There’s nothing an up-and-coming business woman wants more than to be financially stable – and NOW.

As you move along your career path, starting to reach your business goals, it’s only natural to think about your personal expenses – are you paying off student loans? A car? A condo? Planning a wedding? For a baby?

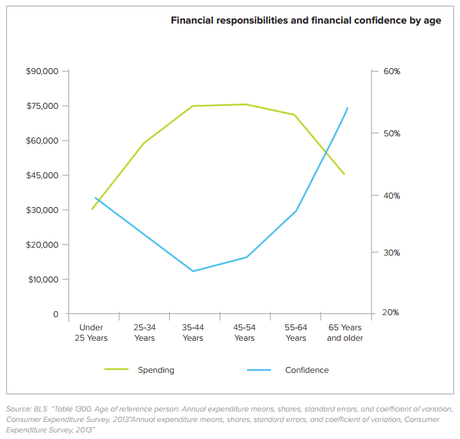

A new study by LearnVest shows that our financial confidence is lowest during our peak earning years. While our earning potential may be at its height during our 30s, 40s, and 50s, our confidence about our finances shrinks conversely, which may have a lot to do with the money we’re spending during this time.

(The full whitepaper of LearnVest’s study can be found here, and includes a detailed breakdown of earning potential and projected expenses by age group.)

What can we do to maintain confidence during these years when our earning power is highest? Investigate your personal finances and make a plan. No, you don’t have to track every penny coming in and going out, but maintaining some concrete financial goals will help with your anxiety.

Here are three simple steps for setting and reaching these goals:

- Change your attitude. Maintaining a positive attitude about money is key. It is inevitable that you will have expenses – rent, food, coffee, loans, even clothes. It’s okay! Think of these basic expenses as an investment in your own well-being. If you splurge and have a night out with the gals – don’t go overboard, but don’t beat yourself up over it either. Your emotional health and the positive reward from a great night with friends is just as important as your financial health.

- Educate Yourself. “Bond ratings.� “Investment banking.� “The market.� Are you financially literate? Do you know how and why these things can impact your financial life? Control of your finances starts with YOU. The more you know, the more confident you will be about what you are doing with your money.

- Take action. Start thinking about when and where you can save money. What percentage of your paycheck do you set aside each month? See if you can start saving 5% more each time you get paid. If that’s not doable, maybe doing the 52 Week Money Challenge is a better goal. (And it’s not too late to set aside the from the first three weeks of 2015!) Are you taking advantage of your company’s 401K plan? Once you have a nice egg started, look into possibly investing your savings further to increase your returns. It never hurts to meet with a financial planner.

Here are a few financial resources geared toward women to get you started:

Geneen Roth, a #1 New York Times bestselling author, lost her life savings to the Bernie Madoff’s Ponzi scheme. Her book Lost and Found: One Woman's Story of Losing Her Money and Finding Her Life chronicles her experience and provides some great tactics for how we should think about the resources we need to sustain us.

Luna Jaffe’s book Wild Money: A Creative Journey to Financial Wisdom is a creative guide to financial planning, and has a companion “field guideâ€� and journal to help you strategize.

In her book Women's Worth: Finding Your Financial Confidence, financial planner Eleanor Blayney provides solid financial advice directed at women. She offers concrete information on the fundamentals of financial planning to help women gain confidence in their own lives.