q2 2014: $971,532

Lobbying:

- All time: $13,702,000

- 2013-2014: $4,020,000

- 2013-14 spending represented 29.3 percent of all-time amount

Source

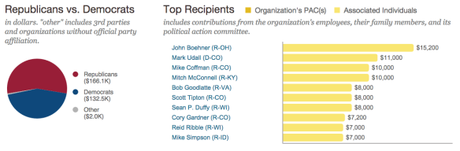

2013-2014 Cycle

Individual contributions:

Political Action Committee contributions:

Individual contributions:

Political Action Committee contributions:

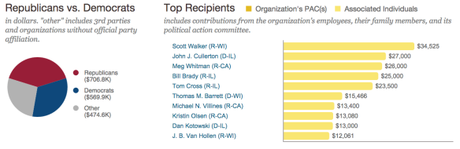

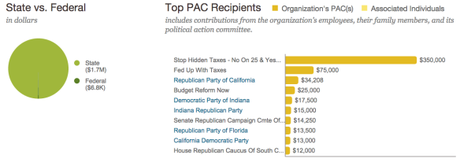

MillerCoors

MillerCoors Campaign finance, from 1989 through 2012: $1,751,299

Source

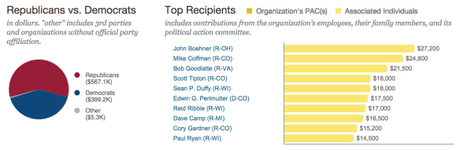

2007 to 2012

Individual contributions:

Political Action Committee contributions:

MillerCoors

MillerCoors Over last 20 years, top-five donation totals to party committees have been:

- California Republican Party: $108,715

- Florida Republican Party: $62,000

- House Republican Caucus of South Carolina: $32,500

- California Democratic Party: $29,000

- New York Senate Republican Campaign Committee: $26,750

Source

(There are dozens of MillerCoors LLCs listed)

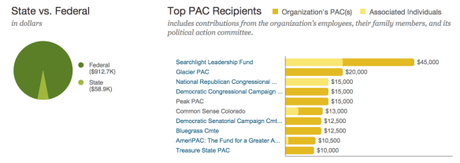

MillerCoors LLC2014 Election Cycle

- Total Raised: $254,668

- Total Spent: $265,763

- Contributions to federal candidates: $190,500 (25% to Democrats, 75% to Republicans)

Source

Dodd-Frank Derivatives Title VII

The goal is to increase transparency and reduce risk in markets while mandating comprehensive reporting of certain financial transactions. Most notably, MillerCoors expressed interest in the implications of the Dodd-Frank Derivatives Title in relation to their contracts with other businesses. For example, a concern was expressed about releasing information on aluminum contracts, which are obviously pivotal to the company's packaging needs.

Excerpt from U.S. House Committee on Financial ServicesJames Cawley, CEO, Javelin Capital Markets:

If you are entering into a contract, and it is probably a big contract-does that have an impact on the market if you are forced to disclose the contract that you are entering into?

Craig Reiners, director of risk management, MillerCoors LLC:

I think it is really all about the details and the careful implementation of any new rules. We would, as a beer guy and someone who actually uses these tools that we are talking about, the level of confidentiality is certainly critical.

Issues related to spent grains at the FDA

As Brewbound reported in March, the FDA, in an effort to clarify regulations included in the Food Safety Modernization Act, had sought to impose new rules on brewers that sell their spent grains to farmers. Specifically, the proposed rule would have required brewers to dry and pre-package their spent grains before selling them, creating an added expense that would have made the centuries-old practice ultimately unsustainable for many.

General interest in the Commodity Exchange Act and CFTC's oversight of the London Metal Exchange

There has been some ongoing friction surrounding the Metal Exchange in recent years, and MillerCoors accused the market of "unfair aluminum market practices and lack of transatlantic oversight cost US industry an extra $3 billion in 2012." Along with Russia, the company has also criticized the Exchange's warehousing policy, which has "led to inflated physical prices and distorted supplies of metal, upending global futures and physical trading."

Beer Money series:

- Introduction

- MillerCoors

- Anheuser-Busch

- Heineken

- Brewers Association

- Beer Institute

- National Beer Wholesalers Association

- Discussion

Bryan Roth

"Don't drink to get drunk. Drink to enjoy life." - Jack Kerouac