Homeownerhsip isn't right for everyone, but if you are wondering whether you should rent or buy, here are some reasons that explain why it can be better to own rather than rent.

1. MORTGAGES ARE CHEAP, monthly payment could be lower to buy than rent

2. FIX YOUR HOME THE WAY YOU WANT IT

When you rent, what you see is what you get... when you own your home you can fix it the way you want it.

3. NO WORRIES ABOUT HAVING PETS

It can be difficult to find a rental property that allows pets... and if they do, they often add an additional charge either monthly or in the form of a higher deposit.

4. IT CAN HELP YOUR CREDIT SCORE

If you are planning to buy your credit score is likely already good. But your regular mortgage payments become part of your credit report while monthly rent likely will not.

5. EQUITY

Having equity that can be tapped in case of an emergency can be a big plus... and with home prices expected to rise that equity could rise quicker than you think. Your home equity can also make it easier to get a loan for almost anything else.

6. PAY YOURSELF RATHER THAN YOUR LANDLORD

Even though you should think of your home as a place to live rather than an investment, it still makes more financial sense long-term than renting.

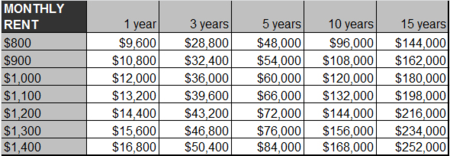

If you pay $1,200 in rent each month for 15 years you will have paid your landlord $216,000. If you own your own home, that money will have gone towards building equity as you pay off your mortgage... and you get to take deductions on your income tax along the way.

Sharlene Hensrud, RE/MAX Results - Minneapolis Buyer's Agent

RELATED POSTS

- Steps to owning your first home... can you afford to buy?

- 10 Signs you are ready to buy

- The five most important things to keep in mind when buying a home

- How soon should you call your Realtor if you are looking ahead to buying or selling?