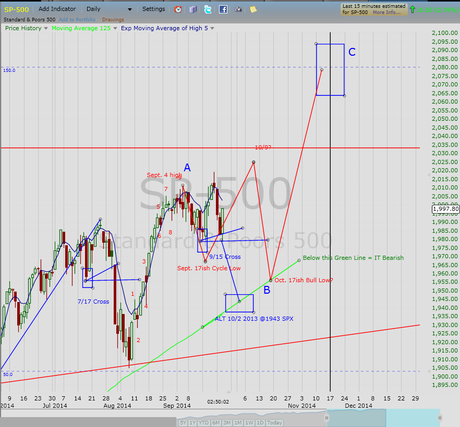

I am not confident we will get that B wave low into October, but will track it when/if we get there. That analog (the red lined analog) was created in mid-August, so at some point it will stop working. Chart:

Long term, IWM is near the bottom of the range, so there is no long term breakdown yet. It held a pivot low on the daily today so far. Long term chart:

Long term, IWM is near the bottom of the range, so there is no long term breakdown yet. It held a pivot low on the daily today so far. Long term chart:

As long as the long term IWM chart support holds, and the 125 SMA on the daily SPX holds, this can run higher for a long long time off the indicator extremes we have been seeing this week. If this long term support area continues to hold, the anticipated next target level is IWM 126 and that is how I am playing this long term off this support until/unless it is broken.

The market could go on a relentless bull run off this support area.Until the market breaks down and is reversed, the market is not reversed and is a bull market. We can only follow. The two cycle lows (August 5 and September 17) anticipated a bullish move into at least October (for the August) and November (for the September) to achieve a minimum equilibrium. So far, we have no bearish breakdown and I continue to follow the bullish analogs and cycles. I will only change if we get that breakdown.

My posting is limited right now as I am dealing with the loss of a family member. There is always a bull path and a bear path. We cannot know which path the future will choose. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester

As long as the long term IWM chart support holds, and the 125 SMA on the daily SPX holds, this can run higher for a long long time off the indicator extremes we have been seeing this week. If this long term support area continues to hold, the anticipated next target level is IWM 126 and that is how I am playing this long term off this support until/unless it is broken.

The market could go on a relentless bull run off this support area.Until the market breaks down and is reversed, the market is not reversed and is a bull market. We can only follow. The two cycle lows (August 5 and September 17) anticipated a bullish move into at least October (for the August) and November (for the September) to achieve a minimum equilibrium. So far, we have no bearish breakdown and I continue to follow the bullish analogs and cycles. I will only change if we get that breakdown.

My posting is limited right now as I am dealing with the loss of a family member. There is always a bull path and a bear path. We cannot know which path the future will choose. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester